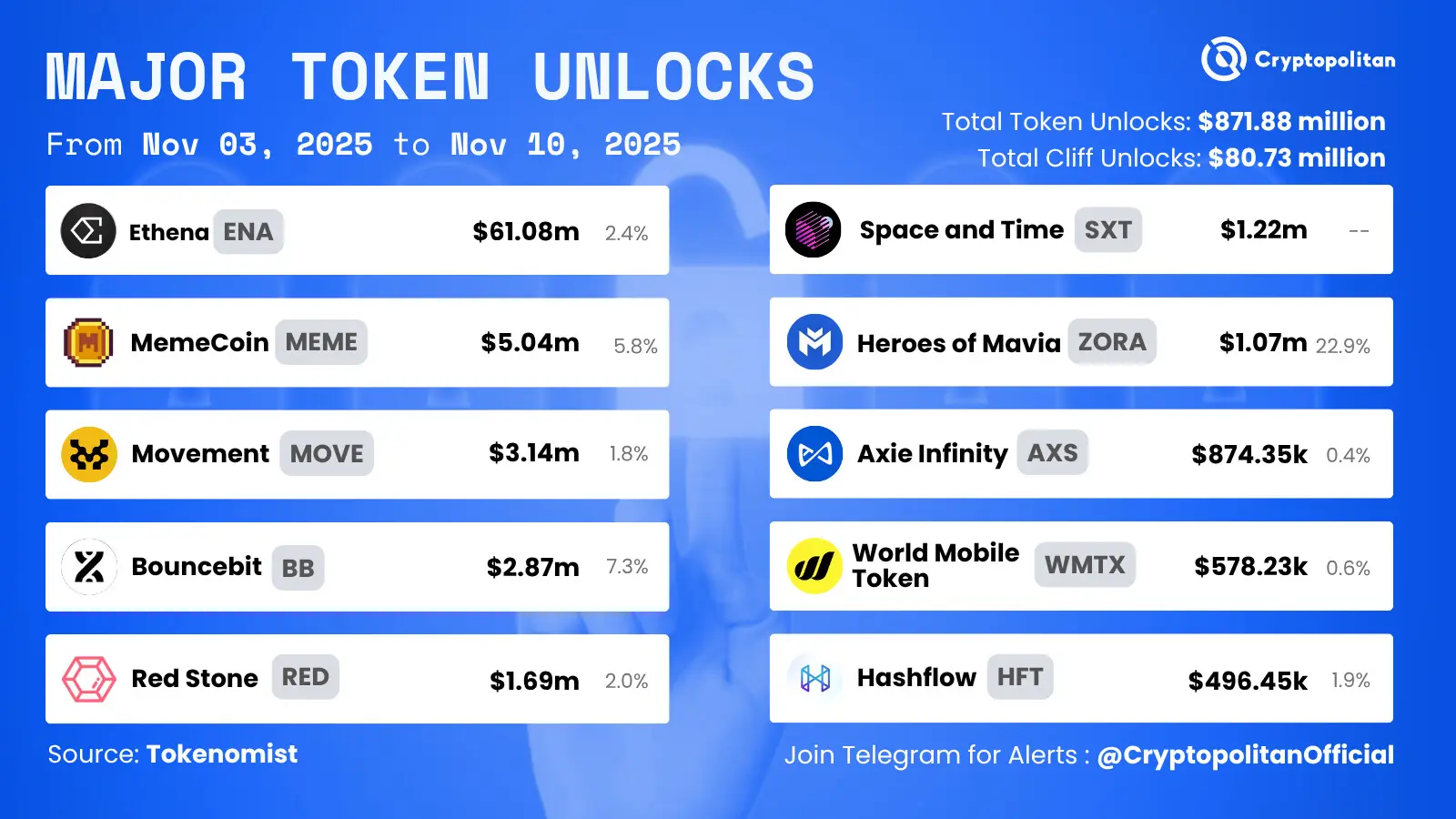

The cryptocurrency market faces over $312 million in token unlocks between November 3 and November 10, with Ethena (ENA) and MEME leading the cliff unlock events.

Data from Tokenomist shows seven major one-time unlocks exceeding $5 million and nine linear unlocks releasing more than $1 million per day. Ethena (ENA) dominates the unlock schedule with 171.88 million tokens worth $63.05 million becoming available. MEME follows with 3.45 billion tokens valued at $5.22 million.

Ethena (ENA) and MEME unlock events dominate schedule

Among all of them, the Ethena unlock is the single biggest value release during the period. The 171.88 million tokens becoming liquid could affect the market situation. This unlock has been set according to a vesting schedule, which specifies the dates on which early investors and team members receive tokens.

The release of 3.45 billion tokens by MEME carries a lower dollar value at $5.22 million but represents a higher percentage of unlock supply at 5.98%. MOVE ranks third among one-time unlocks with 50.00 million tokens worth $3.37 million. This is representative of 1.82% of the unlock supply.

BounceBit (BB) follows with 29.93 million tokens at a value of $3.07 million and 3.85% of its total unlock schedule. RED contributes 5.54 million tokens worth $1.78 million at 2.40% of unlock supply.

Additional one-time unlocks surpass $5 million threshold

Another 24.64 million SXT valued at $1.28 million are unlocked into circulation, which accounts for about 1.62% of unlock supply. The major one-time releases are rounded out by MAVIA, with 11.89 million tokens valued at $1.15 million. This MAVIA unlock represents 16.92% of the unlock supply: the highest among the major cliff events.

ENA, MEME, MOVE, BB, RED, SXT, and MAVIA have combined one-time unlocks totaling approximately $78M. These are cliff events, where tokens unlock on a predetermined vesting schedule that aligns with project milestones, investor lockups, or team allocations.

Solana leads linear unlock schedule

Solana leads in the linear unlock category, with 493.73K tokens scheduled for release, valued at $92.20 million, representing 0.09% of circulating supply. TRUMP token comes a distant second, with 4.89 million tokens valued at $36.68 million, representing 2.45% of circulating supply.

Worldcoin (WLD) adds another 37.23 million tokens worth $30.84 million at 1.64% of supply, while Dogecoin (DOGE) unlocks 96.74 million tokens worth $17.82 million. However, this is only 0.06% of the meme coin’s huge circulating supply.

AVAX unlocks 700K tokens, worth $12.96 million, representing 0.16% of the circulating supply. Astar (ASTER) contributes 10.28 million tokens valued at $12.34 million at 0.51% of supply. Bittensor (TAO) releases 25.20K tokens, worth $12.17 million, accounting for 0.26% of supply.

Story Protocol unlocks 2.32 million tokens worth $9.84 million at 0.72% of supply. Ether.fi rounds out the major linear releases, unlocking 8.53 million tokens worth $8.34 million, or 1.51% of supply.

Linear unlocks differ from cliff events in that they release tokens constantly, rather than in single large batches. Linear vesting is probably the most common vesting used by projects to minimize market supply increases.

Lesser-known tokens reveal fluctuating unlock progress

Beyond the majors, a number of smaller market cap tokens have unlock events in the period according to CoinMarketCap. Hyperbot (BOT) has 18.75% unlock progress, with the next 18.53 million BOT worth $427,044.63. The release represents 1.85% of total locked tokens. BONDEX (BDXN) has 45.33% unlock progress, with 19.92 million BDXN valued at $637,024.29 scheduled, or 1.99% of locked supply.

VaporFund (VPR) has 86.90% unlock progress, with 12.86 million VPR incoming, which accounts for 1.29% of the remaining locked tokens, valued at $5,243.64. Sleepless AI’s unlock progress stands at 41.79%, with the scheduled release of 17.69 million AI tokens worth a combined $1.15 million. This unlock represents 1.77% of total locked supply. Smaller projects usually see more significant price action from unlocks due to generally lower liquidity and trading volume.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.