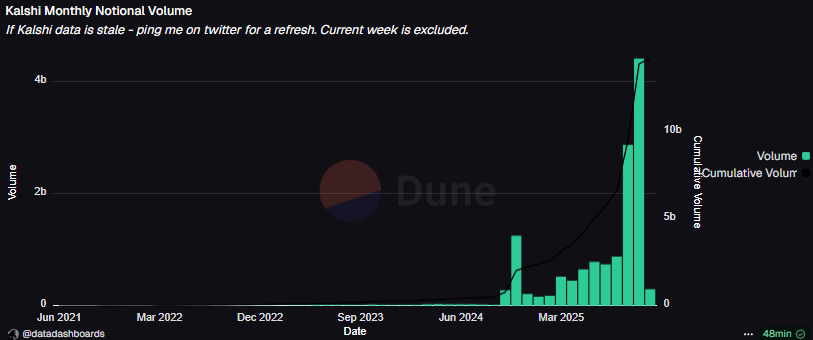

Kalshi, the main competitor of Polymarket, achieved peak record volumes in October. Recently, prediction markets expanded above $1B in monthly volumes.

Kalshi prediction markets set a monthly trading volume record, breaking above $4.39B in October. The platform, which does not rely on a blockchain to settle its predictions, relied mostly on sports bets to get ahead of Polymarket.

For Kalshi, the strongest week was at the end of October, when the platform achieved nearly $1B in notional volumes. In the past month, overall Kalshi activity was at a higher baseline.

Kalshi also gained exposure on a general expansion of prediction markets, linked to active current events. The activity did not always reflect the accuracy of predictions, as the platform recently miscalculated the results of the Dutch elections, alongside Polymarket.

Kalshi taps Web2 users

While Polymarket existed for crypto natives, Kalshi’s success lies in quickly reaching Web2 users. The integration with Robinhood and the general availability of predictions gives Kalshi a head start in mainstream adoption.

Polymarket still relies on wallet and crypto usage, and has a barrier to entry, still requiring some crypto ownership.

Despite the expanded marketing, Kalshi still went through glitches, including a market outage. Polymarket also had a temporary outage, though still allowing experienced traders to use its API and continue their positions.

The platform is still viewed with skepticism, due to its aggressive influencer marketing, and attempts to take over crypto native traders.

Can Kalshi pass Polymarket?

In October, Polymarket came in second among prediction markets, with $2.29B in cumulative volumes. For Polymarket, this was the most successful month since October 2024, when volumes surpassed $2B for the first time.

Polymarket relied on smaller bets, surpassing its activity levels from the last quarter of 2024. As of October 31, the exchange carried over 76K active wallets, breaking the record from the activity surrounding the US Presidential Elections in 2024.

Active wallets expanded from lows of around 14K in October, showing Polymarket could reverse its fortunes. In late 2025, Polymarket still carries most of the volumes for current events.

On both Kalshi and Polymarket, the New York mayoral election is still the most active prediction pair. Kalshi reported volumes above $71B, but Polymarket’s pair reported $365M in trades, showing heightened activity and remaining the leading market for the past month.

As of November 2025, Polymarket searches on Google are also more active compared to interest in Kalshi. In the past couple of weeks, attention for Polymarket is also higher. The on-chain platform is also widely used in the hopes of an eventual airdrop.

Both Kalshi and Polymarket are still facing doubts that their approach to risk is not actual gambling. How prediction markets are viewed by users, and regulated by regional authorities, may be the main factor in limiting growth. In the coming year, Kalshi and Polymarket may also meet with more competition from other rising platforms. As crypto trading slows down, predictions may become a key alternative to direct trading.

Join a premium crypto trading community free for 30 days - normally $100/mo.