Marathon Digital Holdings (MARA), a publicly listed Bitcoin mining firm, has recently transferred a total of 2,348 BTC, worth approximately $236 million. Based on on-chain data, the transfers were made to institutional exchanges, including Coinbase Prime, FalconX, Galaxy Digital, and Two Prime.

Arkham Intelligence flagged the transfers that mark the latest notable transfer in crypto markets following yesterday’s BlackRock transfer of over $290 million into Coinbase Prime. The transfers have not directly signaled any selling proof; however, based on history on-chain, deposits to exchanges have been associated with plans to liquidate or rebalance large positions.

MARA and BlackRock move over $1.2 billion in BTC and ETH

Based on Arkham Intelligence’s latest reveal, MARA deposited roughly $45 million into Coinbase Prime and approximately $60 million into Falcon X, with the rest going into Two Prime and Galaxy Digital. A combined deposit of $236 million was made to the exchanges, which originated from wallets controlled by the MARA Pool, the mining operation responsible for block payouts.

Ahead of today’s announcement, BlackRock was also seen moving more than $1 billion worth of Bitcoin and Ethereum from its cold wallets to Coinbase Prime over the past five days. The breakdown includes 3,496 BTC, valued at $383.9 million, and 31,754 ETH, valued at $122 million, both of which were made on October 31. The asset manager also transferred $506 million at the beginning of this month and another $290 million yesterday.

So far, it remains unclear why the institutions are moving the sizable funds, leaving the market to speculate on possible reasons. The moves could indicate ETF and custodial adjustments, given the firm’s dominant position in the Bitcoin space. MARA’s current total holdings are approximately $1.68 billion.

The fund movements suggest that profit-taking is underway after strong performances from both Bitcoin and ETH in recent cycles, despite ongoing volatility. Meanwhile, due to altcoins such as Solana, which continue to receive inflows and garner institutional interest, some major players may be preparing to reallocate funds.

Bitcoin drops below $104K

As of now, crypto markets have shown signs of a short-term bearish trend, following an almost 5% drop in BTC over the past 24 hours, with trading below $104,000 for the first time in a while. BTC was trading at roughly $102,024, representing a 4.2% drop over the past 24 hours at the time of publication. The token has shed over 17% of its value in the past 30 days, following a new all-time high reached towards the end of October.

Ethereum, on the other hand, has also experienced a nearly 10% drop over the past 24 hours. The Ethereum ecosystem’s native token was trading at $3,348, representing a 7.8% drop at the time of publication. ETH has declined by more than 25% over the past month, indicating a renewed bearish momentum across the cryptocurrency market. SOL also experienced a drop in bearish momentum of over 4% in the past 24 hours and more than 30% over the past 30 days.

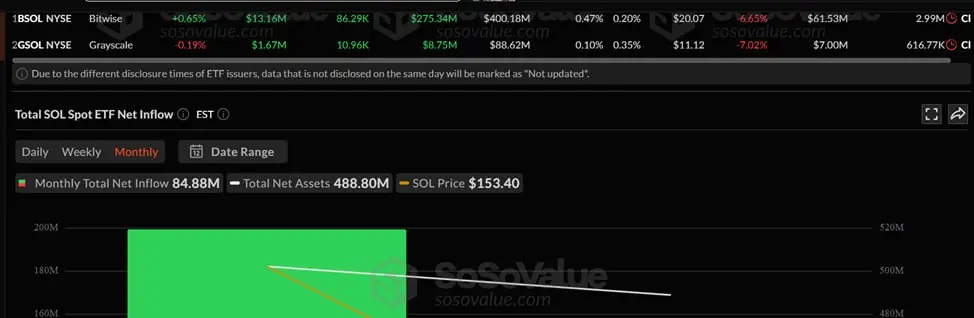

Despite market downtrends, Solana ETFs have recorded new inflows, as opposed to outflows, compared to U.S. spot ETH ETFs and Bitcoin ETFs. Based on SoSoValue data, Solana drew roughly $84 million of new capital over the past month. Ethereum ETFs have recorded $355 million in outflows over the past 30 days. BTC spot ETFs also saw approximately $764 million in outflows during the same period.

So far, Solana ETFs have approximately $488.8 million in net assets and trade at around $ 153.40. The trend has sparked some speculation across the crypto industry that institutions may be moving capital into high-yield stacking products, such as Solana Bitwise, which offers approximately 7%.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.