Binance Chain shows strong recovery as its total value locked nears $10 billion, signaling renewed investor confidence. Analysts highlight growing DeFi activity, rising liquidity, and bullish technical patterns, with the asset trading around $1,112.

Experts project a move toward $15 billion TVL and $1,230 price resistance amid continued market strength.

BNB Chain Recovery Points to Strengthening Ecosystem

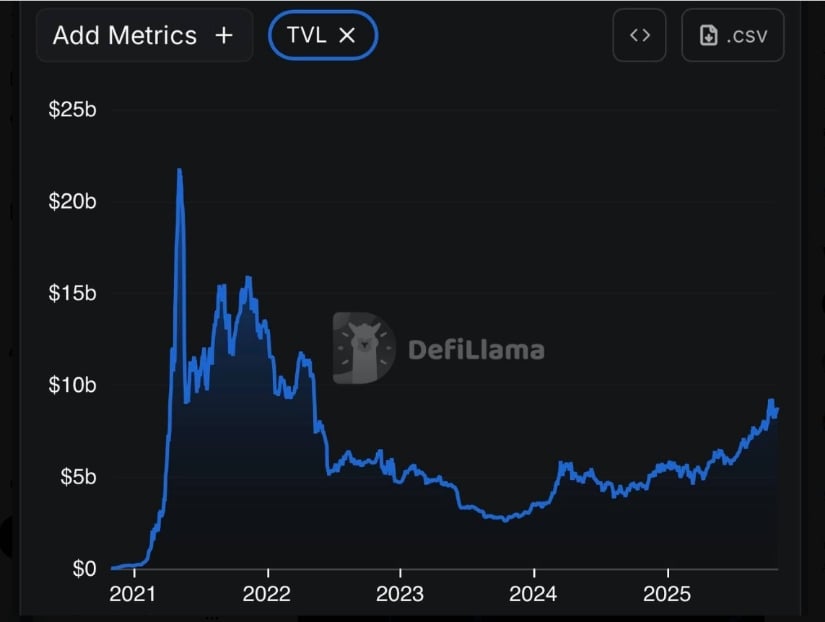

The total value locked (TVL) has returned to nearly $10 billion, signaling renewed confidence in the network’s decentralized finance (DeFi) ecosystem. Analyst Cipher X noted that the rebound marks a sharp recovery from the steep drawdown experienced in 2022 when liquidity across DeFi protocols declined. The chain’s current TVL level reflects consistent inflows of capital, positioning it among the most resilient networks in 2025.

BNB Chart | Source:x

According to Cipher X, the return of liquidity suggests users and developers are once again actively engaging with its Chain DeFi infrastructure. The analyst said the ecosystem has “quietly rebuilt its foundation while many focused elsewhere,” indicating a steady improvement in both participation and on-chain stability.

If the momentum continues, Cipher X projects that the next potential milestone for TVL could reach $15 billion — a level that would signal a full restoration of its Chain dominance in decentralized finance.

Analyst Views Point Toward Long-Term Stability

Market observers interpret the recent TVL recovery as part of a broader capital rotation toward established blockchain networks. The renewed liquidity growth indicates a stable environment where DeFi users are finding improved opportunities for yield generation and trading activity. Increased participation across lending, staking, and decentralized exchanges has contributed to this steady rise.

Cipher X believes the current uptrend shows that the Chain has regained user confidence. While the broader market remains cautious, the network’s activity metrics show steady growth. Developers continue to expand projects within the ecosystem, suggesting that long-term sustainability remains a core focus. This performance reinforces the idea that investors are shifting attention toward ecosystems with clear utility and consistent returns.

Binance Coin Price Builds Momentum Around Key Support Levels

Market analyst BIGGEST DC noted that its recent breakout could mark the beginning of a new upward phase. The price structure shows a rebound pattern forming near the $1,093 support level, an area where buyers have repeatedly maintained control. The asset’s recovery above $1,110 reflects renewed buying momentum and technical strength.

BNBUSDT Chart | Source:x

The analyst pointed out that Binance could be preparing to test higher resistance near $1,234 if current conditions persist. The recent increase follows weeks of sideways trading, during which accumulation by long-term holders remained visible. The chart’s green projection line suggests a continuation setup, aligning with the broader view of improving sentiment across the ecosystem.

BNB Price Performance Reflects Market Confidence

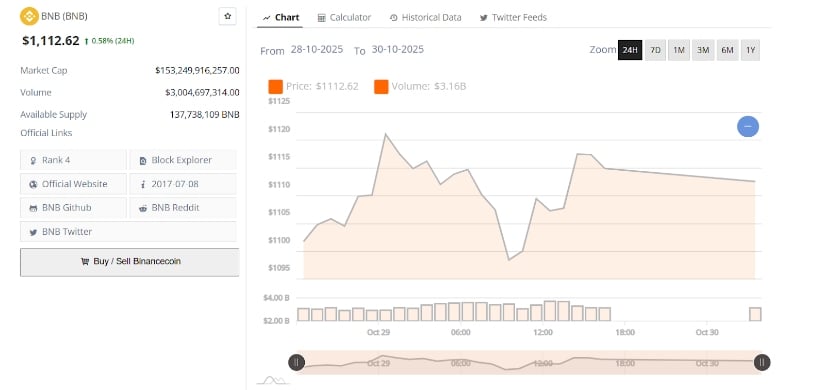

At press time, the asset trades near $1,112.62, a 0.58% gain over the past 24 hours. The token maintains a market capitalization of $153.24 billion and a 24-hour trading volume of approximately $3 billion. The price range between $1,095 and $1,120 shows limited volatility, reflecting market consolidation after a recent uptrend.

BNBUSD 24-Hr Chart | Source: BraveNewCoin

The current structure indicates stability above the $1,110 level, where traders are watching for confirmation of continued accumulation. A sustained move above $1,115 could strengthen the case for further gains, with the next upside target around $1,150. On the downside, $1,095 serves as immediate support, where a breach might lead to temporary retracement.

The token remains the fourth-largest cryptocurrency by market capitalization. Its steady climb in both TVL and price performance shows growing market participation. The combination of a $10 billion DeFi recovery and strong technical structure points to an improving outlook for the ecosystem as it continues to attract renewed liquidity and user engagement.