Uniswap price continues to trade under cautious market conditions, with technical signals suggesting limited bullish momentum in the short term.

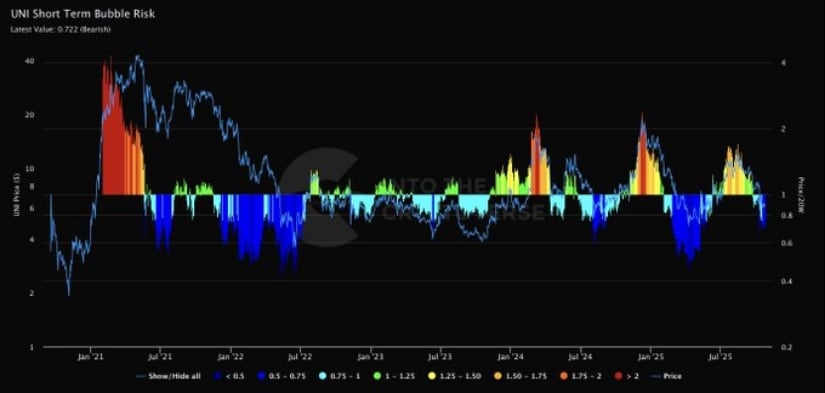

Despite subtle signs of recovery on dominance charts, the latest data from Into The Cryptoverse reveals that the coin’s short-term bubble risk remains bearish, signaling that the token is yet to escape its broader consolidation phase.

Bubble Risk Indicator Suggests Market Still in Cooling Phase

According to data from Into The Cryptoverse, Uniswap’s Short-Term Bubble Risk value currently stands at 0.722, which is classified as bearish. This reading confirms that the token’s price remains below its 20-week simple moving average (SMA), indicating the market is not in an overheated or speculative phase. Historically, bubble risk levels above 1.25 have coincided with local tops, often preceding sharp corrections, while deeply negative readings tend to mark oversold or capitulation conditions.

Source: X

At the present level, the coin’s subdued bubble risk reflects a market lacking speculative excess and sustained buying enthusiasm. The indicator implies that downside risk remains until fresh accumulation occurs and momentum begins to build again. In essence, while the coin is not displaying signs of an overheated rally, it also has yet to establish strong recovery signals, keeping market sentiment neutral to slightly cautious in the short term.

Market Data Confirms Market Stability at $6.18

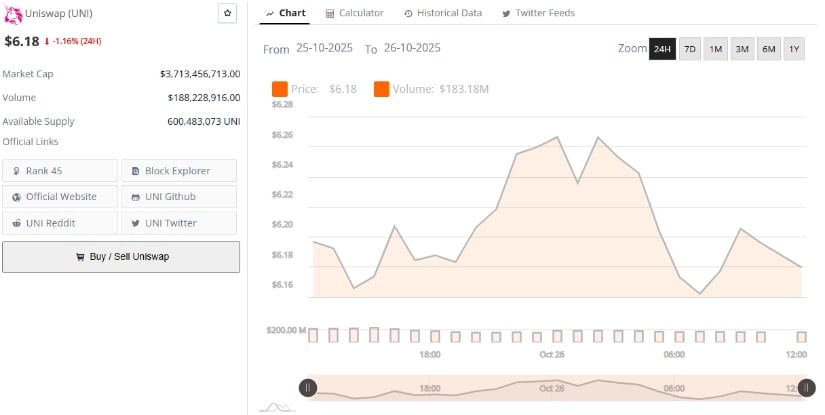

Data from BraveNewCoin shows Uniswap) trading at $6.18, down 1.16% in the past 24 hours. The decentralized exchange token maintains a market capitalization of $3.71 billion, ranking 45th globally, with an available supply of 600.48 million tokens. Trading activity reached approximately $188.22 million during the same period, reflecting moderate liquidity and consistent turnover across key markets.

Source: BraveNewCoin

Although price performance has softened slightly, volume data suggests that market participants remain engaged, with no signs of panic selling. This steady activity implies that the coin’s price is consolidating within a balanced range, awaiting a catalyst to establish directional clarity. A sustained recovery above the $6.30–$6.50 resistance zone could encourage short-term buyers, while failure to hold above $6.00 may trigger further downside testing.

Technical Indicators Point Toward Potential Reversal Setup

A separate analysis from an X technical strategist highlights that the asset dominance has been trending lower since early 2022, characterized by consistent lower highs and lower lows. However, recent price action has brought dominance back to a key historical support zone, a region that has triggered reversals in past cycles.

The chart reveals a bullish divergence, where the coin’s dominance index printed a lower low while momentum indicators such as the RSI formed a higher low, typically a precursor to trend reversals.

Source: X

The RSI is now rebounding from oversold territory, suggesting weakening seller pressure and early accumulation signs. Meanwhile, the stochastic oscillator has made a bullish crossover from extreme low levels, reinforcing the possibility of a short-term uptrend.

The confluence of these signals, historical support, RSI recovery, and stochastic crossover strengthens the case for a potential “UNI season” if momentum continues to build. However, confirmation will require consistent volume growth and a break above key resistance levels to validate this emerging bullish bias.