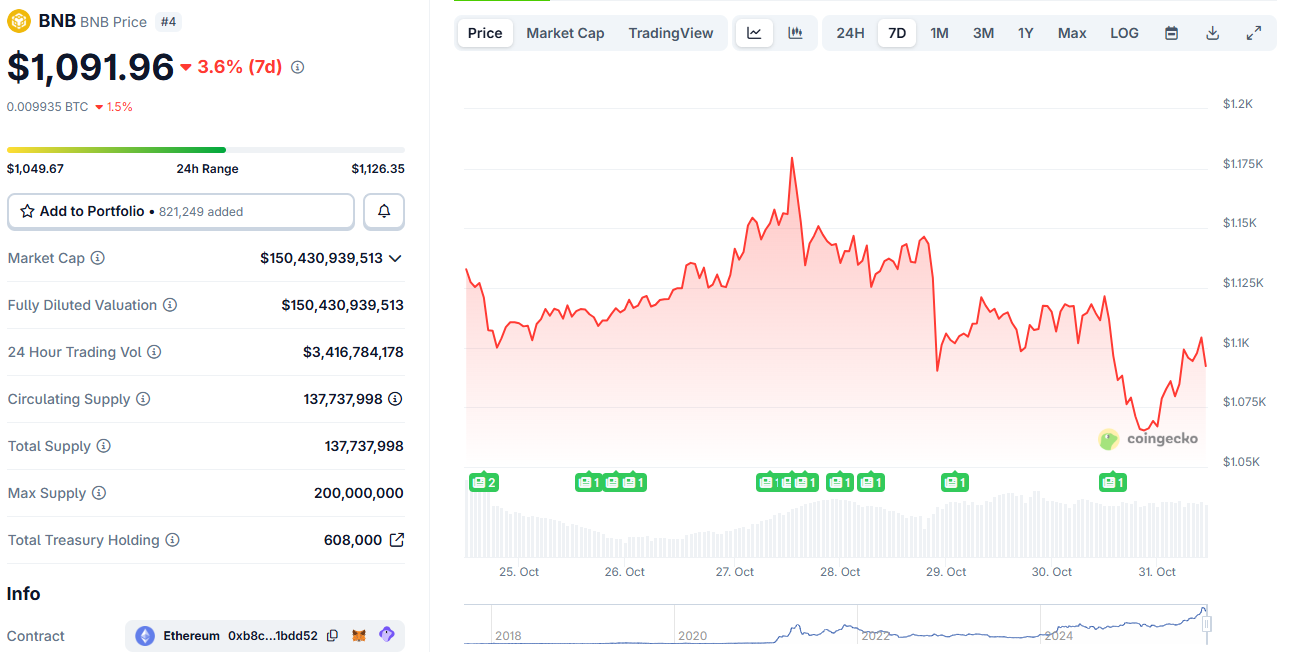

The BNB price prediction for November points toward a mild rebound, with analysts forecasting a climb to $1,122.98 by November 30, 2025. Binance Coin currently trades near $1,092.49, down 1.7% in the last 24 hours, but with trading volume up 12.98% to $4.58 billion, early signals of renewed accumulation are forming.

While sentiment remains neutral, the growing attention around Bitcoin Hyper ($HYPER) – a layer‑two scaling project building for Bitcoin DeFi – is adding momentum to market confidence.

As Binance Coin defends the $1,090 region, traders are watching both on‑chain strength and new altcoin presales that could outperform traditional exchange tokens.

Short‑Term Outlook: BNB Targets $1,127 in Early November

In the immediate term, BNB is projected to record gradual daily increases, targeting $1,127.37 by November 3, which represents a 3.18% rise from current prices. The trend is being supported by a Fear & Greed Index reading of 29 (Fear), showing that the market has room for upside once sentiment turns bullish again.

Over the past 30 days, BNB has recorded 15 green trading days and maintained 6.28% volatility, indicating stable yet active movement. Analysts believe that if Binance Coin closes above $1,120, the next resistance lies around $1,162, followed by $1,200 – a zone that previously triggered profit‑taking during mid‑October.

On the downside, support levels remain firm at $1,040, $1,002, and $960, which together form a base that has historically acted as a bounce region for buyers. Maintaining this support could strengthen the short‑term BNB price prediction and set the foundation for a retest of the $1,200 region.

Trump’s Pardon of CZ Sparks New Publicity Wave

Market discussions intensified this week after a statue of Binance founder Changpeng Zhao (CZ) was unveiled in Washington, D.C., shortly after former President Trump issued him a full pardon. The move has been widely covered, and it comes at a time when BNB remains one of the top‑performing cryptocurrencies of 2025, with year‑to‑date gains of 62%.

The statue, which cost around $50,000 and was funded by four community members, symbolizes Binance’s resilience despite regulatory challenges. Trump’s public statement, describing CZ as “persecuted by the Biden administration,” re‑energized retail sentiment toward the Binance brand.

Analysts note that this renewed visibility could positively influence medium‑term demand for BNB, as the exchange’s ecosystem remains deeply tied to the token’s utility and perception.

Technical Indicators Remain Mixed but Improving

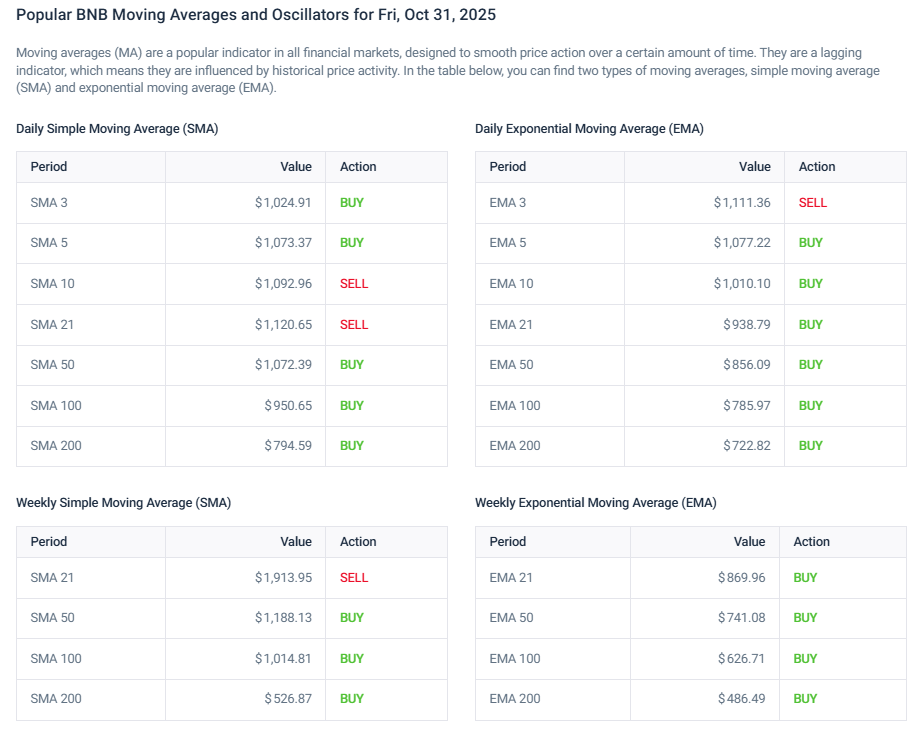

From a technical standpoint, BNB is trading near its 200‑day exponential moving average (EMA), which sits close to $1,090. Historically, this level has acted as a springboard for bullish continuation.

Current data from CoinCodex and other analytic models shows that SMA 3 and SMA 5 are signaling Buy, while SMA 10 and SMA 21 indicate Sell. On the exponential side, the EMA 5 to EMA 50 range remains mostly in Buy territory, confirming a medium‑term positive bias.

The Relative Strength Index (RSI) stands at 44.74, reflecting a neutral stance, but with growing potential for a reversal as selling pressure cools. Analysts believe a decisive daily close above $1,120 could mark the start of a sustained rally toward $1,300, a key level that aligns with prior tops in the BNB chart.

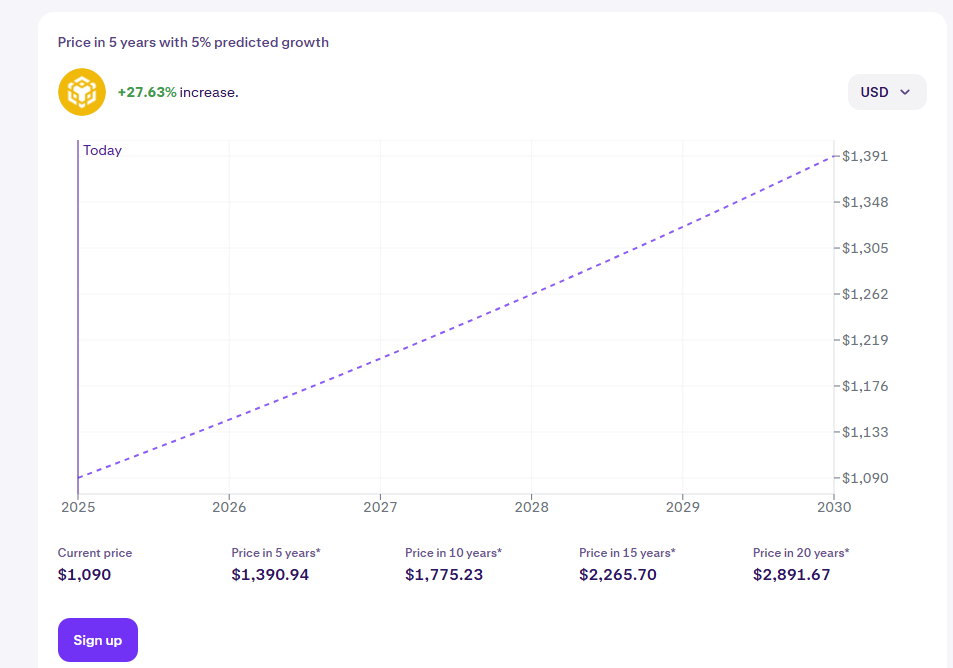

The long‑term BNB price prediction for December remains optimistic, with estimates placing the token at an average of $1,165.62 and a high of $1,237.04, suggesting a 13.22% increase by year‑end.

Why Traders Are Turning to Bitcoin Hyper ($HYPER)

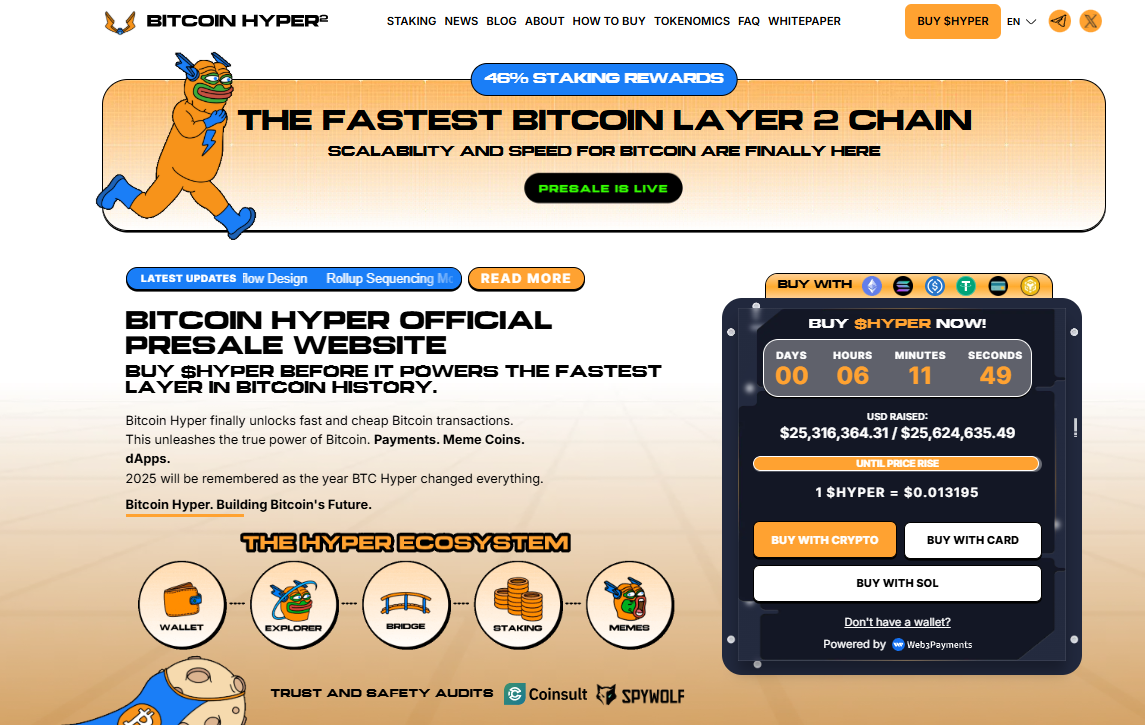

While BNB continues to demonstrate resilience, traders seeking higher upside potential are increasingly shifting focus toward Bitcoin Hyper ($HYPER), a fast‑rising presale that just surpassed $25.3 million raised.

The project, built as a layer‑two scaling solution for Bitcoin DeFi, aims to resolve Bitcoin’s long‑standing scalability challenges while integrating smart contract functionality across multiple chains. Its presale price currently stands at $0.013195, with only a few hours left before the next automatic price rise.

Investors are comparing the early growth pattern of $HYPER to BNB’s early adoption years, noting that both rely heavily on strong community engagement and capped token supply. As presale momentum accelerates, Bitcoin Hyper is emerging as one of the most promising new entrants in 2025’s altcoin cycle, offering traders a chance to position before listings begin.

For investors looking beyond short‑term moves, $HYPER’s deflationary structure and real‑use case narrative have made it a standout against traditional exchange coins that now face slower growth curves.