On-chain data shows the Bitcoin mining pool BTC.com deposited a huge amount of the cryptocurrency to Binance in October.

BTC.com Mining Pool Has Potentially Been Selling Bitcoin This Month

As explained by an analyst in a CryptoQuant Quicktake post, Bitcoin miners connected with BTC.com have made large transactions to Binance recently. The on-chain metric of interest here is the “Miner to Exchange Flow,” which measures the total amount of the cryptocurrency that’s flowing from miner-related wallets to a given centralized exchange.

In the context of the current discussion, the version of the metric that’s relevant is the one involving only the wallets connected to the BTC.com mining pool on the sending side and Binance as the receiver.

Generally, the main reason miners transfer their coins to exchanges is for selling-related purposes, so a spike in the Miner to Exchange flow can indicate that this cohort is participating in distribution.

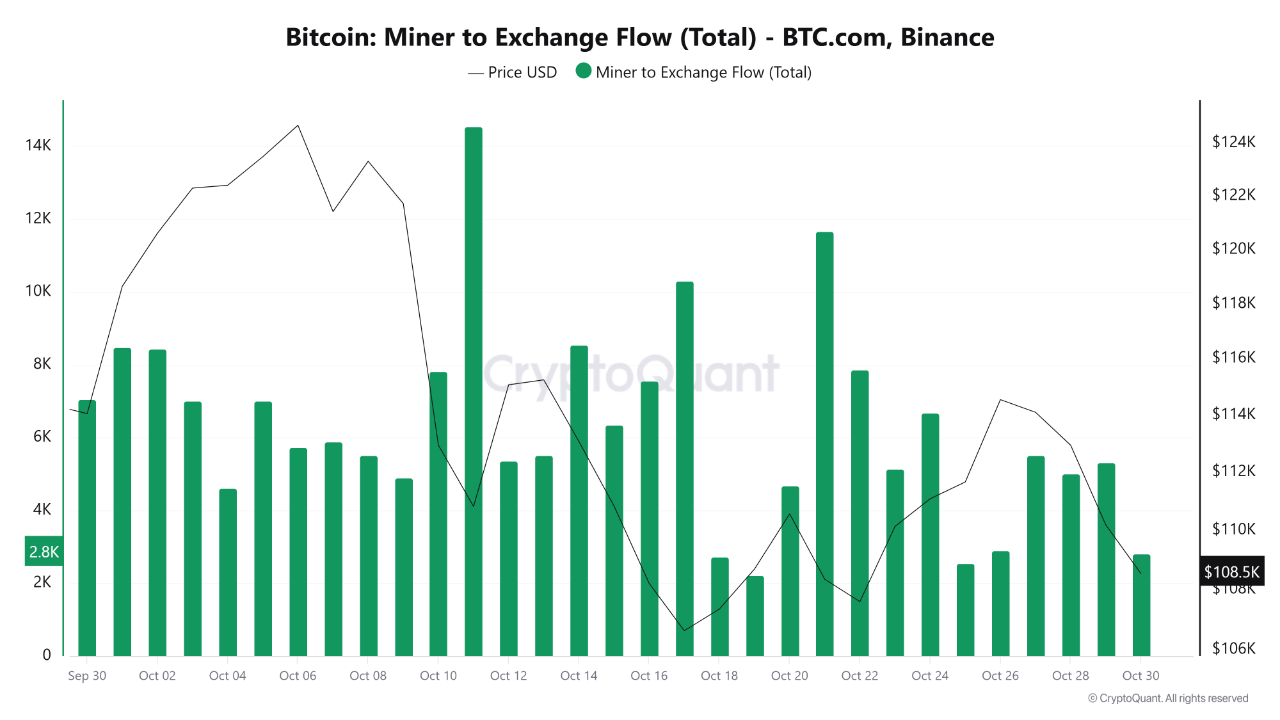

Now, here is the chart shared by the quant that shows the trend in the Bitcoin Miner to Exchange Flow for BTC.com and Binance over the past month:

As displayed in the above graph, the Bitcoin Miner to Exchange Flow for BTC.com and Binance fluctuated during the past month, with a few large spikes coming in mid-October.

Interestingly, these spikes all came around local bottoms in the asset’s price, indicating that miners part of the pool may have been panic selling. In total, this cohort transferred 186,000 BTC (currently worth a whopping $19.9 billion) to Binance over the past month.

Miners have to pay off constant running costs in the form of electricity bills, so distribution from them tends to happen on the regular. Such selling usually gets readily absorbed by the market. Periods of extraordinary selling pressure from the cohort, however, can be a bearish sign for BTC.

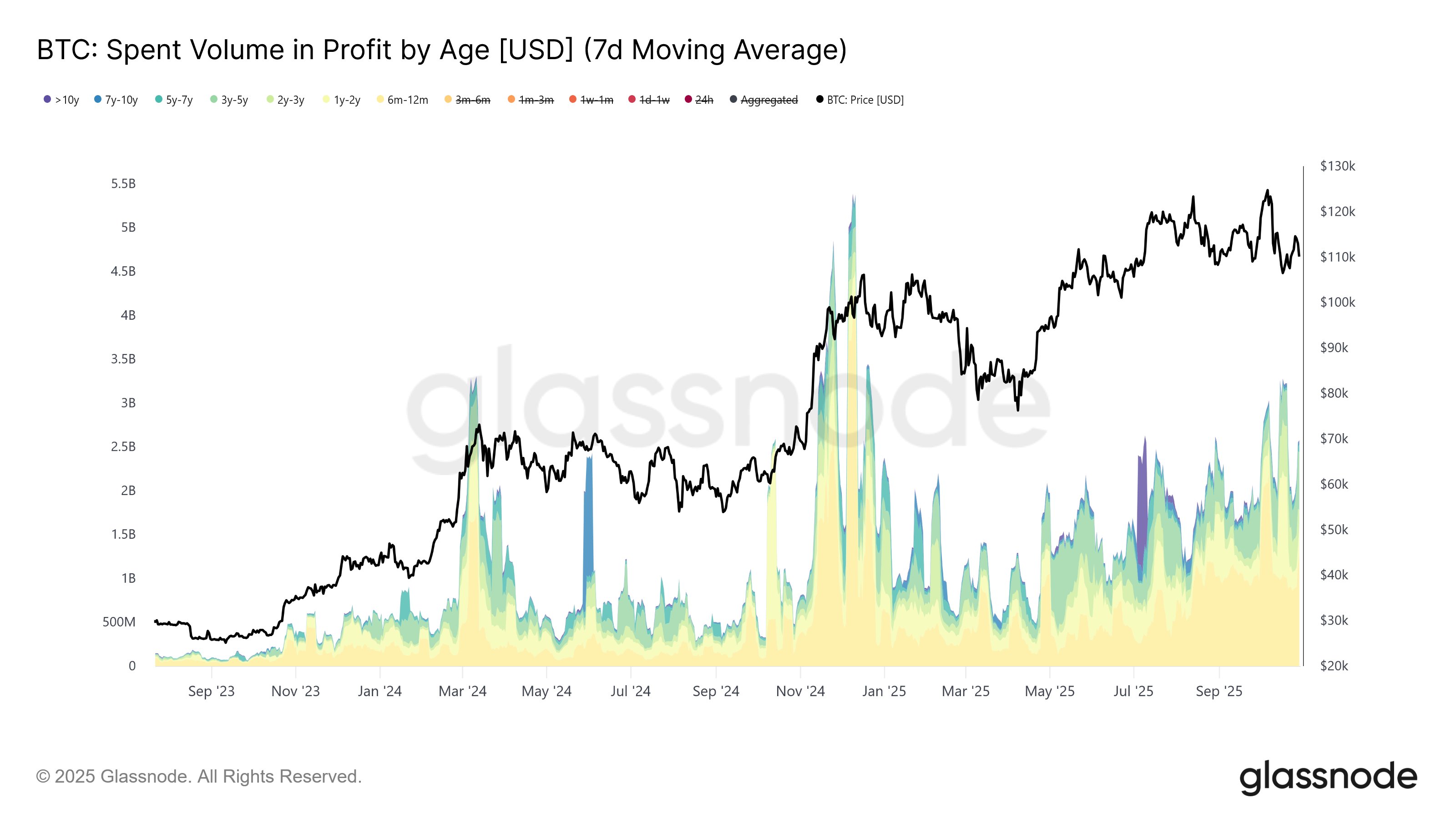

The chain validators aren’t the only ones that have been participating in selling recently. As pointed out by on-chain analytics firm Glassnode in an X post, long-term holders (LTHs), investors holding coins for a period longer than 155 days, have also been on the move.

From the chart, it’s visible that the Bitcoin LTHs were spending about $1 billion per day (7-day average) in mid-July, and by early October, that figure rose to $2 to $3 billion per day.

“Unlike previous high-spending phases in this cycle, this distribution regime has been gradual and persistent, rather than marked by a sharp spike,” noted the analytics firm.

BTC Price

Bitcoin has suffered a bearish blow during the last 24 hours as its price has plunged by almost 4%.