Stablecoin leader Circle, the issuer of USDC, has officially launched its Arc testnet with VISA, Mastercard and other major partners, a new Layer-1 blockchain designed to serve as the “economic operating system for the internet.”

Related Reading: Solana Price Set For Double-Digit Rally Above $230: Analyst Reveals How To Spot Next Move

The testnet already counts over 100 major participants from finance, technology, and payments, including, as mentioned, Visa, Mastercard, BlackRock, Goldman Sachs, and Coinbase, all collaborating to bridge the gap between TradFi and the on-chain economy.

Circle CEO Jeremy Allaire described Arc as purpose-built to connect every local market to the global economy, emphasizing its ability to facilitate lending, capital markets, foreign exchange, and global payments.

Arc’s design centers on USDC as the native gas token, offering predictable dollar-based transaction fees and sub-second finality, features that make it uniquely appealing for regulated financial operations.

A Global Push Toward Blockchain-Based Finance

Arc’s debut underscores a growing institutional appetite for blockchain infrastructure that balances regulatory compliance with decentralized programmability.

Participants such as Apollo, BNY Mellon, and State Street join payment titans and fintech leaders in testing Arc’s capabilities. Circle has also enlisted developer partners like Alchemy, Chainlink, and Anthropic, while Coinbase and Uniswap are providing liquidity support.

The network integrates optional privacy controls to ensure compliance with data-protection standards while enabling transparency for audits and settlements. This balance is crucial for large financial institutions exploring tokenized assets, real-time settlements, and programmable payments.

In a significant regional development, South Korean firm BDACS announced it will issue its Korean won-backed stablecoin (KRW1) on Circle’s Arc blockchain, a move aimed at expanding South Korea’s regulated stablecoin presence on the global stage.

Toward Decentralized Governance and Institutional Adoption

While Circle currently oversees Arc’s testnet operations, the company plans to transition toward community-governed decentralization in the future. Compliance partners like Elliptic are already integrating monitoring tools to strengthen transparency across the ecosystem.

Industry analysts view Arc as Circle’s most ambitious project yet, a move that could reshape how banks, fintechs, and enterprises conduct cross-border payments and tokenized finance.

Related Reading: Solana Just Solved Its Biggest Data Problem, Says Helius CEO

As Arc’s testnet gains traction, it could become the backbone of a new financial era, one where blockchain and traditional finance converge to power the next generation of global commerce.

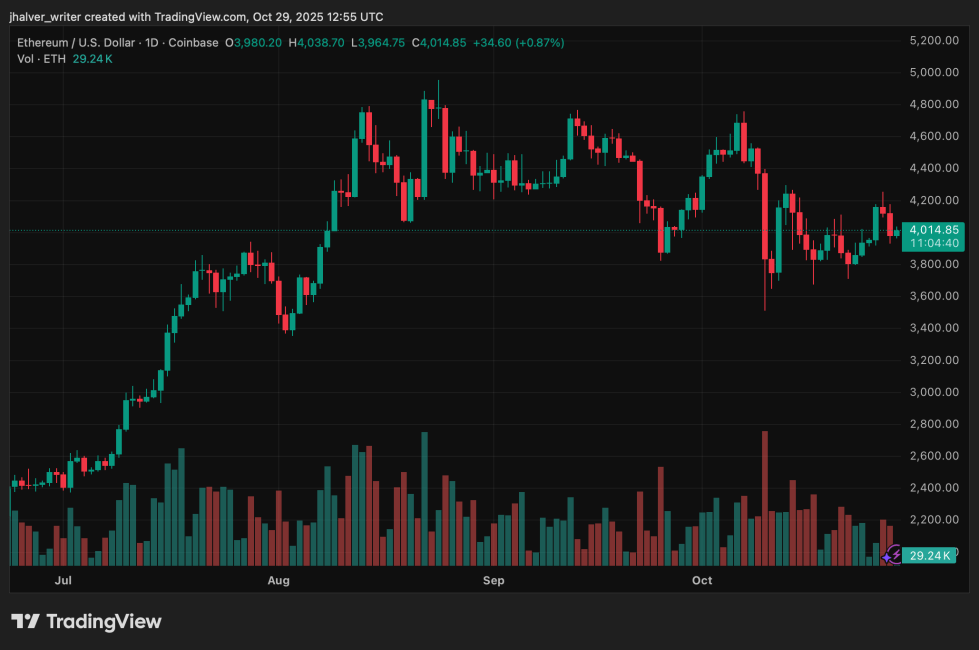

Cover image from ChatGPT, ETHUSD chart from Tradingview