Satoshi Nakamoto’s Bitcoin holdings dropped nearly $5 billion in a single day, cutting the estimated value of the stash to roughly $118 billion.

According to tracking data that ties thousands of early Bitcoin addresses to the name Satoshi, the decline mirrors a wider pullback in crypto markets this week and reflects the sharp swings in Bitcoin’s price.

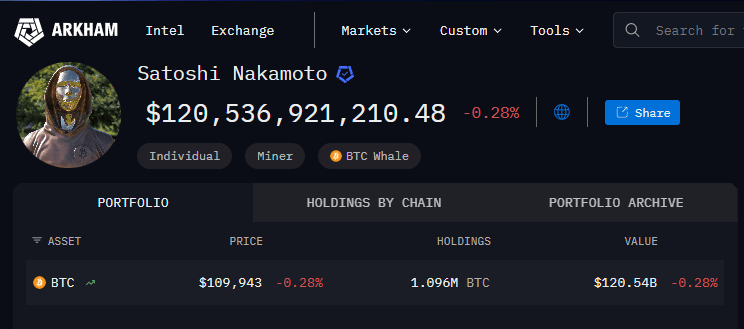

Arkham Intelligence Data

Reports have disclosed that blockchain analytics firm Arkham Intelligence expanded the set of addresses it attributes to Satoshi and now counts roughly 1,096,354 BTC in those clusters.

That haul is the basis for the big headline numbers used by media outlets measuring the “value” of Satoshi’s holdings.

The coins themselves show little sign of movement, and most of the addresses have been inactive for years.

The fall in dollar value does not mean coins changed hands. It only means the market price of Bitcoin fell enough in the past 24 hours to shave about $4.9 billion from the paper worth of those wallets.

Short, sharp swings like this are common in crypto. Longer price trends are what move headline wealth totals more meaningfully.

Market Dip Hits Even The Biggest Holder

Based on reports, the slide happened Thursday as traders reacted to broader selling pressure across the digital-asset space. Analysts and market feeds tied the drop directly to a correction in Bitcoin’s price, not to any outgoing transfers from the old addresses.

That detail matters because a sale from a wallet tied to Satoshi would be an event with big market implications; none has been recorded.

At the recent peak in mid-August, when Bitcoin briefly pushed above $124,000, those same addresses were valued at about $130billion.

That comparison shows how volatile headline “net worth” figures can be when they track a fluctuating asset rather than bank accounts or shares.

The holdings of Satoshi Nakamoto are often used as a shorthand to show how much value is effectively locked away in early-mined coins.

For observers, the point is simple: large sums can vanish from dollar-denominated lists overnight when prices move. For traders, those moves feed into short-term momentum and sentiment.

What This Means For Investors

For now, the situation is a valuation story more than an operational one. Reports highlight that the coins remain largely dormant and that the tally is an estimate built from on-chain patterns linked to early mining activity.

That leaves market watchers with two basic facts: the dollar value can swing wildly, and the coins have stayed put.

Featured image from Vecteezy, chart from TradingView