What to Know:

1. Ethereum’s ecosystem dominates the DeFi landscape with over $370B in user assets locked, far ahead of Solana ($36B) and Polygon ($4B).

2. Its success stems from powerful network effects, developer maturity, and deep liquidity, reinforcing Ethereum as the go-to platform for high-value on-chain activity.

3. Best Wallet Token ($BEST) leverages this momentum, offering a user-friendly Web3 wallet that enables secure swapping, bridging, and participation in crypto presales.

Applications built on Ethereum currently hold around $370B in user assets. That’s a striking confirmation that, despite mounting competition from newer networks, Ethereum’s ecosystem remains the go-to hub for high-value, on-chain activity.

As Ethereum dApps continue to outshine rivals such as Solana, the ecosystem’s success continues to boost related projects.

That includes Best Wallet Token, the utility token for the growing Best Wallet ecosystem. Here’s how Ethereum’s dominance sets up $BEST presale participants for major gains.

Ethereum’s $370B Milestone

The $370B figure reflects the aggregate value locked across smart contracts, decentralized applications (dApps) and other on-chain services running on Ethereum’s network.

It underscores user engagement (435K daily users) and the trust placed in the ecosystem by developers, builders and participants.

By comparison, rival platforms such as Solana ($36B ecosystem total value locked) and Polygon (a mere $4B) continue to grow but are still significantly behind in terms of the total assets embedded in their ecosystems.

Three reasons have helped Ethereum maintain and even expand its lead:

Network effect and ecosystem maturity – Ethereum enjoys a virtuous cycle. The largest pool of developers builds on its chain, which attracts users and protocols, which in turn brings more assets and liquidity, reinforcing the ecosystem’s value.

Trust and liquidity concentration – When users commit assets to a network, they consider not only fees or speed, but also security, liquidity and established reputation. Ethereum has had more time to build those properties.

Legacy advantage – As one of the earliest platforms to support complex smart contracts and decentralized finance (DeFi), Ethereum holds a significant first-mover advantage over newer chains.

Platform choice matters: not just in terms of underlying token price, but in where value is concentrated. For competitor chains like Solana and Polygon, the challenge remains in how to meaningfully close the gap with Ethereum’s lead in both token price and ecosystem TVL.

While DeFi-centric chains duke it out over TVL, smaller token projects focus on more down-to-earth considerations. That includes how to equip retail investors to navigate the ever-growing Ethereum ecosystem.

That’s precisely what Best Wallet Token ($BEST sets out to do – make it easy for investors to store, swap, and spend tokens securely.

Best Wallet Token ($BEST) – Leading Web3 Wallet with Crypto Presale Edge

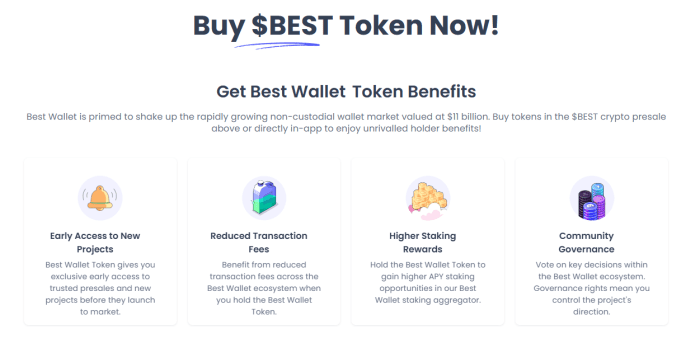

Best Wallet Token ($BEST) is the native utility token of Best Wallet, a next-generation Web3 ecosystem.

The foundation is the Best Wallet app, a Web3, non-custodial app with biometric and MPC security. As our review highlights, Best Wallet enables users to swap, bridge, and track assets across multiple blockchains while maintaining full control of their private keys.

Its smooth interface reduces the technical barriers to Web3 adoption, making it ideal for new users entering crypto markets. At the same time, key features like a dedicated section for upcoming crypto presales allow even new investors to research and trade tomorrow’s hot tokens today.

$BEST functions as the ecosystem’s fuel, offering staking rewards, transaction discounts, and early access to new token launches. Token utility expands with the broader ecosystem, through governance rights and integration with partner DeFi protocols.

The potential for growth includes a planned Best Card, allowing users to spend their crypto seamlessly. With that in mind, our price prediction sees $BEST climbing from $0.025885 to $0.62 by the end of 2026, delivering 2200% returns to current investors.

Visit the Best Wallet Token website to join the presale.

Ethereum’s lead is not invulnerable. High transaction fees and network congestion remain challenges, Layer-2 scaling, interoperability advancements, and novel chain architectures could shift the balance over time.

But for now, $370B signals that Ethereum’s network effects and ecosystem scale have translated into an enduring lead in the on-chain application space.

Can $BEST, with its support for the EVM, follow in Ethereum’s footsteps?

Authored by Bogdan Patru for Bitcoinist — https://bitcoinist.com/ethereum-dominates-web3-370b-locked-best-rising-fast