Worldcoin price continues to battle bearish momentum as the token remains pinned below critical resistance levels despite slight intraday recoveries.

Following a series of failed attempts to sustain rallies, market analysts now view the asset’s short-term trend as technically fragile, with downward pressure dominating across multiple timeframes.

Highlight Show Sustained Bearish Structure

In a recent post on X, market analyst Unknown.Ai emphasized that WLD/USDT is entrenched in a strong downtrend across all observed timeframes. The analysis points to repeated failures to reclaim the short-term moving averages (EMA 9, 21, 50, and 200), indicating that bearish sentiment remains firmly in control.

Source: X

According to Unknown.Ai, the coin has struggled to maintain rallies above $0.90, with each brief recovery attempt meeting consistent selling pressure. The coin’s structure reveals clearly defined support at $0.85 and a secondary level near $0.80, while resistance zones remain established at $0.90 and $0.95 historical thresholds that have repeatedly capped upside momentum.

Market Metrics Show Continued Weakness Despite High Liquidity

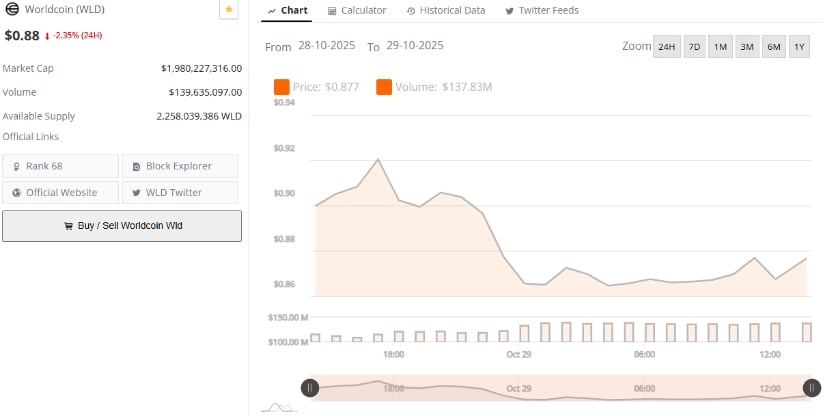

On one hand, data shows Worldcoin trading at $0.88, marking a 2.35% decline in the past 24 hours. The token holds a market capitalization of $1.98 billion and a 24-hour trading volume of $139.63 million, supported by an available supply of 2.25 billion tokens. Despite the recent decline, the project remains ranked #68 by market cap, underlining its continued liquidity and broad market participation.

Source: BraveNewCoin

The coin’s trading pattern indicates cautious behavior among buyers. The narrow price range between $0.82 and $0.90 shows a lack of conviction on both sides, suggesting that traders are waiting for a clear breakout before committing to new positions. Historically, the coin’s rallies have been brief and met with strong selling, particularly near the $0.95 level, reinforcing the importance of that range as a key reversal zone.

Technical Indicators Reflect Fragile Momentum and Potential Relief Signals

At the time of writing, TradingView data shows WLD trading at $0.877, showing mild upward momentum after weeks of consolidation. The coin continues to trade well below its September high of $2.21, reflecting a prolonged correction and fading market interest. Nonetheless, the formation of higher lows in recent sessions hints at an early attempt by buyers to stabilize price action.

Source: TradingView

Momentum indicators support a cautiously improving picture. The Relative Strength Index (RSI) stands at 39.45, just below the neutral 50 zone, suggesting that while the token remains weak, bearish pressure may be easing. The RSI-based moving average, currently at 37.52, confirms this gradual improvement, though analysts caution that bulls must lift the RSI above 45–50 to reestablish short-term strength.

The MACD readings remain neutral, showing limited divergence between the signal and MACD lines, which implies reduced volatility but no confirmed bullish crossover. For buyers, the key technical threshold remains a decisive close above $0.90, which could shift market structure toward recovery. Failure to achieve this may invite renewed selling pressure toward the $0.85 and $0.80 support levels in the coming sessions.