Dogwifhat (WIF) is showing signs of stabilization after recent selling pressure, hovering near the $0.40 mark.

While short-term volatility has eased, derivatives data suggests that renewed participation could soon influence the token’s next major move.

Open Interest Indicates Cooling Phase for The Markets

The WIF/USD 1-hour chart reveals muted volatility after a multi-day downtrend, with the token trading around $0.406. Aggregated open interest (OI) currently stands at approximately $75.5 million, indicating subdued activity compared to peaks observed late last week. This contraction implies that leveraged traders have reduced exposure, likely taking profits or closing positions amid uncertainty.

Historically, such phases of declining OI precede significant market resets where new entrants reposition for directional momentum.

Source: Open Interest

If open interest begins to climb alongside positive price action, it could confirm renewed speculative confidence, potentially driving WIF toward the $0.44–$0.46 zone. Conversely, sustained stagnation in OI might keep the asset range-bound, signaling caution among futures participants. For now, derivatives data paints a picture of consolidation rather than outright capitulation, suggesting that market sentiment remains watchful but not exhausted.

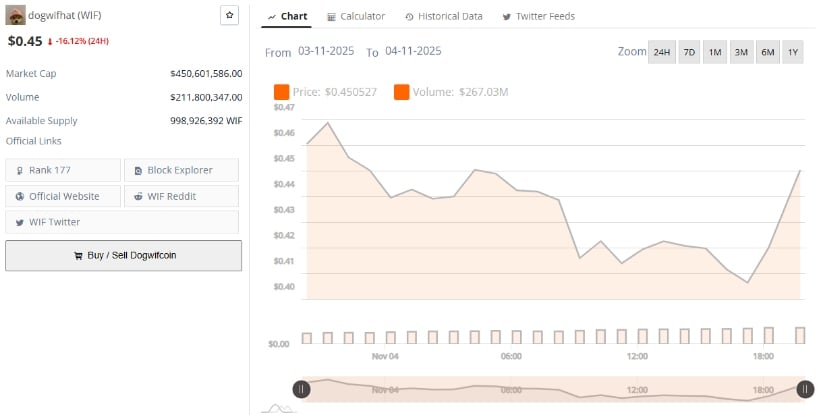

Data Shows Market Pullback and Moderating Volume

According to BraveNewCoin, Dogwifhat’s current price stands at $0.405, marking an 8.16% decline in the past 24 hours. The token’s market capitalization is estimated at $404.7 million, with 24-hour trading volume around $82.5 million. The drop in both price and trading volume aligns with a cooling market structure following the October volatility spike.

Source: BraveNewCoin

Despite the retracement, liquidity remains sufficient to support short-term rebounds if broader sentiment across meme coins improves. The moderation in daily turnover suggests that short-term speculators have temporarily stepped back, leaving room for organic accumulation by patient holders. The stabilization of market cap near the $400 million level underscores ongoing confidence, though buyers must defend the $0.40 floor to avoid deeper losses.

Oversold Conditions and Technical Exhaustion

On the other hand, the WIF/USDT daily chart from TradingView shows that the token is testing its lower Bollinger Band at $0.44, while the basis line (20-day SMA) sits around $0.519, acting as overhead resistance. The widening of Bollinger Bands indicates increasing volatility after a compression phase, which often precedes a directional move.

Source: TradingView

Meanwhile, the Relative Strength Index (RSI) has dipped to 31.43, hovering just above oversold territory, signaling potential for a technical rebound if buyers regain control. Historically, similar RSI readings in WIF’s price history have been followed by short-lived recoveries toward the mid-band. To confirm strength, WIF needs a daily close above $0.44, which would validate renewed accumulation. Failure to do so may expose the token to deeper retracement toward the $0.36–$0.38 region, a zone where buyers last showed aggressive defense in early October.