Floki Crypto is showing signs of stabilization after a steep correction, with short-term price action hinting at a possible rebound.

As the token consolidates near the $0.000006 mark, technical indicators suggest that the market may be preparing for its next directional move.

Traders Seek Bottom Formation on Hourly Chart

The FLOKI/USDT 1-hour chart shows a mild rebound after a recent pullback, with the token trading around $0.00000600, posting a modest +0.58% gain. This movement comes after several lower highs and lows formed in late October, reflecting a broader downtrend that has recently shown signs of easing. The ongoing stabilization between $0.0000058–$0.0000060 suggests that buyers may be gradually accumulating positions, building a potential base for a short-term relief rally.

Source: OpenInterest

According to intraday momentum readings, price compression near the lower Bollinger Band has slowed the bearish momentum, hinting that the token might be oversold on lower timeframes. A successful bounce from this level could open the door for a retest of resistance zones near $0.0000064–$0.0000068, which coincide with the 20-day moving average and short-term channel top. Failure to hold above $0.0000058, however, may invite further downside pressure toward the next key support near $0.0000055.

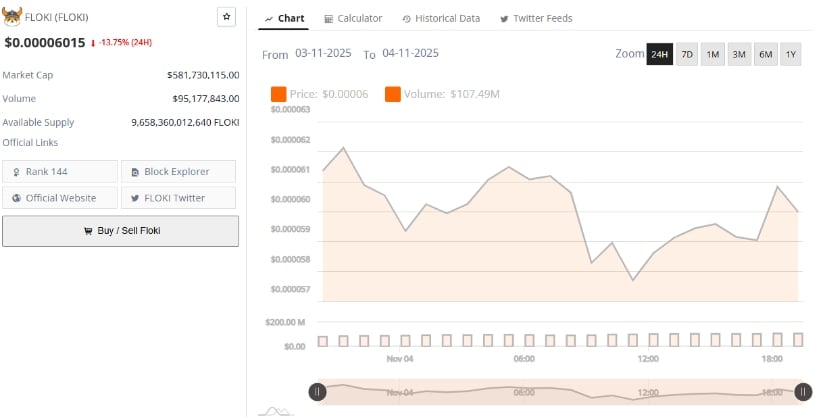

Market Data Shows Down 13.75% Amid Cooling Speculation

Data from BraveNewCoin shows that FLOKI currently trades at $0.00006015, down 13.75% in the past 24 hours. The token holds a market capitalization of $581.73 million and 24-hour trading volume of $95.17 million, ranking 144th by market cap. The available supply stands at 9.65 trillion tokens, reflecting steady circulation amid subdued market activity.

Source: BraveNewCoin

The data highlights a notable contraction in speculative interest. Aggregated open interest (OI) sits near 4.00 million, marking a clear decline from last week’s levels. This indicates that many leveraged participants have exited the market, either through profit-taking or liquidations during the recent decline. The drop in OI, coupled with lower volatility, suggests a pause phase — often preceding renewed momentum once fresh liquidity re-enters.

For a confirmed shift toward bullish momentum, open interest would need to increase alongside price recovery, signaling that new participants are entering the market. Sustained gains above $0.0000064 could validate this scenario and encourage a stronger uptrend continuation.

Technical Outlook Near Lower Bollinger Band, RSI Suggests Weak Momentum

The daily chart from TradingView shows FLOKI trading near the lower Bollinger Band at $0.00000602, suggesting that the token is approaching an oversold region. The basis line (20-day SMA) currently lies at $0.0000699, acting as a near-term resistance level that must be cleared for a bullish reversal confirmation. The upper band at $0.0000796 marks the next significant ceiling if momentum returns.

Source: TradingView

Meanwhile, the Relative Strength Index (RSI) is positioned at 35.42, indicating weak momentum but nearing oversold territory. The RSI-based moving average sits slightly higher at 43.03, and a crossover above it could serve as an early signal of recovery. If buying pressure strengthens and RSI rebounds, the coin could see a short-term rally toward mid-channel resistance, aligning with historical recovery zones from prior consolidations.