The price of Bitcoin (BTC) has recently fallen to around $104,268, sliding below the key $105,000 support zone.

That region has long been a crucial defensive line for the bulls since May. While the price remains above the psychological $100,000 mark, traders and analysts are increasingly cautious about short-term momentum.

Giveaway Hype Sparks Skepticism

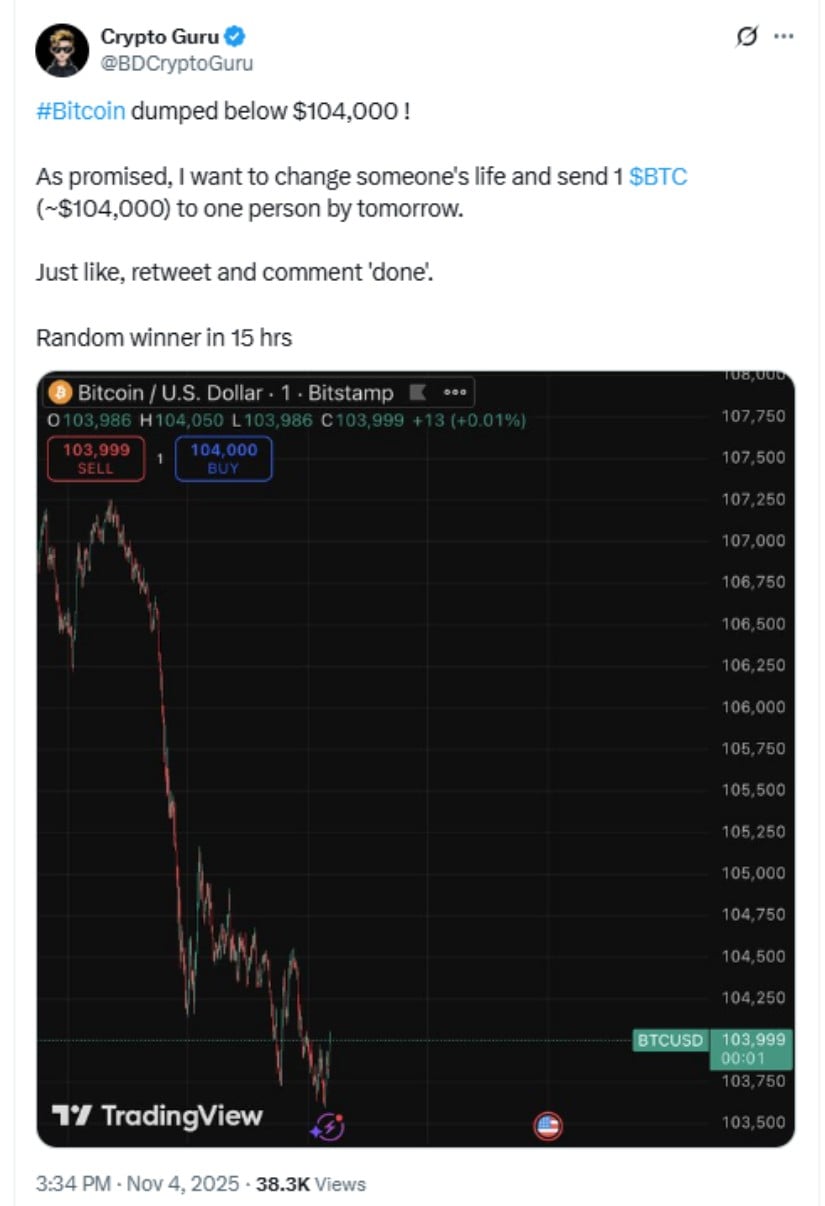

Adding to the uncertainty, a social media account known as BDCryptoGuru claimed to be giving away 1 BTC (worth about $104,000) following Bitcoin’s drop.

Bitcoin briefly dropped below $104,000 amid a controversial 1 BTC giveaway promotion on social media. Source: Crypto Guru via X

The post urged followers to like, retweet, and comment for a chance to win, promising a random selection within 15 hours. However, the same account has made multiple similar promises over the past year without evidence of payouts. Critics warn that such “giveaway” posts often serve to boost engagement metrics or may lead unsuspecting users into phishing traps and verification scams.

Technical Risk: Head & Shoulders Pattern Forming

Technically, Bitcoin has been making what looks like a head-and-shoulders pattern—a classic bearish reversal pattern that usually signals fading momentum.

Bitcoin trades at $104,268, below $105K support; a head and shoulders pattern signals a drop toward $89,948, but a rebound above $105K could target $110K. Source: BeInCrypto on TradingView

The neckline is close to the $112,500 level, and if this structure is confirmed, it could indicate a drop to or below $100,000. Analysts say Bitcoin has started showing signs of exhaustion after hovering for several days near the $105,000 level as the number of people taking profits increases.

Liquidation Surge Adds to Pressure

The recent market turbulence has intensified as over $1.27 billion worth of long positions were liquidated within just 24 hours, reflecting the scale of panic among leveraged traders. This wave of liquidations followed Bitcoin’s sharp dip below key levels, mirroring the broader correction seen across major cryptocurrencies.

Trader spetsnaz 3 highlights Bitcoin at $106,000 as a “last bull long,” signaling a potential rebound despite $1.27B in liquidations and overbought RSI concerns. Source: $0uL via X

Such heavy unwinding of leveraged positions often accelerates downside pressure, as forced sell-offs push prices even lower around critical support zones. The cascading effect not only deepens short-term volatility but also shakes market confidence, making it harder for Bitcoin to stabilize unless fresh buying interest emerges near the $100,000 region.

The EMA Crossover & Support Test

Technical indicators are signaling caution as Bitcoin navigates a critical phase. Analysts have highlighted a potential bearish EMA (Exponential Moving Average) crossover, a scenario in which a shorter-term moving average falls below a longer-term one. This pattern is generally seen as an early warning of weakening bullish momentum and could foreshadow further downward pressure.

Bitcoin may test the 50-week EMA or fall toward $100,000 WZRD support, as previously noted 17 days ago. Source: CRYPTOWZRD via X

At the same time, the $100,000–$105,000 range remains a crucial support zone. How Bitcoin behaves within this band is likely to determine its short-term trajectory. Holding above this range could allow for a rebound, while a breakdown might trigger further declines, amplifying the pressure already evident from recent liquidations.

Two Key Scenarios Unfold

For now, the short-term outlook of Bitcoin depends on its reaction to crucial support levels. If it fails to hold the support area, the head and shoulders pattern will be confirmed in a bearish case, resulting in an approximately 13.6% drop toward $89,948. This can be expected to further accelerate selling pressure and dent investor confidence in the asset in the short run as well.

Conversely, if Bitcoin can find fresh buying vigor and re-establish support at $105,000, the market might bounce back toward $110,000. A movement higher than this would invalidate the bearish head and shoulders setup and likely restore confidence, encouraging traders to re-enter positions and stabilizing the short-term trend.

Final Thoughts

The outlook for Bitcoin at this stage is delicately poised. While long-term fundamentals support a broader bullish narrative given institutional accumulation and growing ETF inflows, rising liquidations, weakening inflows, and the prospect of the EMA crossover all press for increased caution from traders.

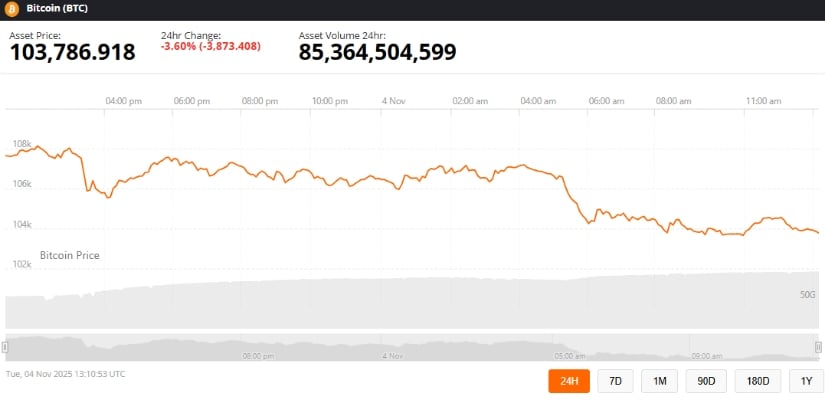

Bitcoin was trading at around 103,786.91, down 3.60% in the last 24 hours at press time. Source: Brave New Coin

Investors in the near term will be focusing on whether Bitcoin re-establishes $105,000 firmly as a support level and holds above the psychologically important $100,000, a structural threshold. The behavior of the EMAs and the emerging head-and-shoulders pattern will be key to determining market direction, while changes in liquidation and open interest data in derivatives markets may further signal strength or fragility in Bitcoin’s short-term trend.