After a day of barely holding the $107,000 level, BTC extended its losses. The latest dip to the $105,000 range caused over $191M in long liquidations in just one hour.

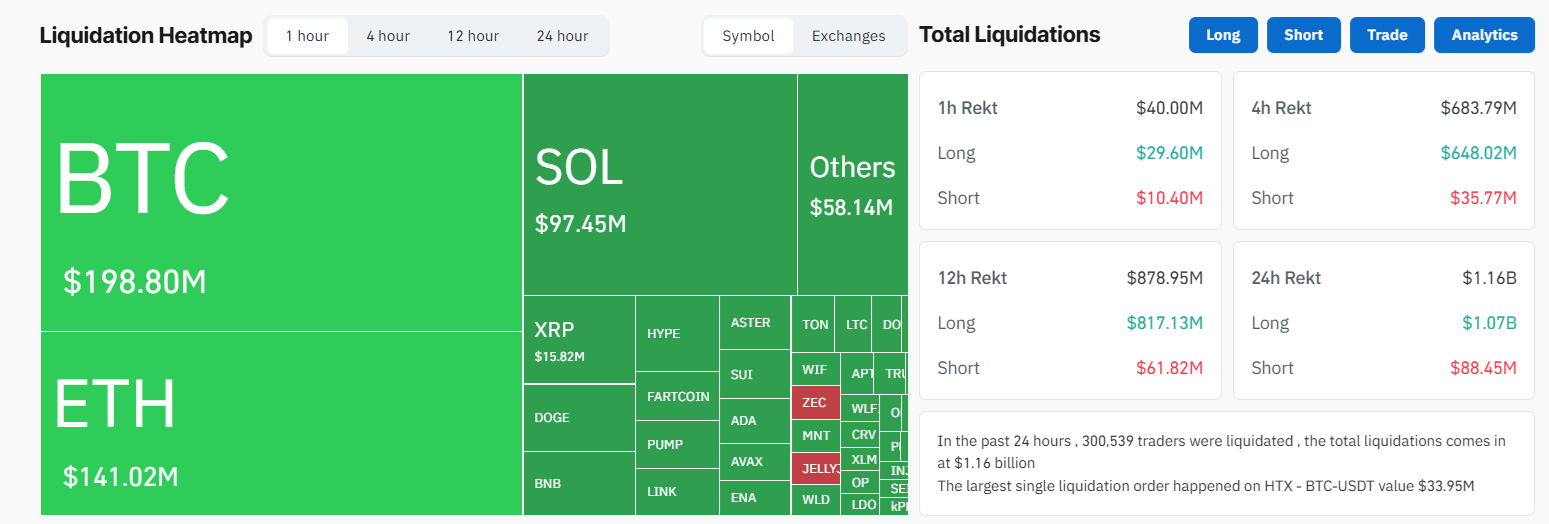

BTC dipped to the $105,000 range, causing an immediate $191M in long liquidations in under an hour. The leading coin slid after re-testing the $107,000 level several times in the past week. A failure to hold above this range may turn into a dip below $100,000. Short-term buyers are also feeling pressure as the most recent wallets are in the red. Total liquidations for the past 24 hours were once again above $1B, the highest since October 11.

For the past day, over $303M in long positions were liquidated. BTC extended its losses after losing several levels in the past day. Hyperliquid was again the leader, with $240M in liquidations for the past 24 hours.

Soon after the initial slide, BTC bounced to $106,464, as most of the long liquidity was wiped out. BTC has not seen prolonged capitulations, but has often moved by a few thousand dollars within a tight range.

The recent BTC drops also wiped out any attempt at an altcoin season. Other assets are still unable to break out, with the exception of ZCash (ZEC).

BTC breaks down to a lower range

BTC traded at $105,405, retaining a dominance of 58.5% as altcoins were hit harder. BNB sank under $1,000, ETH traded in the $3,500 range, and SOL sank to $166. The current market weakness reflects the overall sentiment of a threatening bear market, especially if BTC dips under $100,000.

Recently, BTC broke below its 200-day moving average after days of trading with a fearful sentiment. Volatility remains near a six-month high at 1.89%, while the BTC fear and greed index is at 42 points, indicating fearful trading.

BTC leverage decreased after the latest round of liquidations, with open interest on all exchanges again at $33B. BTC has barely rebuilt its liquidity since the October 10-11 liquidation event.

Hyperliquid shows a return of prominent whales

On Hyperliquid, BTC positions rose a bit to $3.4B in open interest. In the past week, Hyperliquid became the main venue for longing BTC. More than 57% of whales are long on BTC, with more short positions. On general exchanges, only around 30% of traders are shorting BTC due to the outsized risk of liquidations and a short squeeze.

On Hyperliquid, the rapid shift in BTC prices affected even one of the top whales with a 100% win rate, closing all positions with a loss of $17M. The whale partially closed some positions, but sits on continued unrealized losses, with the eventual goal of recovering.

At the same time, the whale that shorted the market just before the October 10-11 liquidation is back with long positions for BTC and ETH, betting on a market recovery.

Based on the liquidation heatmap, traders are also reluctant to open big short positions. Liquidity also diminished on short positions, with the most accumulation around $108,000.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.