Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as markets buzz with mixed signals. Wall Street’s biggest names are cautioning that stocks look stretched, while Bitcoin’s momentum against major indices is fading, leaving investors wondering if a quiet reset is already underway.

Crypto News of the Day: Wall Street Sees “Full, Not Cheap” Valuations as a 10–15% Correction Looms

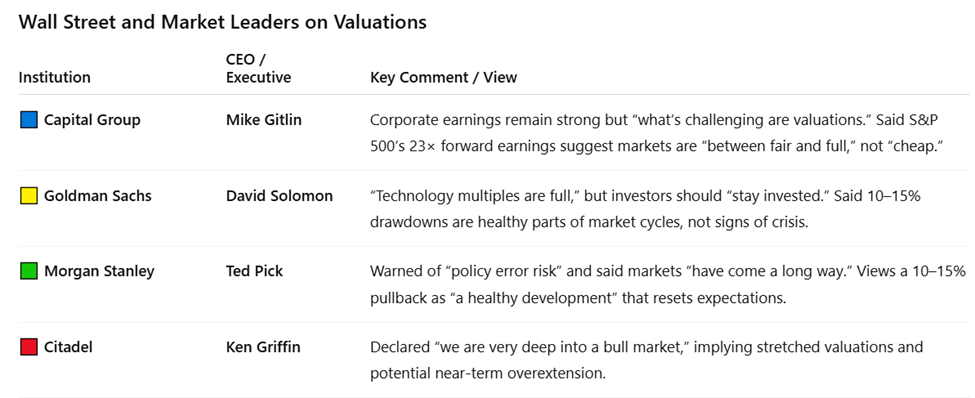

Wall Street’s biggest names are sounding the alarm on overheated markets. Bloomberg reports that Goldman Sachs’ David Solomon, Morgan Stanley’s Ted Pick, and Citadel’s Ken Griffin all expect a 10–15% equity correction in the next 12–24 months. In their opinion, this would be a “healthy” adjustment after an extended rally.

Capital Group CEO Mike Gitlin struck a similar tone, saying that while corporate earnings remain strong, valuations have reached “full, not cheap” territory.

“What’s challenging are valuations,” he told a Hong Kong financial summit organized by the city’s Monetary Authority.

Gitlin noted that the S&P 500 currently trades at 23 times forward earnings, well above its 5-year average of 20x. He says this signals that risk premiums have compressed even as policy uncertainty lingers.

Gitlin added that most investors would agree the market is “somewhere between fair and full,” but few would say it’s “between cheap and fair.” Credit spreads are showing the same pattern, with pricing strength, but offer little cushion against shocks.

Wall Street Top CEOs on Valuations.

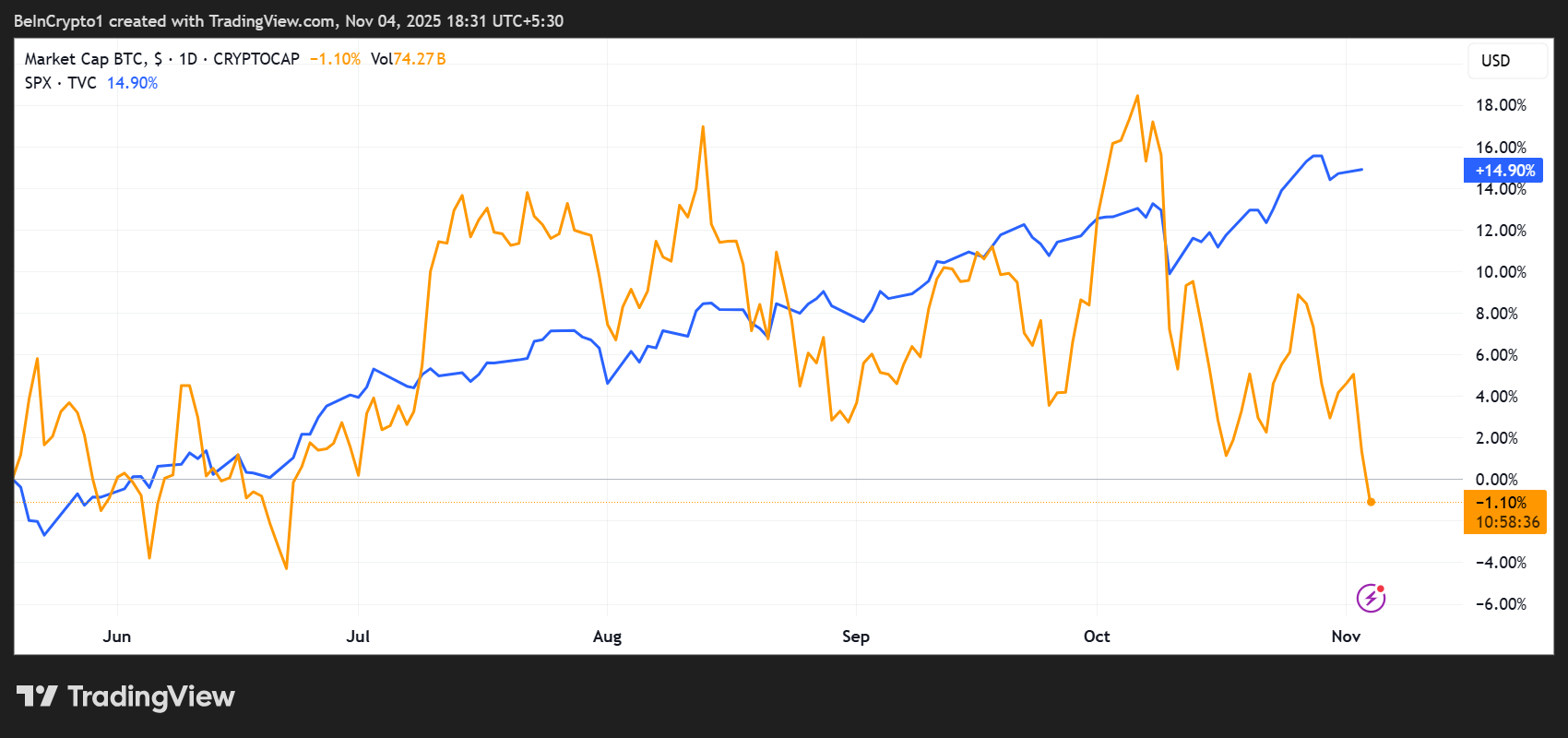

Crypto Mirrors the Macro: Bitcoin Weakens Against S&P 500

The caution on Wall Street is also being felt in crypto markets, where Bitcoin’s relative weakness against the S&P 500 (BTC/SPX) is drawing comparisons to previous late-cycle behavior.

Crypto analyst Brett noted that BTC/SPX is printing its third consecutive candle below the 50-week simple moving average, a level that has historically supported the asset during bull runs.

“In the prior cycle, Bitcoin began showing weakness against the SPX near the end of the cycle,” he said, warning that losing this level could foreshadow a broader risk-off rotation.

Brett also observed that in the past three cycles, when Bitcoin peaked, the S&P 500 entered a prolonged 750–850-day chop phase, often retesting its pre-peak price before resuming its upward trend. If history repeats itself, equity markets may be approaching a similar inflection point.

Meanwhile, Bitwise CEO Hunter Horsley suggests that expectations of a 2026 bear market may have already “pulled forward” much of the downside risk.

“What if we’ve actually been in the bear market for much of this year? Crazier things have happened. The market is changing,” he posed.

As equities flirt with record valuations and Bitcoin’s momentum wavers against traditional indices, both markets appear to be approaching a phase of price normalization rather than collapse.

Based on the top CEO’s projections, Wall Street’s tone is cautious but not panicked. This suggests that while risk appetites remain high, investors may soon favor fundamentals over euphoria.

Chart of the Day

Bitcoin vs S&P 500. Source: TradingView

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today: