Cryptocurrency exchange MEXC saw increased activity on its platform on Friday, October 31st, with several users seemingly moving their assets away. These massive withdrawals coincided with the exchange’s chief strategy officer’s public apology for mishandling a situation with a user with the pseudonym The White Whale.

Earlier in July, The White Whale claimed that MEXC froze over $3.1 million worth of his personal funds without any terms of service violations. The crypto user later launched a $2 million social media pressure campaign against the exchange, claiming that the trading platform had requested a 12-month review period before unfreezing their funds.

The White Whale said the “vague review” allowed the exchange to hold customers’ money hostage despite having completed the platform’s most advanced KYC (Know Your Client) process.

MEXC Apologizes For Withholding Users’ Personal Funds

On Friday, MEXC Chief Strategy Officer Cecilia Hsueh took to X to apologize to White Whale on behalf of the exchange. After revealing that the user’s money has been released, and “he can claim it at any time,” the exchange’s executive said that she got emotional communicating with White Whale when she shouldn’t have.

Hsueh added in the post on X:

Since I joined MEXC 2 months ago I’ve been fighting behind the scenes to get MEXC to change. We grew really fast—a few years ago, we were a very small exchange, but given our current scale, our risk, operations, and PR teams have not kept up.

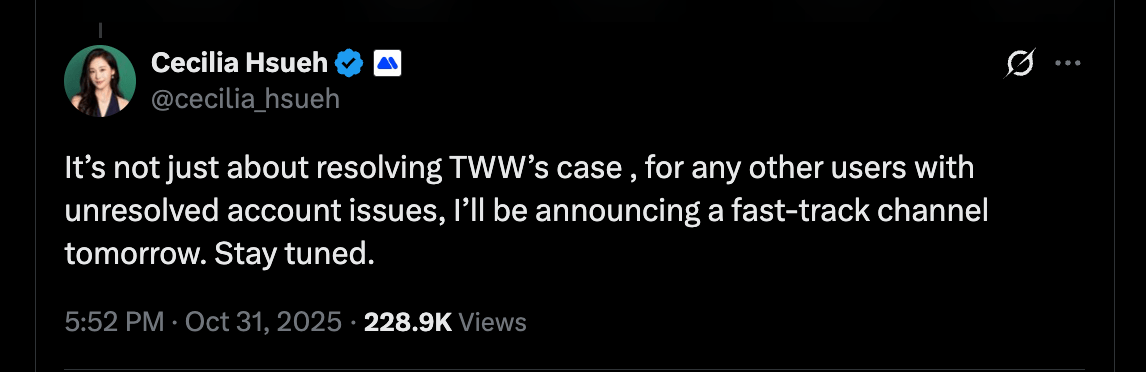

Furthermore, the exchange’s CSO clarified that her statement was not limited only to the White Whale’s case. Hsueh said other users with unresolved account issues will also be attended to, as they look to implement changes that will improve their transparency.

Is Another FTX Fiasco Looming?

A few minutes after this apology was posted on the X platform, pseudonymous on-chain analyst Maartunn revealed that exchange withdrawal transactions on MEXC were on the rise. It appeared at the time that users were moving their funds off the cryptocurrency platform.

Burak Kesmeci, another prominent on-chain analyst, also noticed the big outflows from the MEXC exchange, likening this situation to that of the now-defunct FTX exchange. However, the crypto pundit later revealed that the exchange’s Bitcoin reserves are still intact.

It’s worth mentioning that FTX’s Bitcoin reserves were found to have hit zero days before the exchange declared bankruptcy. Hence, if there is to be a repeat of such an incident, the Bitcoin reserves might be worth watching over the next few days.