As Tuesday drew to a close, the broader cryptocurrency market experienced a bearish move, causing major digital assets such as Solana to lose their renewed bullish momentum. Despite the ongoing fluctuations in the price of SOL, the institutional interest in the leading altcoin continues to grow stronger through the SOL-based treasury.

A Significant Portion Of Solana Held In Treasury Reserve

In the pursuit of a digital asset-based strategic treasury reserve, Solana continues to demonstrate its potential and resilience as a formidable crypto asset for this growing initiative. Since a SOL treasury reserve was introduced, the strategy has persistently expanded to significant levels.

As protocol income, validator awards, and ecosystem donations flood in, Solana’s treasury has gradually gathered resources, setting up the project for long-term sustainability and innovation. SOL’s treasury rise to dominance reaffirms investor confidence in the network’s capacity to finance upcoming projects, grants, and technology developments, notwithstanding general market turbulence.

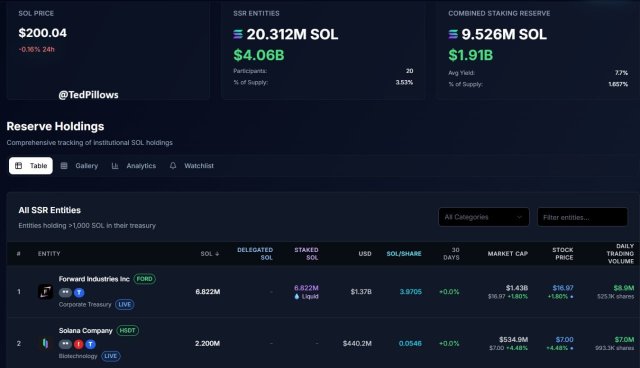

After its steady expansion, Ted Pillows, an on-chain and market expert, has shared a post on X that shows that the SOL strategic reserve has reached a new high. This massive growth in its treasury strategy underscores the rise in the network’s financial strength and the maturity of its ecosystem.

Data shared by Ted Pillows shows that SOL treasury entities now hold a total of 20.13 million SOL, valued at a whopping $4.6 billion. The accumulated SOL by these treasury companies consists of 3.53% of the altcoin’s total supply.

It is important to note that this massive supply of SOL is held by a total of 20 corporate entities. A trend that underscores the rapid adoption of SOL by high-net-worth investors, strengthening its price prospects. While SOL treasury has grown strong, Pillows believes that the anticipated SOL staking Exchange-Traded Fund (ETF) is likely to attract more inflows into the initiative.

SOL Is Leading All Chains In DApp Revenue And DEX Volume

Solana treasury is gaining traction due to the blockchain’s strong on-chain activity and developer engagement. The network has taken the lead in Decentralized Application (DApp) revenue and Decentralized Exchange (DEX) trading volume.

According to a report from SolanaFloor, SOL has surpassed all Layer 1 and Layer 2 chains across the crypto sector in both areas. Its dominance in these areas solidifies SOL’s position as one of the most active ecosystems in the crypto space.

In terms of DApp revenue, the network recorded a total of $4.67 million within a day, ahead of Ethereum and Hyperliquid. Meanwhile, the leading blockchain accumulated over $4.87 million in terms of DEX volume within the same period, with ETH and BSC (Binance Smart Chain) coming in second and third spot, respectively.

At the time of writing, the price of SOL was trading at $195, after recording a more than 2% decline over the last 24 hours. Despite the pullback in SOL, bullish sentiment is gradually improving among investors, as evidenced by the over 21% increase in its daily trading volume.