Ethereum (ETH) has gone down by 4% in the past 24 hours but briefly dipped below the key $3,700 threshold as the crypto market started the week with a strong selling spree.

The top altcoin has now booked a 17% retreat in the past month as President Trump’s ongoing trade war with China and the Federal Reserve’s apparent reluctance to lower rates in December have depressed market sentiment.

Trading volumes in the past day have increased by 80% as well, currently accounting for nearly 8% of the token’s circulating supply, indicating that market participation is strong.

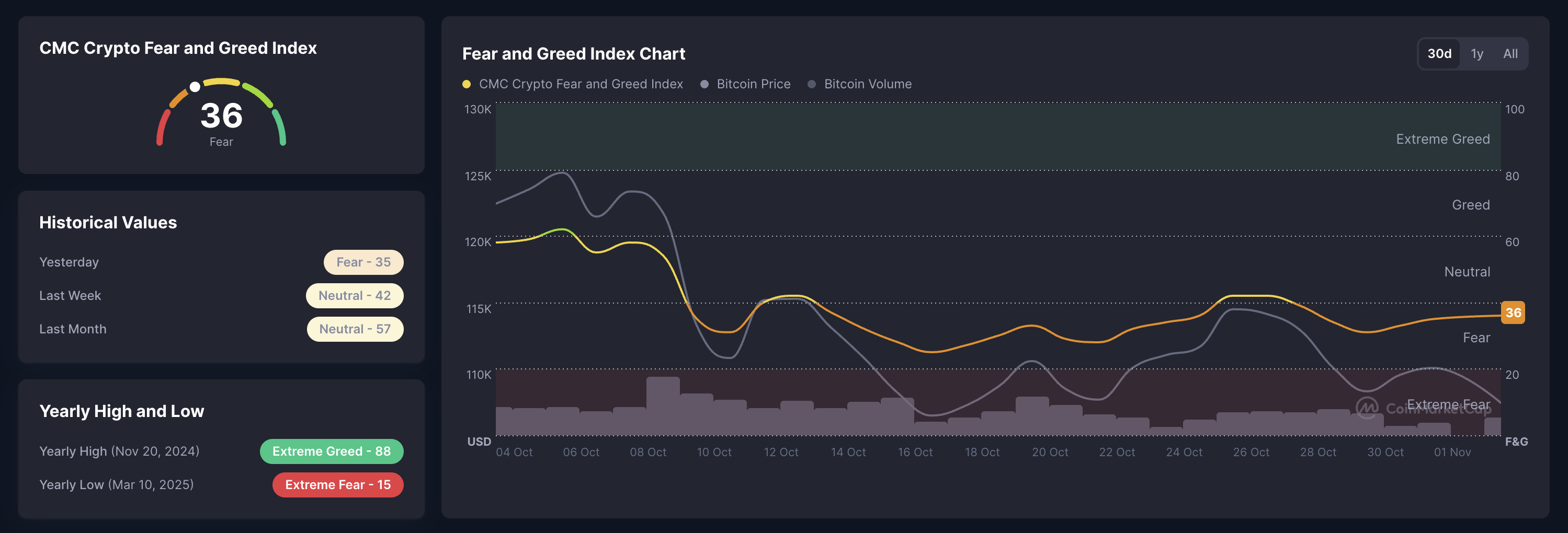

The Fear and Greed Index for cryptos has plummeted from a 30-day high of 62 to 36 at the time of writing after comments from the head of the Federal Reserve, Jerome Powell, last Wednesday.

“A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it,” he commented during the speech that followed the release of the FOMC’s interest rate decision.

Odds of a rate cut in December exceeded 90% as per data from FedWatch, but they now sit below 70%. This may have caused a shift in the market’s baseline Ethereum price prediction for year end.

Nonetheless, the latest decline seems to be a bit exaggerated, considering that a third rate cut is not entirely off the table. It is just less likely than it was before last week.

Hence, ETH could recover after the market shakes the weak hands and the smart money pops up to scoop up the token at a much lower price, with the expectation that it will recapture the $4,000 level at some point.

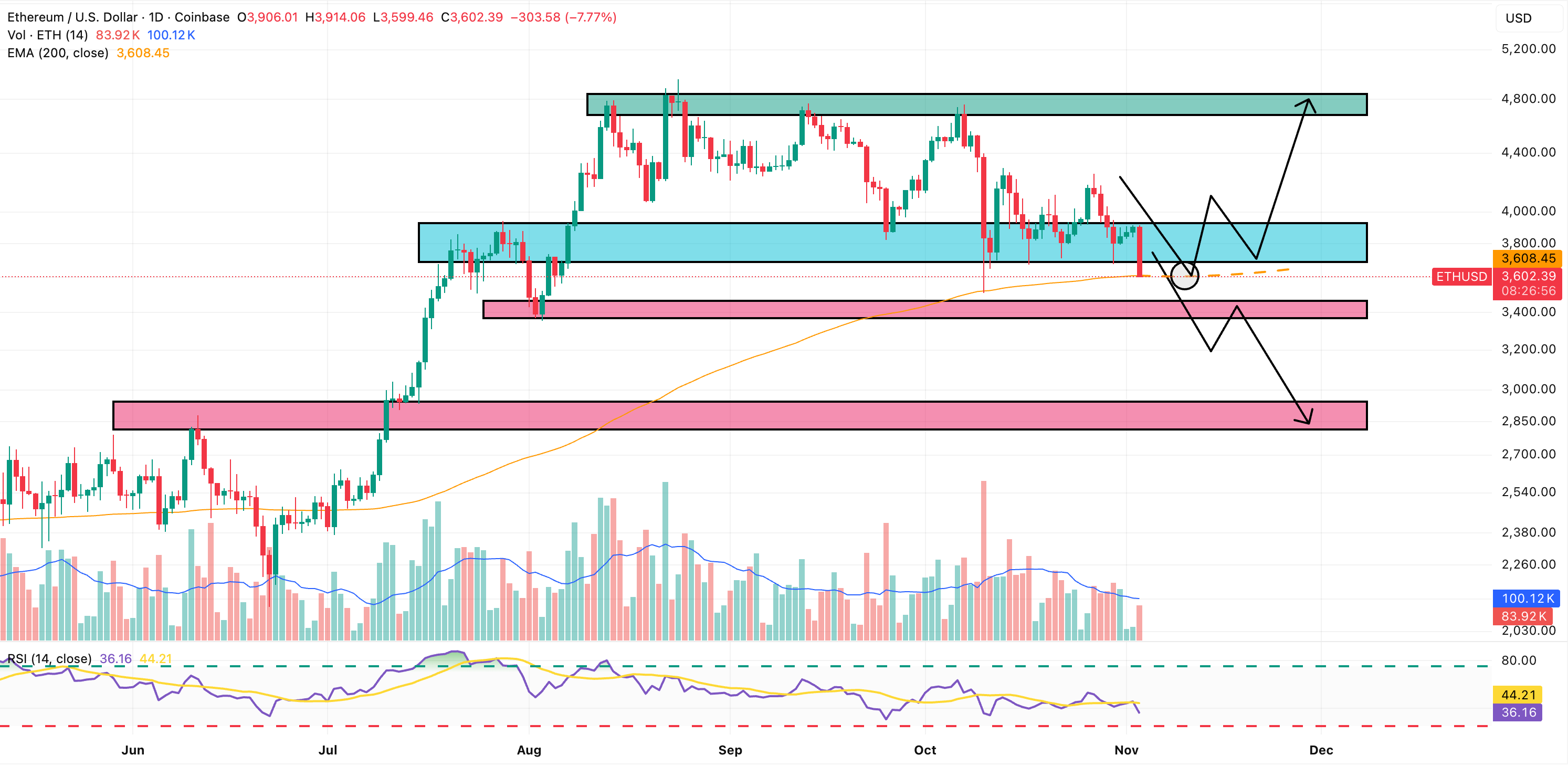

Ethereum Price Prediction: A Move to $3,000 Could Happen If ETH Breaks Below Its 200D EMA

ETH is at a critical juncture at the time, as the price has once again hit a key support level from which the token has bounced off multiple times.

This $3,700 area may have depleted its buying power already, and that could set the stage for a much deeper correction during the rest of the week. That said, the 200-day exponential moving average (EMA) stands in the way.

When prices are above the 200-day EMA, it typically favors a positive long-term outlook. Hence, if the price stays above this key line, the odds of a bearish outlook will be lower as the token could bounce off that mark and resume its uptrend.

That said, if the price breaks below this mark, we could see ETH dropping to $3,4000 first, and then to $3,100 if the downtrend continues. The Relative Strength Index (RSI) indicates that negative momentum is accelerating, as the oscillator has dropped below the 14-day moving average once again.

As the market struggles to find direction, the best crypto presales like Bitcoin ($HYPER) could be the best bet if a recovery commences. This Bitcoin layer-2 chain could kickstart a new era for the top crypto by allowing holders to access a thriving DeFi ecosystem.

Bitcoin Hyper ($HYPER) Nears $26M Raise to Launch Its L2

Bitcoin Hyper ($HYPER) plans to launch the first true Layer 2 built to upgrade Bitcoin’s speed, scalability, and efficiency.

Designed to overcome the network’s biggest challenges — like slow transactions, high fees, and limited programmability — Bitcoin Hyper creates a faster, low-latency environment where Bitcoin can finally support dApps, DeFi, and smart contracts.

Built on a Solana-powered architecture, this new layer enables thousands of transactions per second without the need to leave the Bitcoin ecosystem.

Token holders can send their BTC safely to the Hyper Bridge and get the corresponding amount on the Hyper L2 with near-instant finality. Once in there, they will be able to earn yield, stake, and lend their tokens.

Analysts agree that once top wallets and exchanges embrace the solution, the price of $HYPER could skyrocket. Hence, early buyers who take advantage of the token’s presale price will be positioned favorably to reap the highest returns.

To buy $HYPER, simply head to the Bitcoin Hyper official website and link up your wallet. You can either swap USDT or ETH for this token or use a bank card to invest.