Cardano price is approaching a pivotal breakout zone, holding strong near support as participants anticipate a potential surge towards the $1 mark.

Cardano’s steady climb has started to draw renewed attention from participants, as the altcoin shows early signs of a structural turnaround. Despite recent market turbulence, Cardano price has held firm near key support, with technical indicators hinting at a potential breakout.

Cardano Price Eyes a Major Breakout Setup

Cardano price is beginning to mirror a familiar fractal structure, similar to the pre-rally formations seen in previous cycles. The recent EmilioBojan chart shows ADA forming a clear double-bottom pattern between $0.50 and $0.55, with higher lows building momentum for a potential surge. The neckline of this formation lies around $0.66, and a breakout above it could trigger a move towards $0.90 to $1.00, levels that align with historical expansion zones.

Cardano price forms a double-bottom structure between $0.50 and $0.55, signaling a potential breakout above $0.66 towards the $1 mark. Source: EmilioBojan via X

Momentum is strengthening as on-chain metrics point to renewed accumulation. With ADA showing resilience around its base, the technicals now favor a recovery scenario that could set the stage for a larger bullish reversal.

Cardano Market Outlook

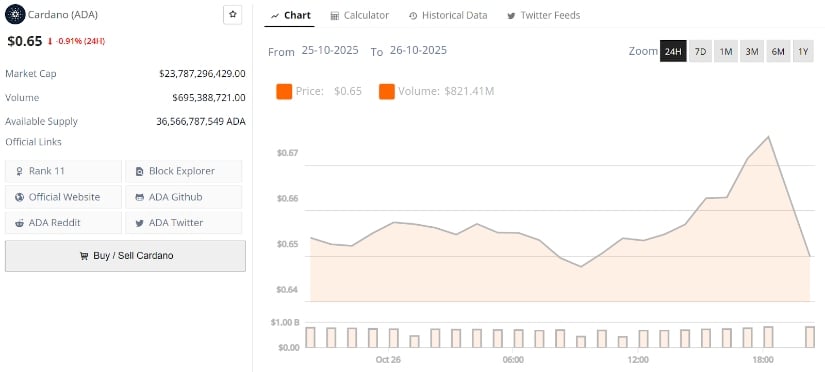

According to Brave New Coin data, Cardano trades around $0.65, boasting a market cap near $23.7 billion with daily volumes exceeding $690 million. These figures reinforce the narrative of steady accumulation even amid recent market volatility.

Cardano price is trading around $0.65, down -0.91% in the last 24 hours. Source: Brave New Coin

Technically, ADA is attempting to reclaim its mid-range zone between $0.64 and $0.68, which has acted as both resistance and support in previous cycles. A sustained close above $0.70 could confirm a shift in trend structure, opening the door to a strong push towards $0.85 to $0.90 in the short term.

Trendline Break Could Spark Reversal Momentum

Sssebi highlights ADA Cardano price breaking through a descending trendline after weeks of compression. The move, though occurring on low weekend volume, signals potential strength returning to the market. The pattern also forms an inverse head-and-shoulders, with a clear neckline near $0.64 to $0.66.

ADA breaks above a key descending trendline, forming an inverse head-and-shoulders pattern that could target $0.80 if momentum holds. Source: Sssebi via X

If confirmed, this setup could trigger a measured move towards $0.80, aligning with prior resistance zones and reinforcing a short-term bullish bias. Participants are watching whether the breakout gains momentum early in the week with stronger liquidity inflows.

Cardano Price Prediction: Preparing for a Larger Move

Market projections show ADA holding firm above $0.63, a level that Mintern considers crucial for maintaining bullish structure. A successful retest of this region could spark a climb to $0.85, and potentially ignite a breakout towards $1.70, according to broader symmetrical triangle formations.

Cardano holds steady above $0.63 support, with symmetrical triangle formations hinting at a potential breakout toward $1.70. Source: Mintern via X

The setup suggests a mix of consolidation and expansion dynamics, with ADA coiling for a high-volatility move. Should momentum continue to build above $0.70, the next few weeks could mark the beginning of an extended recovery leg in line with broader market optimism.

Final Thoughts: ETF Speculation Adds Narrative

Optimism around a potential Cardano ETF has intensified, with Bloomberg analysts assigning a 75% approval chance by 2026. This narrative, combined with ongoing protocol upgrades and community-backed improvements, strengthens the long-term case for Cardano Price Prediction.

If these developments align with current bullish structures, institutional adoption could become a key driver for ADA’s next cycle. The confluence of technical strength, market recovery, and ETF speculation paints a picture of renewed confidence.