Ethena (ENA) is back in the spotlight as traders closely watch its key support levels, aiming for a potential rebound toward $1.20 amid recent market volatility.

After a sharp decline from recent highs, ENA is attempting to stabilize above critical support zones. Analysts highlight both the risks of further dips and the potential for a bullish recovery, making this phase crucial for investors monitoring Ethena crypto.

ENA Shows Signs of Recovery

Ethena (ENA) is currently navigating a period of heightened volatility after experiencing a significant price decline from recent highs. Traders and analysts are closely watching the token’s performance as it attempts to hold critical support levels while positioning for a potential bullish rebound toward $1.20.

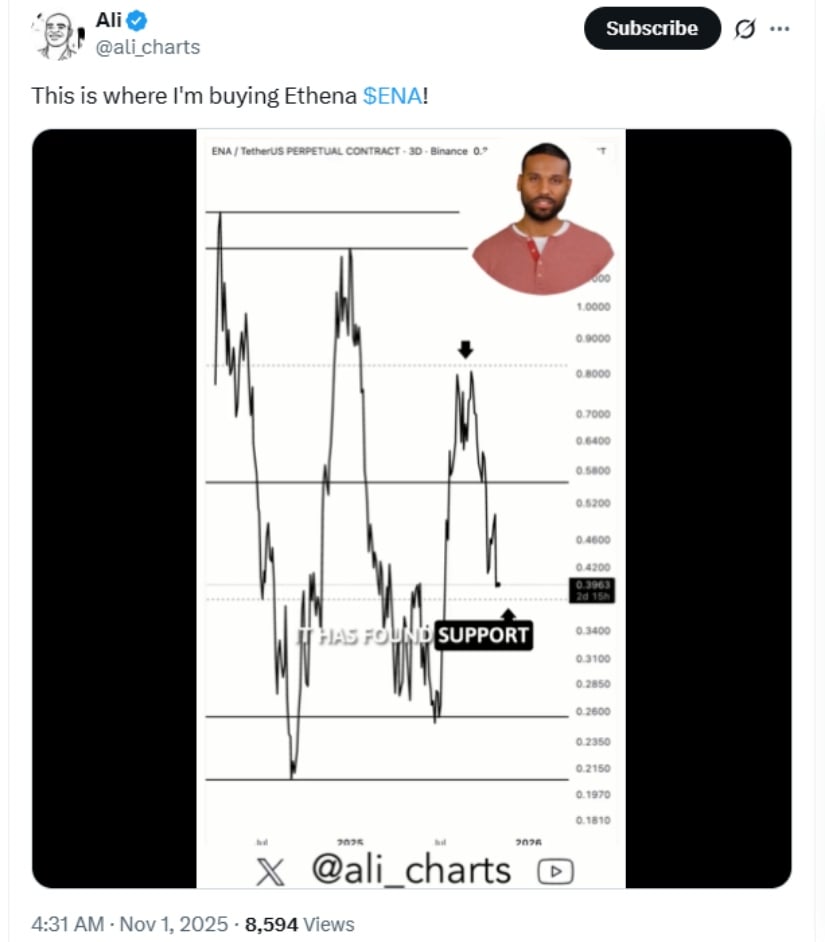

Ali identifies $0.38 as key support for Ethena (ENA) with potential upside toward $1.20. Source: Ali Martinez via X

As of November 1, 2025, ENA is trading around $0.39, stabilizing near a key support zone identified by market experts. “$0.38 is a strategic entry point for Ethena’s $ENA perpetual contract,” noted crypto analyst Ali, highlighting both the risks of further dips and the upside potential if buying pressure persists.

Support Levels Under the Microscope

Technical analysis points to a primary support range between $0.38 and $0.45. This zone is crucial for maintaining market confidence and preventing further downward momentum.

A market maker signals potential support for Ethena (ENA) around $0.25–$0.31. Source: Hyper Up via X

Additional lower support zones exist between $0.25 and $0.31, as highlighted by Hyper Up, which referenced Hyperliquid order book data showing clustered buy liquidity. Such levels may act as temporary floors if volatility intensifies due to upcoming token unlocks. These scheduled unlocks, totaling over 266 million $ENA tokens in early November, are expected to introduce short-term selling pressure, testing the resilience of current support levels.

Current Price Action and Market Structure

Currently trading around $0.50 in some markets, ENA appears to be in a recovery phase above its strong base levels of $0.13–$0.15. Analysts describe this as an early stage of a potential impulse wave recovery, suggesting that the token may be forming the groundwork for a renewed upward trend.

Volume trends support this narrative. Gradually increasing trading activity indicates growing market interest, a bullish signal that buyers are gradually returning after the token’s 50% decline from $0.80.

Analysts note Ethena (ENA) has rebounded from major support, signaling a recovery setup toward the $0.87 resistance level. Source: SatochiTrader on TradingView

Looking ahead, the next big barrier standing in Ethena’s way is the $0.87 level. A breach over this resistance will confirm a trend reversal and may give way to a longer-term rally. Analysts indicate that as long as support is held between $0.45 and $0.50, ENA’s price could first head to $0.65 before trying to break to $0.87. Beyond this, bulls are targeting the $1.20 mark as an important psychological and technical point.

Risk Zones and Market Caution

Despite the bullish potential, there are also some risks involved. If the price fails to hold above $0.45, it would likely fall back toward the lower accumulation areas around $0.30–$0.35. Such a pullback would not necessarily negate a recovery, but it could delay the upward trajectory and create additional short-term volatility.

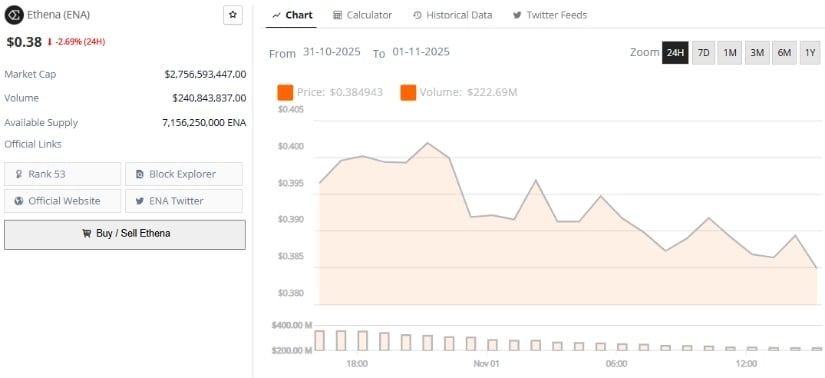

Ethena was trading at around $0.38, down 2.69% in the last 24 hours at press time. Source: Brave New Coin

Community sentiment has mixed perspectives: some investors expect the $0.34–$0.38 range to hold due to behind-the-scenes accumulation, while others are still cautious about unlocks and wider crypto market dips.

Key Takeaways

ENA is showing early recovery signs after a significant price correction. Holding above $0.45 is crucial for sustaining bullish momentum.

Upcoming token unlocks may increase volatility, testing key support levels and challenging the resilience of current price floors. Breaking above $0.87 would signal a potential trend reversal, opening the door for bulls to target $1.20.

Ethena’s stablecoin protocol, USDe, continues to maintain over $3 billion in total value locked (TVL), reflecting the underlying strength of the platform amid market turbulence. This adds an extra layer of confidence for traders considering positions in ENA or its associated stablecoin ecosystem.

Final Thoughts

EN is in a very delicate phase right now, stuck between critical support zones and the possibility of a strong bullish rebound. However, the combination of short-term volatility effects caused by token unlocking and general market conditions may bring some challenges to keeping key support above $0.45 for the continuation of higher prices.

Price action should, therefore, be carefully watched by traders and investors, as a breakout above $0.87 could confirm a trend reversal, setting up a chance for the bulls to target $1.20. Overall, Ethena’s underlying fundamentals, such as its stablecoin protocol USDe, add further confidence against market turbulence, which dictates that careful positioning and effective risk management are of great importance in the weeks ahead.