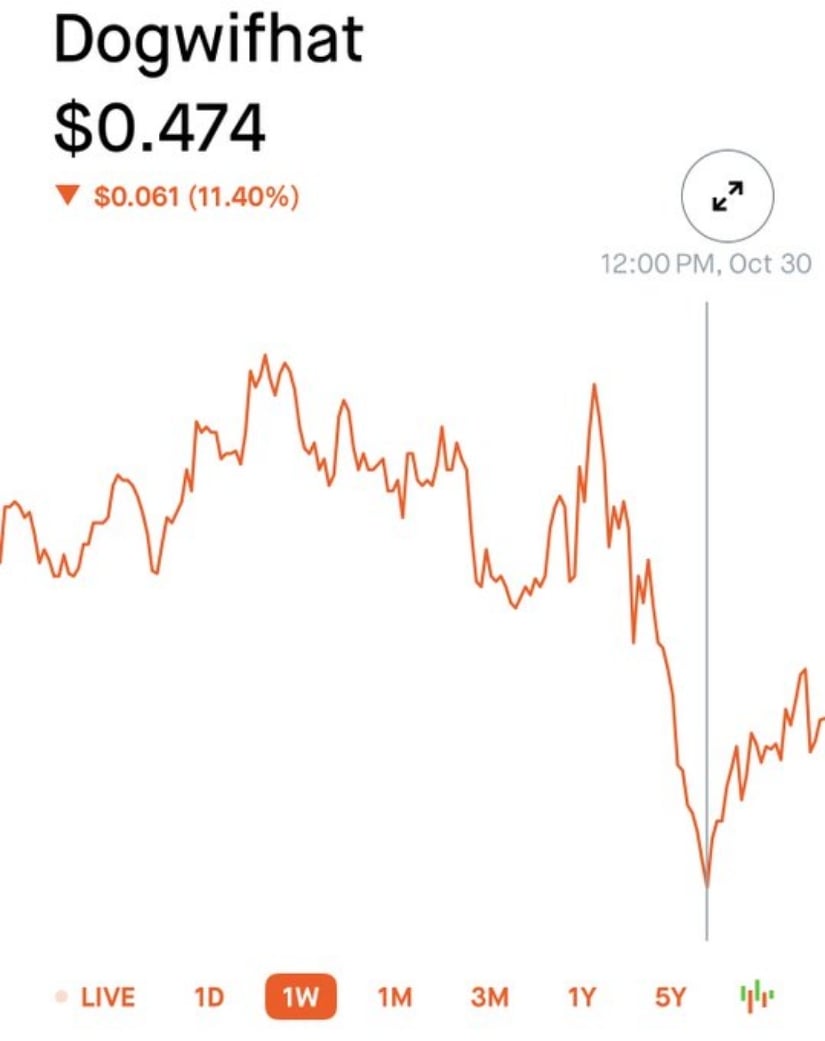

Dogwifhat price shows early signs of a short-term recovery after a volatile trading week.

Buyers appear to be regaining confidence following recent liquidations, pushing the token back above key intraday levels as market sentiment improves across meme coins.

Analyst Insight from X Shows Tactical Profit-Taking

In a recent X post, analyst Modern Day Investing confirmed a tactical exit, closing the coin position at $0.54 for a quick 12% profit within just a few days. His decision reflects the short-term strategies dominating the asset market, where rapid swings define intraday setups.

Source: X

The analyst noted that the move coincided with a temporary resistance level near $0.55, an area that has repeatedly rejected upward extensions in the past. Despite this localized profit-taking activity, Modern Day Investing maintained that overall sentiment around Dogwifhat remains cautiously optimistic.

The coin’s chart has displayed several attempts to re-establish momentum since the recent decline, indicating that buyers are steadily absorbing selling pressure. The ability to sustain price action above $0.50 is seen as critical for maintaining structure, with traders watching for a potential retest of the upper resistance once accumulation deepens.

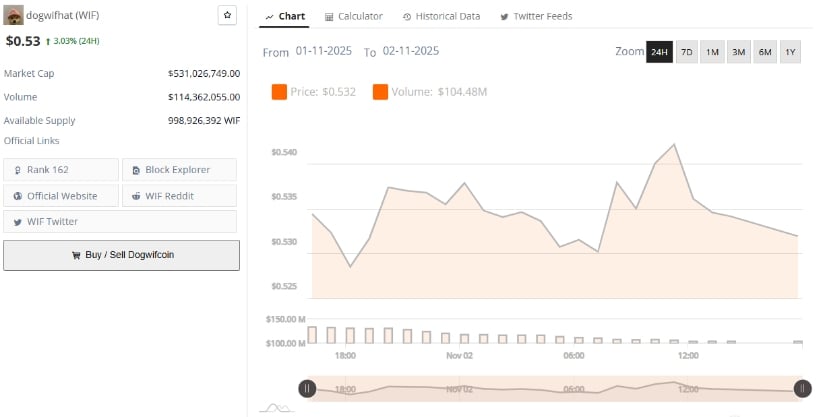

Data Reflects Steady Volume and Market Resilience

According to BraveNewCoin, Dogwifhat is currently priced at $0.53, showing a 3.03% increase in the past 24 hours. The meme coin’s market capitalization stands at $531 million, supported by $114 million in daily trading volume. These figures point to consistent market participation even after periods of volatility, a key signal that liquidity remains stable across major exchanges.

Source: BraveNewCoin

The available supply of 998.9 million tokens continues to maintain equilibrium within the ecosystem, helping prevent excessive dilution. This structural stability provides the token with a more predictable trading environment compared to other speculative meme assets, where sudden supply shifts can distort price action.

Market data also shows that while speculative intensity has cooled slightly, sustained interest among core holders persists. This trend suggests that the coin’s current movement is less reactive to short-term hype cycles and more reflective of a gradual accumulation process.

Technical Data Suggests Early Signs of Stabilization

At the time of writing, WIF/USDT trades around $0.53, consolidating mildly after heavy selling pressure throughout October. The daily TradingView chart highlights visible compression within the Bollinger Bands, with the midline around $0.532 acting as a pivotal short-term reference.

Source: TradingView

The Relative Strength Index (RSI) stands at 42.9, signaling improving momentum while remaining below the neutral 50 threshold—an indication that the asset is gradually recovering from oversold territory. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram shows early signs of contraction, hinting at a potential reversal if momentum persists.

A clean breakout above $0.575 could open the path toward $0.62, aligning with a short-term bullish continuation setup. On the downside, the $0.49 level remains key structural support. A confirmed breakdown below that mark might trigger renewed selling pressure and extend the consolidation phase.