Takeaways:

Strategy posts $2.8B Q3 income, beating analyst expectations as Bitcoin holdings surge past 640K $BTC.

Saylor’s success validates the Bitcoin ‘store of value’ narrative, but $BTC still can’t compete with modern blockchain speed.

Bitcoin Hyper launches as the first true Bitcoin Layer 2, bringing sub-second transactions and near-zero fees to $BTC.

$HYPER presale offers early access to a Bitcoin execution layer that finally makes $BTC usable for DeFi, dApps, and memes.

Michael Saylor’s strategy just released Q3 earnings that would make most CFOs happy: $2.8B in net income. Sure, it’s down from Q2’s incredible $10B profit, but with over 640K Bitcoin, a weak quarter still generates cash like the Federal Reserve wishes it could.

The company’s Bitcoin yield hit 26% year-to-date with a $13B gain, and they’re projecting a 30% yield if $BTC reaches $150K.

While strategy shows that holding $BTC is highly profitable, anyone who has paid $20 in transaction fees to move $50 knows that Bitcoin’s ‘store of value’ narrative comes with a big asterisk: it’s slow, costly, and about as practical for daily transactions as using gold bars for everyday purchases at Starbucks.

Saylor’s success shows that the world wants Bitcoin exposure, but Bitcoin can’t do much beyond sitting in a wallet. What if it could move at the speed of modern blockchain technology, power DeFi protocols, launch meme coins, and still maintain Bitcoin’s legendary security?

Bitcoin Hyper ($HYPER) is the first true Bitcoin Layer 2 that offers full Bitcoin functionality with Solana-level speed, perfectly meeting the market’s needs as institutional players, such as Strategy, continue to invest heavily in $BTC.

Bitcoin Hyper ($HYPER) – The Layer 2 That Fixes Bitcoin’s Problem

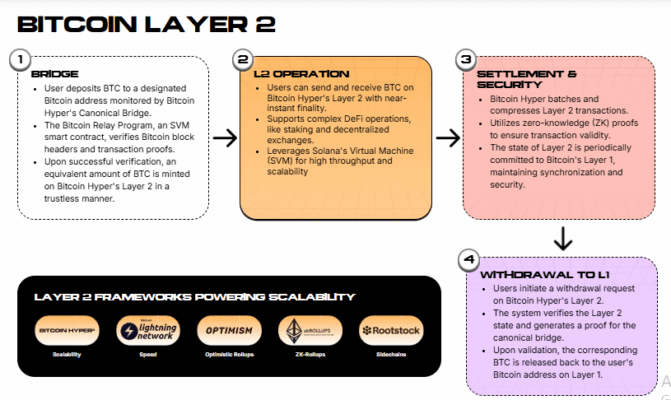

Bitcoin Hyper leverages Solana’s Virtual Machine (SVM) to create a Layer 2 execution layer that processes transactions in sub-seconds with near-zero gas fees.

At the same time, zero-knowledge proofs keep everything synced and secure, all the way back to Bitcoin’s main chain. It’s trustless bridging in, lightning-fast transactions in the middle, and secure settlement back to Bitcoin Layer 1.

While Strategy shows institutions are eager for Bitcoin exposure, retail investors and developers seek Bitcoin utility. Bitcoin Hyper offers both: a platform where the world’s most trusted cryptocurrency acts as the foundation for the next generation of dApps, DeFi protocols, and even meme coins.

Solana taught us that speed and low fees are the difference between a blockchain that people actually use and one that remains unused in a wallet.

The $HYPER presale is live now at $0.013195 per token, with over $25.3M raised so far, including whale buys of $379.9K and $274K.

Early participants get priority access to staking rewards, airdrops, governance rights, and the first chance to join token launches within the ecosystem. Get in before the network launches, stake your claim, and ride the wave as Bitcoin finally enters its era of widespread adoption.

Strategy just proved that Bitcoin’s value proposition works at an institutional scale. Bitcoin Hyper is proving it works at execution scale.

Saylor’s sitting on $2.8B in quarterly income from holding $BTC. Imagine the value creation when that $BTC can flow freely through DeFi protocols, power cross-chain applications, and enable the kind of on-chain activity that’s been impossible on Bitcoin Layer 1.

When Saylor’s next earnings report shows another multi-billion dollar profit, you’ll want to be holding the token that makes Bitcoin truly usable, not just valuable. Position yourself for Bitcoin’s execution layer revolution.