Ethereum and Bitcoin extended their sharp declines on November 4, triggering over $1.1 billion in crypto liquidations within 24 hours as traders rushed to the exits amid mounting market stress.

The drawdown has plunged the Ethereum price to a milestone last seen a year ago.

Ethereum Turns Negative for 2025 as Crypto Liquidations Exceed $1.1 Billion

Ethereum broke below the critical $3,400 mark, officially turning negative year-to-date (YTD) after starting 2025 near $3,353. The move marked a 7% daily plunge, its steepest drop in months.

Ethereum (ETH) Price Performance. Source: TradingView

The decline has effectively erased all of ETH’s year-to-date gains, signaling a shift in sentiment after months of relative stability in the altcoin market.

Bitcoin, meanwhile, slid to an intraday low of $100,721, putting the leading cryptocurrency within striking distance of the psychologically crucial $100,000 support zone, a level not seen since June 23.

Bitcoin (BTC) Price Performance. Source: TradingView

For both assets, the RSI (Relative Strength Index) trended at near-oversold territories, indicating the magnitude of investor sentiment.

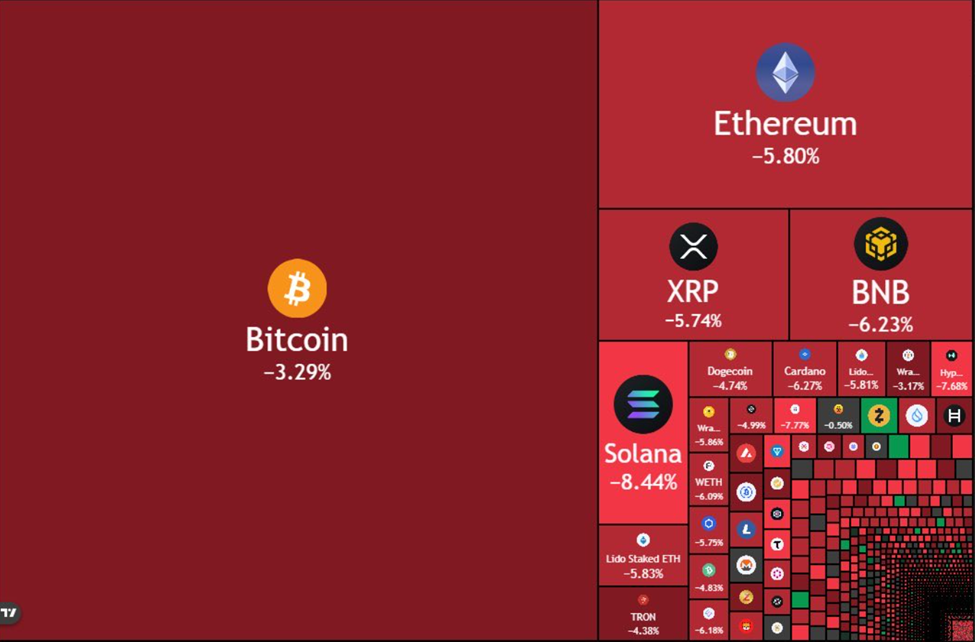

The synchronized selloff sent shockwaves across the market, with major altcoins following suit amid widespread deleveraging.

$1.1 Billion in Liquidations as Leverage Unwinds

Data from Coinglass shows that over 303,000 traders were liquidated in the past 24 hours, resulting in a total of $1.10 billion in forced liquidations across major exchanges.

Within a single hour, over $300 million in positions were wiped out, with approximately $287 million representing long positions. This highlights how overleveraged bullish bets were punished as prices broke key support levels.

Total Crypto Liquidations. Source: TradingView

Bitcoin and Ethereum accounted for the bulk of these liquidations, but high-beta assets like Solana, BNB, and XRP also experienced aggressive unwinding as traders rushed to reduce their exposure.

Amidst the chaos, however, one controversial trader, James Wynn, has been vindicated. According to Lookonchain, Wynn is finally in the green, sitting on an unrealized profit of $66,465.

Whale Dumping Deepens Bearish Pressure

On-chain analytics firm Santiment reported a notable behavioral split between large and small Bitcoin holders.

Wallets holding between 10 and 10,000 BTC, often referred to as whales and sharks (respectively), have offloaded over 38,366 BTC since October 12. This represents a 0.28% decline in their overall holdings.

These addresses currently control 68.5% of Bitcoin’s total supply, meaning their selling has an outsized market impact.

Conversely, retail traders holding less than 0.01 BTC (“shrimps”) have been accumulating, adding 415 BTC (+0.85%) during the same period.

Santiment noted that this accumulation pattern is typically seen during market drawdowns but warned that a sustained rebound would only begin when whales flip from distribution to accumulation.

“Markets rise when key stakeholders accumulate the coins that small wallets shed. Micro traders need to show capitulation and fear, losing patience and selling off their coins at a loss as whales scoop them up. When this happens — and it will — it will signal a market bottom and an ideal time to buy,” Santiment wrote.

With both Bitcoin and Ethereum now flirting with critical psychological and technical thresholds, traders are closely watching for signs of stabilization or further breakdown.

A decisive breach below $100,000 for Bitcoin could accelerate outflows and compound negative sentiment across the digital asset space.