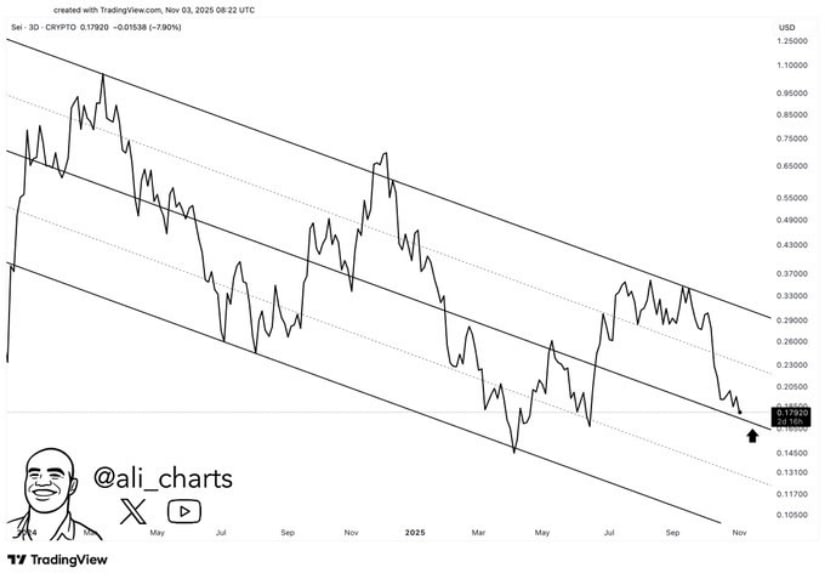

The Sei Price Prediction remains centered around the $0.15 support zone, which analysts identify as the defining foundation for the asset’s short-term structure.

Price action over recent sessions suggests that the coin is testing this critical level, which serves as a key determinant between a potential rebound and extended downside continuation.

Analyst Identifies Critical $0.15 Level

In a recent post on X, analyst Ali emphasized the significance of the $0.15 level, describing it as a “make-or-break” zone for SEI’s market structure. According to the analyst, this price area has historically attracted strong buying interest, often aligning with major Fibonacci retracements, volume clusters, and psychological price zones. Maintaining support above $0.15 signals that buyers continue to defend the structural base, increasing the likelihood of a rebound phase.

Source: X

Ali noted that a decisive bounce from this level—accompanied by higher lows and a surge in trading volume—could confirm $0.15 as a solid foundation for renewed bullish sentiment. However, if the level fails to hold, it could trigger a chain reaction of stop-loss activations and momentum-based selling, pushing the asset deeper toward lower support regions.

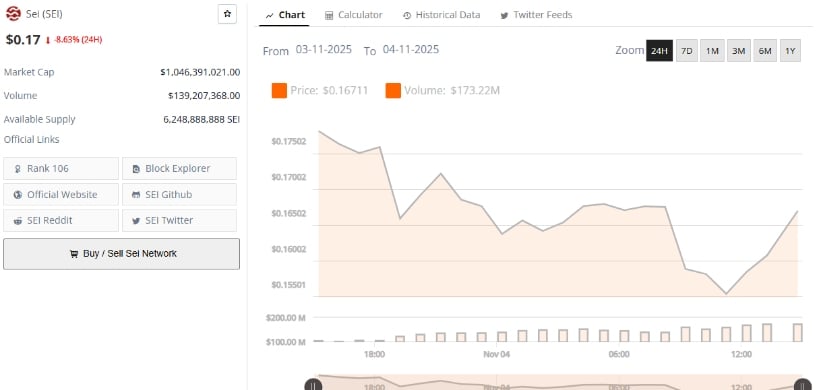

Market Data Shows The Asset Down 8% Amid Volatile Trading

Data from BraveNewCoin indicates that Sei is currently priced at $0.17, reflecting an 8.63% decline in the past 24 hours. The token’s market capitalization stands at $1.04 billion, supported by a trading volume of $139 million. This elevated turnover highlights active market participation as the asset consolidates near its structural pivot, suggesting that volatility remains elevated while buyers and sellers battle for control.

Source: BraveNewCoin

The current trading zone between $0.15 and $0.17 aligns with historical liquidity clusters, where previous reactions have shaped short-term market cycles. A sustained hold above $0.15 would indicate accumulation and possibly spark recovery attempts toward the $0.20 region. On the other hand, a close below this threshold could confirm a short-term breakdown, exposing downside targets near $0.12—a deeper demand area noted by multiple technical analysts.

With the coin ranked 106 by market capitalization, its performance remains sensitive to broader sentiment shifts across the crypto market. Monitoring volume surges and price stability in this region will be essential to gauge whether the market is preparing for consolidation or continuation of the current decline.

Technicals Show Tiered Demand Zones

A separate analysis by StefanB on X outlined SEI’s broader market structure, noting that the token has entered a significant demand region between $0.146 and $0.12 USDT. Within this zone, he highlighted concentrated buyer interest at $0.13 and $0.11, both corresponding to historical liquidity pockets and previous reversal points.

These areas, according to Stefan B, represent ideal accumulation targets where patient buyers could seek discounted entries amid capitulation.

Source: X

The analyst explained that a base formation within this $0.146–$0.12 range could set up an aggressive rebound, similar to prior recovery cycles where sharp reversals followed deep pullbacks. A key technical confirmation for a bottom would be a reclaim above $0.15, supported by increasing volume and momentum indicators turning upward.

However, should the coin lose footing below $0.12, the probability of revisiting $0.10–$0.11 grows significantly, signaling that bears remain in control. StefanB’s tiered approach reflects a pragmatic market perspective favoring accumulation near historically reactive zones while awaiting volume-backed reversals before confirming trend shifts.