Takeaways:

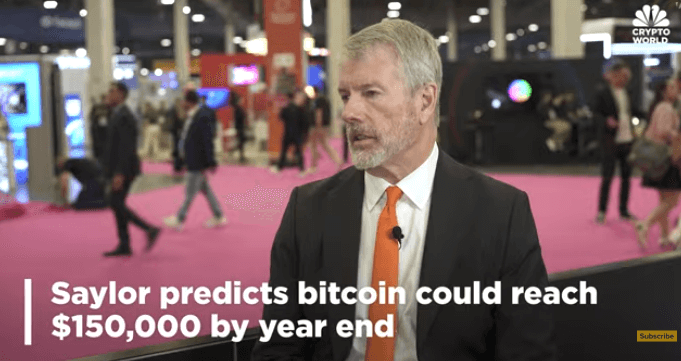

Michael Saylor predicts Bitcoin will reach $150K by the end of 2025, citing reduced volatility and a maturing market structure.

The Strategy company holds over $71B in $BTC and plans to keep ‘buying the top forever’ regardless of price movements.

While Bitcoin’s value skyrockets, its sluggish transaction speeds remain a massive bottleneck for real-world adoption.

Bitcoin Hyper’s SVM-powered Layer 2 solution finally unlocks the speed and scalability Bitcoin desperately needs to match its valuation hype.

Michael Saylor, Strategy Executive Chairman, told CNBC he expects Bitcoin to hit $150K by the end of 2025, even after $BTC’s recent slip from its October all-time high above $126K.

His reasoning? Diminishing volatility, maturing market structure, and apparently an unshakeable faith that number-go-up technology simply cannot fail.

The man who turned his software company into a $71B Bitcoin piggy bank is borderline prophetic. Saylor predicts $BTC will eventually ‘grind up’ to $1M per coin within four to eight years, and $20M per Bitcoin over the next two decades.

At this point, Strategy is ‘buying the top forever,’ as Saylor himself puts it. It’s the ultimate power move in corporate treasury management.

But while Bitcoin’s price action might be on the upside, its actual usability is still stuck in 2009. While Saylor is busy stacking $BTC and predicting moonshot spikes, the Bitcoin network itself is chugging along at a blistering 3–7 transactions per second.

Institutional giants like Strategy bet big on Bitcoin hitting six figures, the White House endorses $BTC as digital gold, and the SEC is warming up to tokenized equities. The bullish narratives are there. The price action is there. The one thing that’s not there is the ability for Bitcoin to actually function as the revolutionary payment system it was supposed to be.

This is where Bitcoin Hyper, an emerging upscaling project, steps in to boost Bitcoin’s ecosystem.

Bitcoin Hyper – The Layer 2 Meant to Fix Bitcoin’s Transaction Speed

While everyone’s celebrating Bitcoin’s price predictions and institutional adoption, Bitcoin Hyper ($HYPER) is tackling the elephant in the room: Bitcoin can’t scale without help.

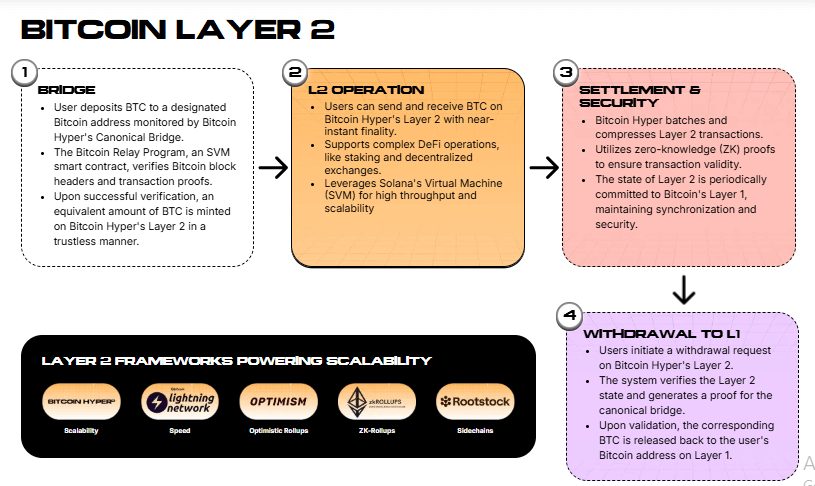

Bitcoin Hyper is the newest Bitcoin Layer 2 (L2) solution to integrate the Solana Virtual Machine (SVM) for running smart contracts. Settlement remains on the Bitcoin L1, keeping the same security and decentralization that made Bitcoin safe and reliable.

Thanks to its setup, Hyper’s new blockchain finally gives Bitcoin the execution layer it’s been begging for. That means Solana-style sub-second transactions, near-zero gas fees, and full compatibility with the $BTC everyone knows and loves.

Saylor’s $150K prediction means more institutions buying, more retail FOMO, and more transactions flooding the network. If Bitcoin can barely handle current demand without fees going ballistic, what happens when it hits mainstream adoption?

Hyper is the answer to that question. Its upcoming network is the place where payments actually happen, where meme coins can launch, and where DeFi doesn’t cost you $50 in fees to move $100.

Bitcoin Hyper ($HYPER) – The Token Fueling it All

Bitcoin Hyper ($HYPER) is the project’s native token and the actual fuel for the entire ecosystem. Every transaction, dApp, and DeFi protocol built on Bitcoin Hyper runs on $HYPER. Currently on presale, this crypto’s success is a stake in the Bitcoin execution layer.

If the project reaches its funding and development goals, it could help Bitcoin become more than a store of value collecting digital dust in corporate treasuries.

The L2 could bring the speed, scalability, and cross-chain compatibility that turns $BTC from digital gold into digital everything.

At a current price of $0.013195 per $HYPER token, the Bitcoin Hyper ICO is still far from over. And yet, Hyper has gathered over $25.2M so far, with massive transactions of $379.9K and $274K showing growing whale interest.

If you’re even remotely bullish on Saylor’s $150K thesis, it’s easy to see why more big players are paying attention.

The token price during presale gives supporters priority access to staking rewards, governance rights, and a first-mover advantage on what could be Bitcoin’s most important infrastructure upgrade yet.

Saylor bets that $150K is inevitable, but Bitcoin actually needs to work when it gets there. The next phase of Bitcoin’s evolution isn’t optional — it’s crucial. For $BTC to become fully usable, it needs an efficiency upgrade so it doesn’t take 10 minutes and $30 just to buy a coffee.