While Bitcoin’s price action points to a relative scarcity of spot activity, recent on-chain data reveals an increasingly dynamic atmosphere within its futures market, especially on the Binance network.

Binance Dominates Futures Market As Trader Sentiment Sees Structural Shift

In a recent post on the CryptoQuant platform, crypto education institution XWIN Research Japan shares insights into developments in the Bitcoin futures market, with their key focus being the Binance network. According to the research institution, the world’s leading crypto exchange is maintaining its reputation after reaching its record high of $1.88 trillion in trading volume.

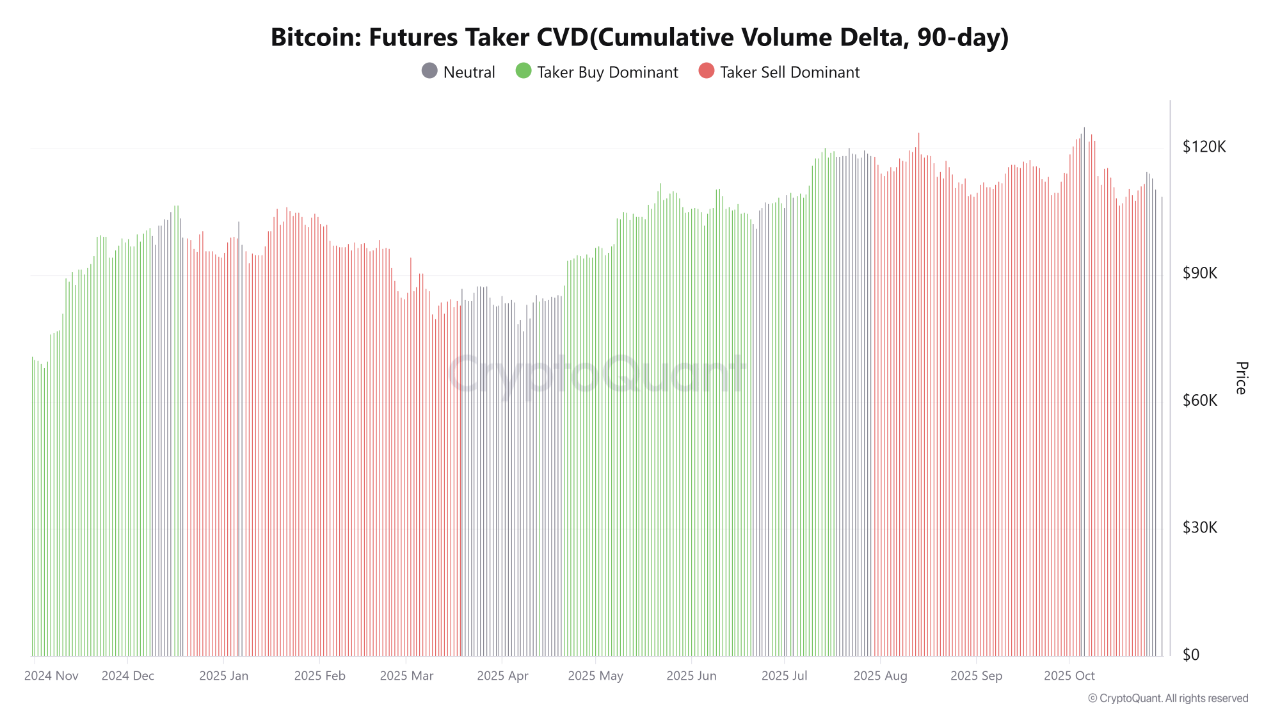

At the same time, the trader sentiment within Bitcoin’s futures market evidently appears to be undergoing a transition, with data from the Bitcoin: Futures Taker CVD (Cumulative Volume Delta, 90-Day) informing the supposition. For context, this metric tracks the net difference between taker buy volume and taker sell volume over 90 days, revealing if the traders in the futures market are predominantly adding to its buying pressure or contributing to its selling pressure.

XWIN Research points out that as of the middle of 2025, Bitcoin’s taker buy volume dominated the futures market, as most traders accumulated positions. This period of accumulation, notes the analyst, was seen as the flagship cryptocurrency climbed above $100,000. However, from late August to the present, there has been a re-emergence of taker sell pressure, signaling the predominance of profit takers in the market.

What This Means For Price

Contrary to what this structural shift might be interpreted as, the educational institution explains that the market seems instead to be becoming more mature. A typical mature market, as XWIN Research points out, is one where the market participants manage their exposure, rather than chase any or all price spikes.

The reappearance of taker sell pressure therefore signifies a growing inclination among traders to protect their gains nested within the $110,000-$115,000 price range. Historically, this kind of “moderation” has often been a sign of long-term strength. Binance’s $1.88 trillion in trading volume also lends credence to this view, as it reveals the presence of solid institutional confidence in the cryptocurrency’s long-term growth.

Aside from institutional backing, this trading volume also puts into perspective the width of global participation in the Bitcoin derivatives market. In the long run, the Bitcoin market could be in the early phases of a sustained and long-lasting expansion. At press time, Bitcoin is worth approximately $110,110. The premier cryptocurrency shows a slight growth of 0.40% in 24 hours. Also reflecting the online asset’s sideways movement is its net loss of 1.36% over the past seven days.