DOGE Dogecoin's decade-long pattern suggests another explosive rally might be brewing, with analysts eyeing the meme coin's potential run toward $4.20 if current cycles hold true.

Dogecoin isn't just riding on memes anymore - it's riding on math. For over ten years, DOGE has been following a surprisingly consistent cyclical pattern that has crypto analysts taking notice.

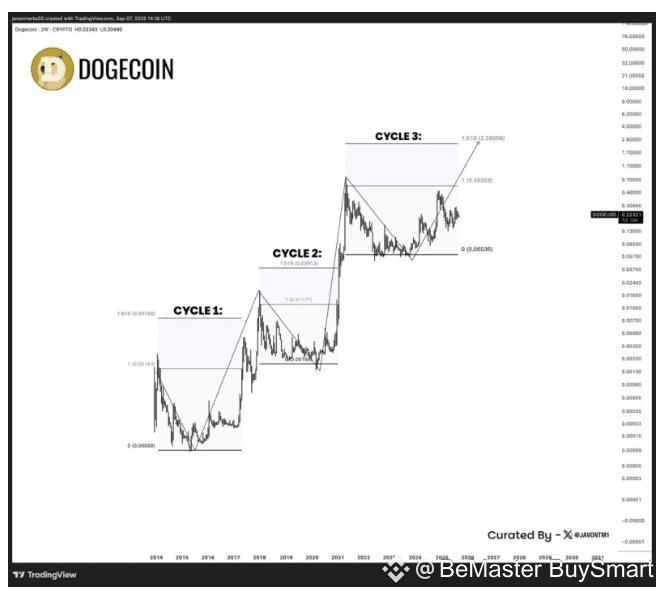

DOGE's Three-Act Performance

According to Tesla Model Ðoge's analysis, we might be sitting on the edge of another massive rally, one that could potentially push the beloved meme coin toward the community's holy grail of $ 4.20.

The story unfolds in three distinct acts, each more dramatic than the last:

Cycle 1 (2014–2017): DOGE climbed from pocket change to $0.00748, hitting that sweet 1.618 Fibonacci target

Cycle 2 (2018–2021): Lightning struck twice, rocketing to $0.739 using the exact same playbook

Cycle 3 (2022–present): We're potentially in the setup phase right now, with targets pointing to $2.28 and possibly beyond

What the Charts Are Screaming

The Fibonacci levels don't lie, and they've been DOGE's best friend for years. Right now, the coin is hanging around $0.06 support - the same level that's caught it multiple times before. The next major hurdle sits at $0.56, which represents the 1.0 extension level and a critical breakout zone. If history repeats, we're looking at $2.28 as the main target, following that familiar 1.618 extension pattern.

But here's where it gets interesting - the community's speculative target of $4.20 isn't just a meme number. It represents what could happen if this cycle proves even stronger than the previous two, especially considering how much the crypto market has evolved since 2021.

Dogecoin's track record speaks volumes. Each cycle has been bigger than the last, and there's no technical reason why that pattern should break now. The meme coin still commands massive retail attention, and whenever Elon Musk tweets about it, the market listens. Plus, if Bitcoin and Ethereum kick off another bull run, DOGE typically follows with even bigger percentage gains.

The crypto landscape has also matured significantly. With ETFs bringing institutional money into the space and major platforms offering easier access to altcoins, there's more liquidity flowing through the system than ever before. That rising tide could lift all boats, especially the ones with strong communities and proven staying power.