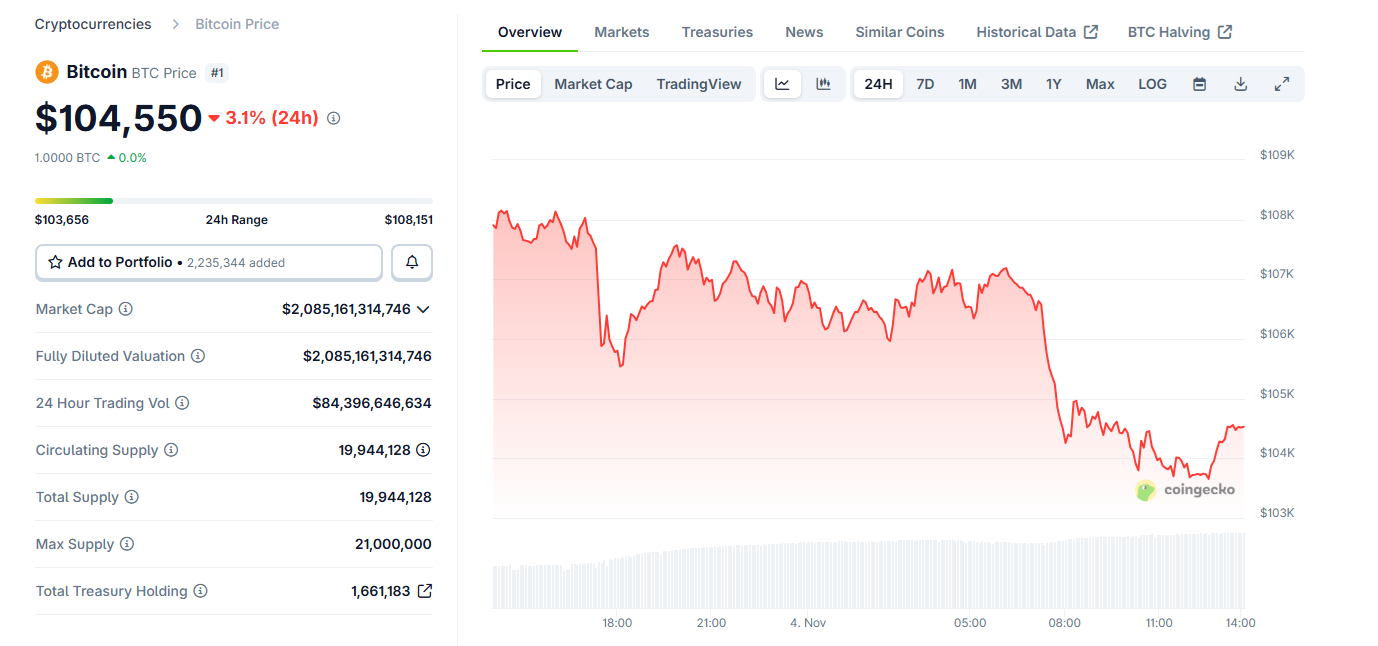

BTC dipped to the $103,000 range, extending the losses from Monday. The leading coin lost some of its recent cost basis support levels, leaving the last support at $99,000.

BTC lost another support level after dipping below $104,000 on Tuesday. The market showed increasing fragility, pushing BTC down to $103,668.

Based on recent Glassnode data, BTC lost the $109,000 cost basis, where 85% of the supply was in profit. The next level of support is at $99,000 and may serve as a local market bottom or support.

The BTC selling and fearful trading continued on Tuesday, as both retail and whales bet against BTC. The leading coin is now over $20,000 below its record valuation, sparking fears of a bear market.

The current BTC trading happens under conditions of extreme fear, as the Crypto Fear and Greed Index dipped to 21 points. Until recently, the index was at a neutral position, still awaiting a recovery for BTC. The most recent price moves show a shift to a potential bear market.

During the latest downturn, profit-taking continued. A whale that held for 14 years sold 10,000 BTC for over $1B, after acquiring the assets for just $1.54. Some of the whale selling was absorbed by new wallets buying the dip.

BTC prepares for return to $100,000

Based on Polymarket predictions, BTC has a high probability of returning to $100,000. In the past day, the probability rose from 60% to over 70%.

BTC has also shown an ability to rebound quickly after selling, moving above $104,000 within minutes of the latest dip.

So far, the market has absorbed significant selling from whales, as well as retail buyers, without causing a deep capitulation. BTC is still mostly held for the long term, though holders were willing to take profits.

Will BTC return with a short squeeze?

Based on the liquidation heatmap, a BTC short squeeze is not as probable. During previous periods, BTC often rallied to liquidate short positions. Recently, liquidity accumulated around the $112,000 and $115,000 levels, but those positions were closed.

The new liquidation heatmap shows BTC short liquidity accumulated around the $108,000 level, though the positions were smaller.

BTC open interest also moved lower to $32.6B. Since October 11, traders have not rushed to rebuild open interest, instead waiting for a directional move.

As of November, BTC is awaiting a bounce while watching the weekly close levels. A close under $103,000 for the week is seen as another signal of a potential bear market.

BTC is now repeating the price moves from early November in 2024, which later turned into a year-end rally. In the long term, BTC is still seen as revisiting new all-time peaks, though short-term market corrections are also causing pain.

Get $50 free to trade crypto when you sign up to Bybit now