Zcash trims gains after rising to near $450, signaling potential profit-taking.

ZEC's derivatives market remains strong, but a slight dip in the Open Interest could accelerate the correction.

The RSI and the MACD indicators on the 4-hour chart highlight a bearish technical structure.

Zcash (ZEC), a privacy-focused token, is trading at around $392 at the time of writing on Monday. This follows a steady price increase over the weekend, during which ZEC approached $450 before correcting in tandem with crypto majors such as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

Establishing a higher support would be crucial for the bulls in the coming days as they push to resume the uptrend above $400.

Zcash wobbles as retail demand slows

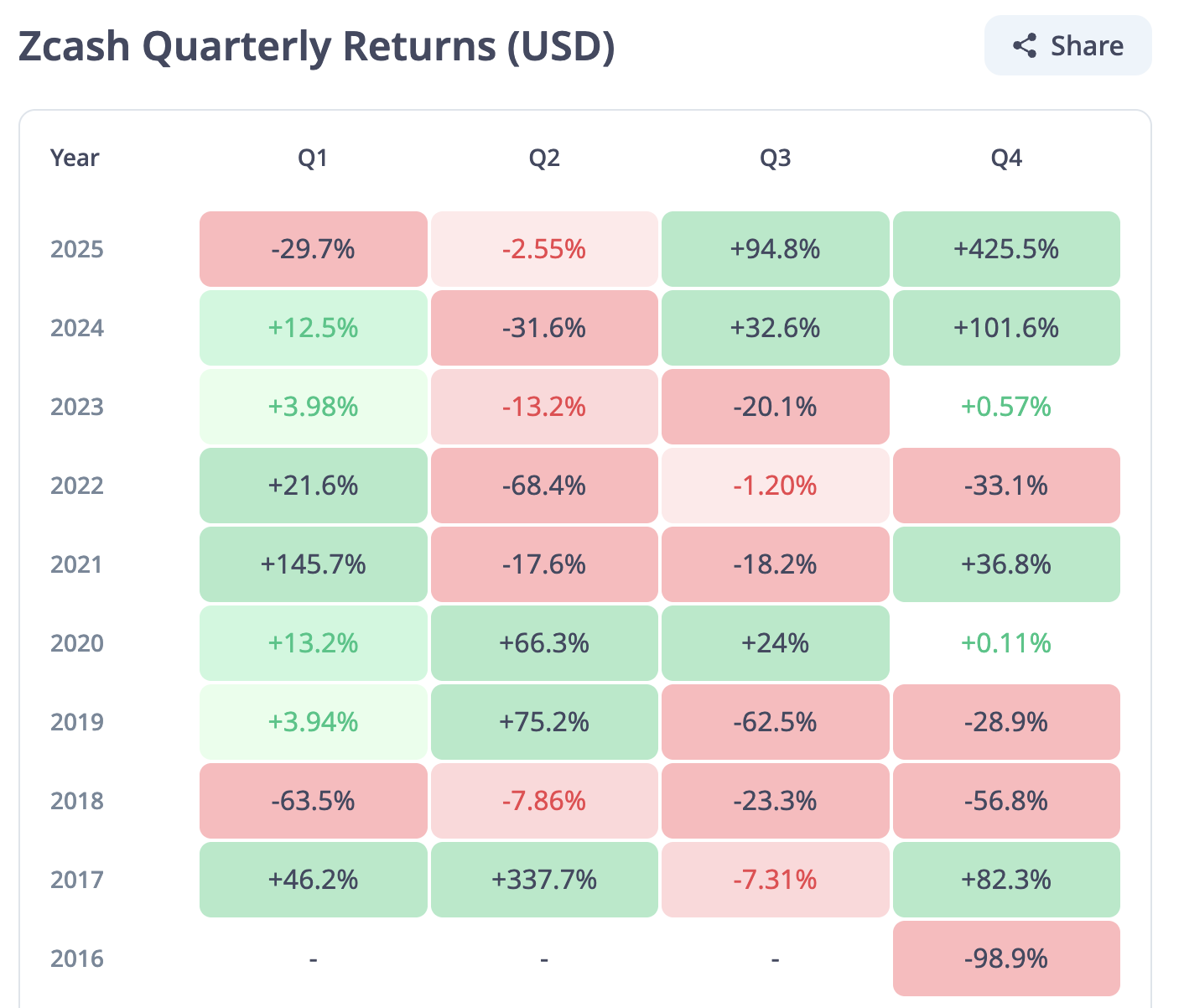

Zcash remains one of the best-performing cryptocurrencies in the fourth quarter, up by nearly 425%, according to CryptoRank. The token has sustained two consecutive bullish quarters, highlighting an intentional shift toward privacy blockchains.

Zcash quarterly returns | Source: CryptoRank

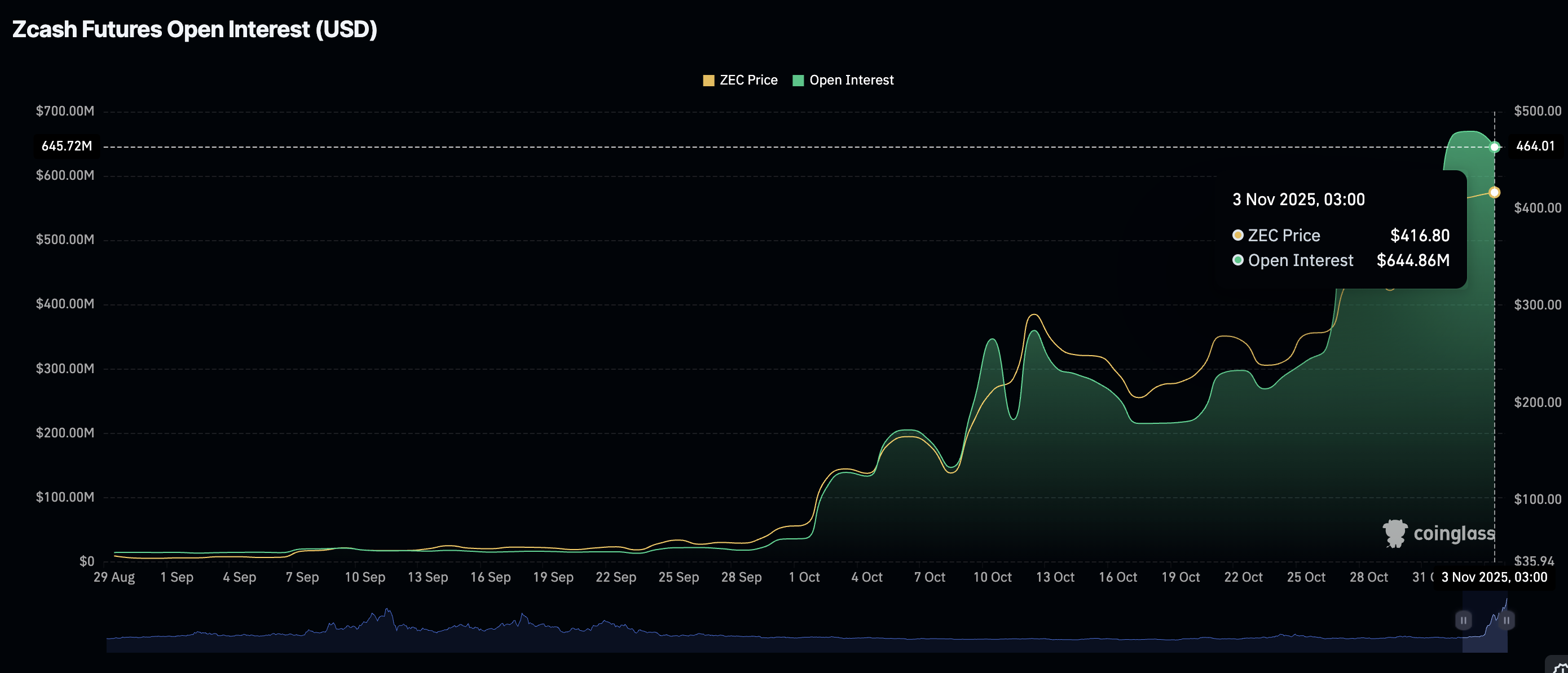

However, CoinGlass data shows that retail demand is wobbling, possibly due to profit-taking as Zcash's price rises. The futures Open Interest (OI), representing the nominal value of outstanding futures contracts, averages $645 million, down from $669 million, its record high reached on Sunday. The OI must steadily increase to support the uptrend. Otherwise, pullbacks would mean that traders are losing conviction in the uptrend.

Zcash Open Interest | Source: CoinGlass

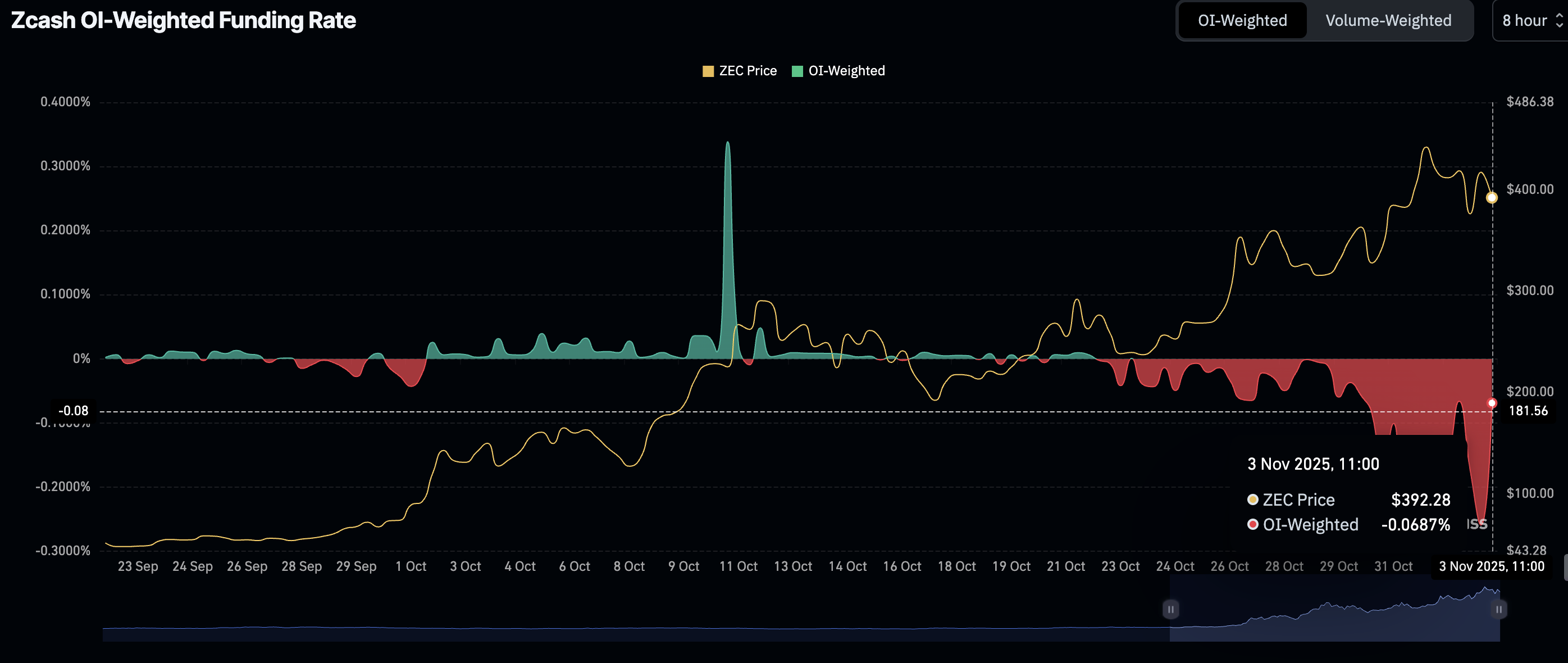

On the other hand, the OI-weighted funding rate remains negative despite the Zcash price trading near its all-time high of $449 set on Saturday. Negative funding rates indicate that traders are currently de-risking, hinting at bullish exhaustion. The continued piling into short positions tends to increase selling pressure.

Zcash OI-Weighted Funding Rate | Source: CoinGlass

Technical outlook: Zcash eyes short-term support

Zcash is trading above its short-term support at $390 after trimming gains from the all-time high of $449, reached on Saturday. A sell signal from the Moving Average Convergence Divergence (MACD) indicator on the 4-hour chart since Sunday calls for investors to reduce their risk exposure, which adds to selling pressure.

The RSI is stable at 51 after declining from the overbought region on Saturday. This stability suggests that bearish and bullish forces are canceling each other out, with the winner of the tug-of-war likely to determine Zcash's short-term direction.

A daily close below $390 could push ZEC toward the 50-period Exponential Moving Average (EMA) at $363 on the same 4-hour chart.

ZEC/USDT 4-hour chart

Still, Zcash may lift off to close the day above the round-number $400 resistance level if bulls seek new opportunities to buy the token after the correction from highs.