Zcash remains bullish, trading above $360 on Thursday, hinting at steady risk-on sentiment.

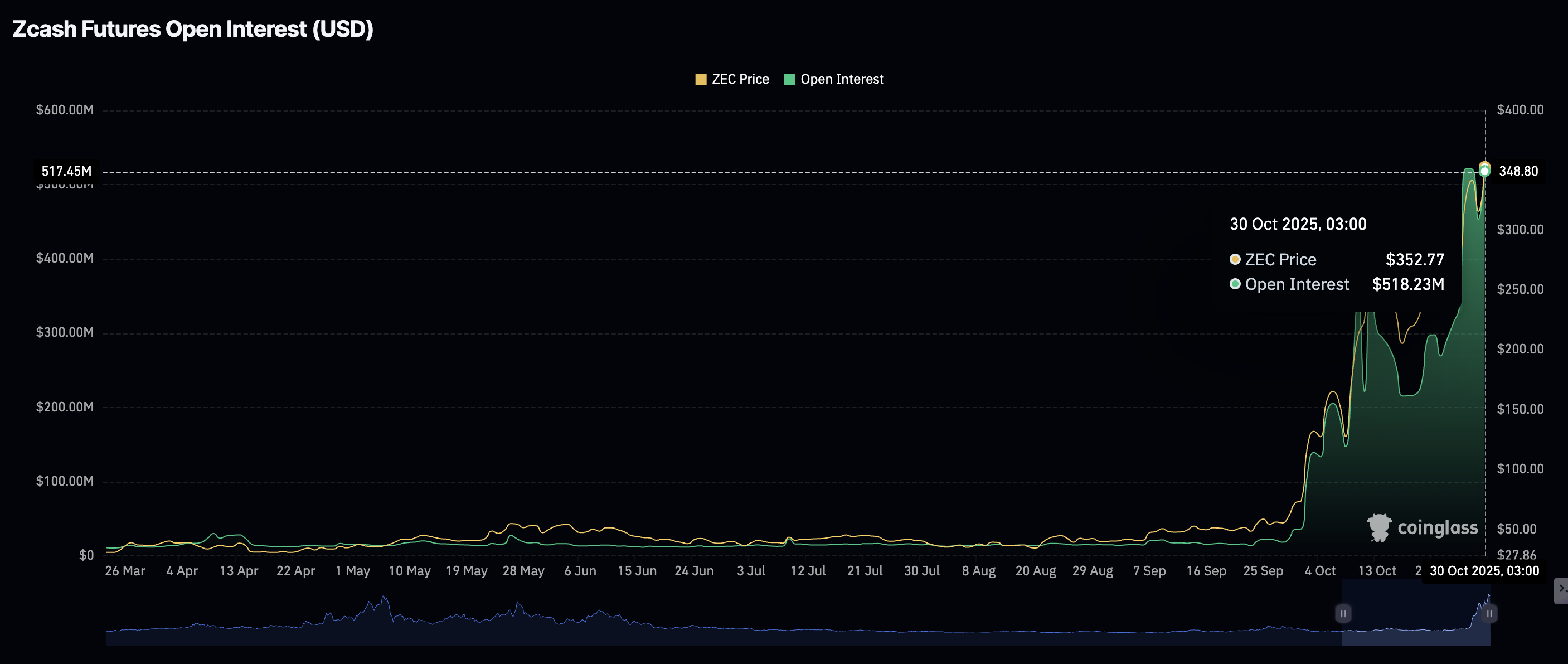

Retail interest in ZEC has increased, with futures Open Interest at record highs, averaging $518 million.

The MACD and RSI indicators send mixed signals on the medium-term amid potential profit-taking.

Zcash (ZEC) upholds its bullish outlook, trading at around $360 at the time of writing on Thursday. The privacy-focused token has, over the past few weeks, edged higher, shrugging off volatility and risk-off sentiment in the broader cryptocurrency market.

Interest in ZEC follows a steady shift in user sentiment toward privacy-focused cryptocurrencies. Zcash operates a privacy-oriented blockchain, allowing users to transfer tokens using obscured pools to shield their transaction history.

According to CoinMarketCap, "shielded supply represents ZEC tokens held in private addresses utilizing zero-knowledge proofs, specifically zk-SNARKs, which enable transaction validation without exposing sender, receiver, or amount details."

Retail interest surges, bolstering Zcash's bullish potential

Zcash showcases one of the strongest short-term derivatives markets, with futures Open Interest (OI) holding around $518 million on Thursday after hitting a record high of $521 million on Monday.

OI refers to the notional value of outstanding futures contracts. A steady increase in OI indicates that traders are confident in ZEC's ability to sustain the uptrend in the short- to medium-term.

ZEC Futures Open Interest | Source: CoinGlass

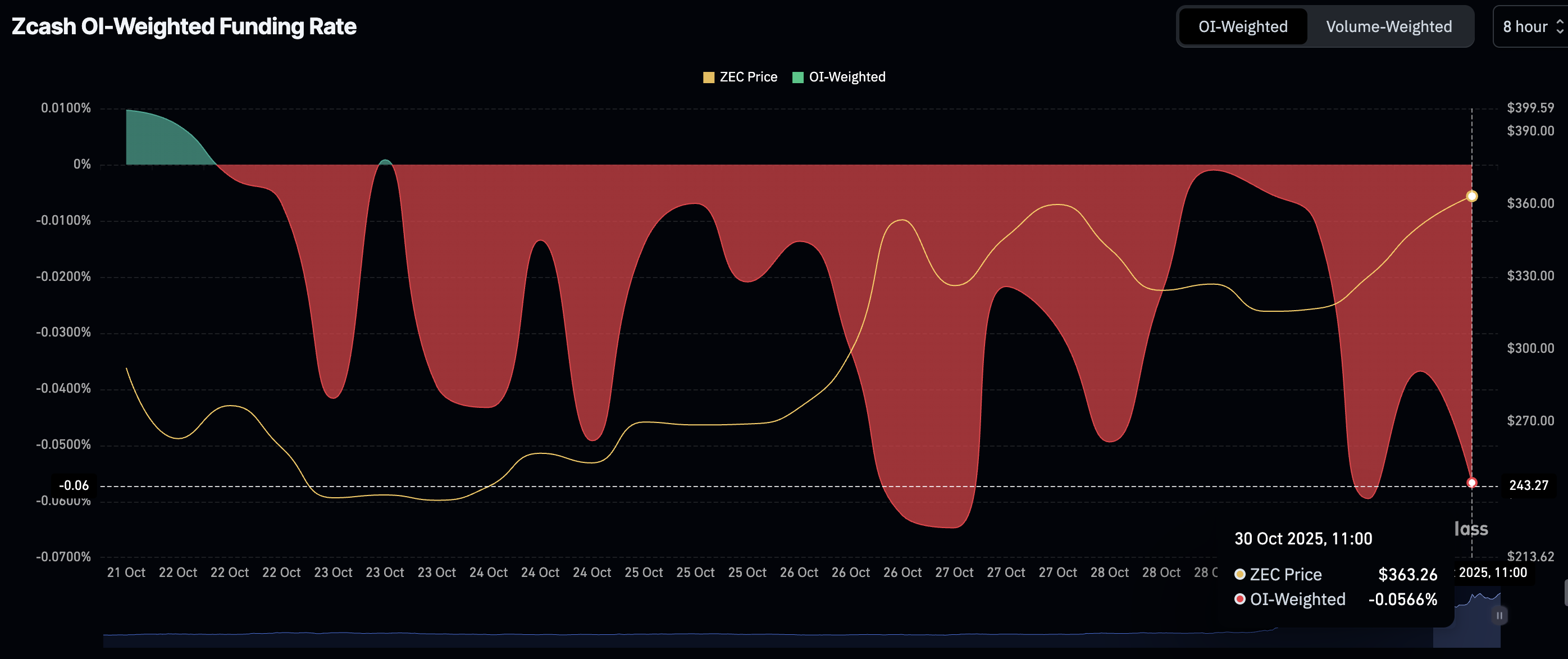

Still, Zcash has maintained a negative OI-weighted funding rate since October 22, suggesting potential profit-taking amid traders' deleveraging. CoinGlass data shows the metric at -0.0566% on Thursday, down from -0.0010% on Tuesday. If this trend persists, it may derail the anticipated uptrend toward the yearly high of $375 and the psychological resistance at $400.

ZEC OI-Weighted Funding Rate | Source: CoinGlass

Technical outlook: Zcash offers mixed technical signals

Zcash is trading at around $360 at the time of writing on Thursday, building on a buy signal confirmed by the Moving Average Convergence Divergence (MACD) indicator on the 4-hour chart earlier in the day. Investors will likely increase their risk exposure if the blue MACD line remains above the red signal line.

ZEC's position above the uptrending moving averages, including the 200-period EMA at $223, the 100-period EMA at $274, and the 50-day EMA at $308, supports the short-term bullish outlook and positive sentiment.

A daily close above the immediate support at $360 would reinforce the bullish grip, increasing the odds of a breakout above Zcash's yearly high of $375. Bulls target a short to medium-term close above resistance at $400.

ZEC/USDT daily chart

Still, the Relative Strength Index (RSI), which is currently at 65 on the same 4-hour chart and falling, suggests traders should be cautiously optimistic. Continued weakness would imply easing of bullish momentum, encouraging profit-taking. Key support levels include a short-term accelerated ascending trendline near $340, the 50-period EMA at $308 and the 100-period EMA at $274.