XRP’s start on the first Monday of November hasn’t inspired confidence. The token has dropped 3% in the past 24 hours and is now down 19.1% over the past 30 days. This clearly marks a period of downtrend for the XRP price.

The broader setup remains weak, and the charts suggest more downside, unless buyers step in soon.

Hidden Bearish Divergence Signals Continued Weakness

Between October 13 and November 2, XRP’s price made a lower high, while the Relative Strength Index (RSI), which tracks buying and selling strength, formed a higher high. This is known as a hidden bearish divergence, a setup that often signals the continuation of an existing downtrend.

Simply put, while momentum appears to rise, sellers are still in control. For XRP, the only way to invalidate this bearish setup is a daily close above $2.64, which could open a move on the upside.

Price Shows Bearishness: TradingView

Until then, the market remains tilted toward sellers.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Profit-Taking and Short-Term Selling Add Pressure

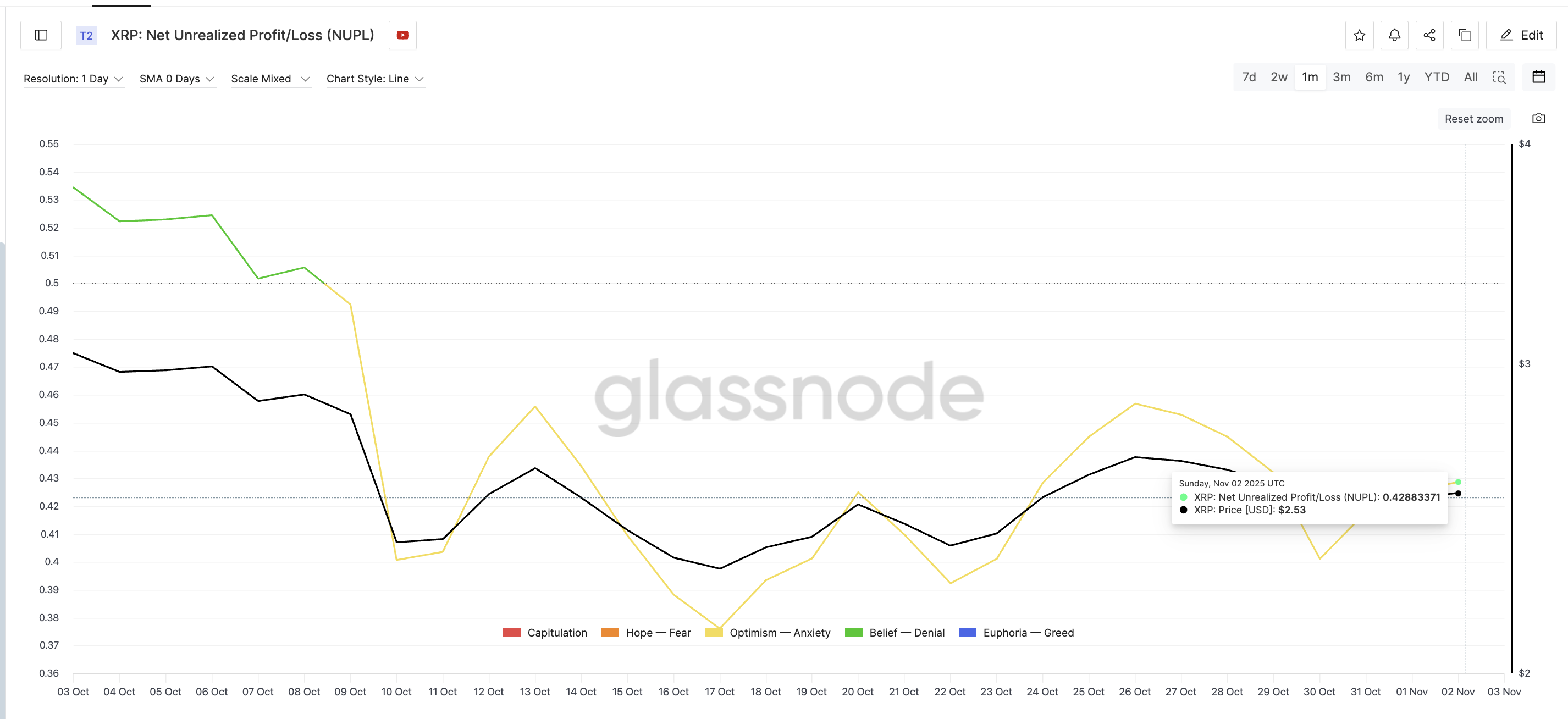

On-chain data supports this weakness. The Net Unrealized Profit/Loss (NUPL), which measures investor profit levels across the network, stands at 0.428, almost identical to the local peak of 0.425 reached on October 20. At that time, XRP dropped from $2.50 to $2.36, a 5.6% correction in just two days.

Holders Are Still Profitable: Glassnode

High NUPL values often mean investors still hold profits, so many may sell to secure gains.

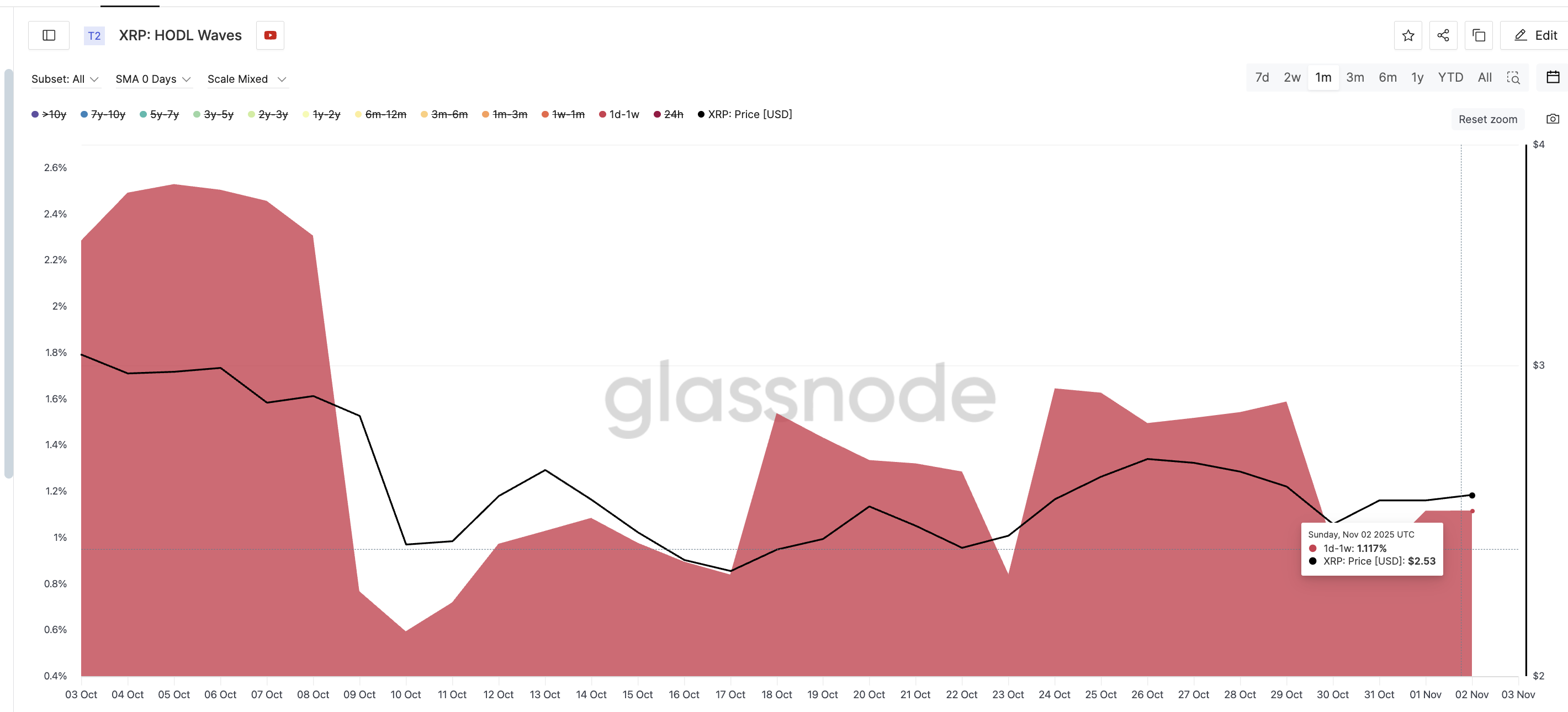

That’s exactly what’s happening. The HODL Waves metric, which tracks how long investors hold coins, shows that wallets holding XRP for 1 day to 1 week have cut their supply share from 2.28% to 1.17% in just two weeks. That’s a near 50% drop in reserves.

Short-Term Holders Selling More Aggressively: Glassnode

These short-term traders are actively selling into rallies, adding to the downward pressure.

Key XRP Price Levels To Watch as Selling Intensifies

As short-term holders keep offloading, XRP’s key support at $2.31 is under pressure. If this level fails, the token could slip toward $2.18, confirming further downside. Note that $2.31 is just 4.91% away from the current price level, still within the NUPL-driven drop zone, as discussed earlier.

XRP Price Analysis: TradingView

However, holding above $2.31 could stabilize prices long enough to test the $2.64 ceiling again. Crossing that level would invalidate the bearish divergence and signal the start of a possible rebound.

That would shift momentum back to buyers and align XRP price movement with RSI strength — an early sign of trend recovery.