SEI is showing signs of a potential bullish reversal as analysts highlight a falling wedge breakout and strong support retest near $0.15.

With RSI divergence and multi-month accumulation signals aligning, the token could target the $1.14 zone if momentum shifts, indicating renewed buying interest and possible mid-term trend recovery.

SEI Prints Classic Falling Wedge Pattern on Weekly Chart

According to Bitcoinsensus, the asset is forming a classic falling wedge structure on the weekly chart. The formation is generally viewed as a bullish reversal setup, developing after a prolonged period of lower highs and lower lows. The price has repeatedly tested the lower boundary of the wedge and held above it, suggesting firm support at that level.

SEIUSD Chart | Source:x

The pattern shows multiple successful retests of this support area, indicating a slowdown in selling momentum. As the wedge narrows, compression between support and resistance lines often precedes a breakout. The analyst notes that this setup has developed over several months, positioning it for a potential mid-term reversal if it breaks above the upper boundary of the wedge.

Analyst Sets Breakout Target Near $1.14 Zone

Bitcoinsensus projects that the breakout target lies around the $1.14 level. This price area corresponds to a key structural resistance zone observed in previous market cycles. A decisive close above the wedge and a successful retest of the breakout area could confirm a trend reversal.

The projection suggests that bulls may regain control if the price sustains momentum above the wedge’s resistance line. Should it achieve this breakout, a steady upward move toward the $1.14 target could unfold, marking a major shift from its recent bearish trend. The setup reflects a possible transition from accumulation to recovery, supported by the pattern’s historical tendency to precede rallies in similar market conditions.

Analyst Points to Support Retest and RSI Divergence

Analyst Sjuul | AltCryptoGems observed that the token has revisited its 2023 support zone, which previously acted as a strong accumulation region before sharp price upswings. The price has now returned to this key range after a lengthy correction phase, suggesting that buyers may attempt to defend it once again. Historical reactions around this level indicate that it has served as a foundation for earlier recovery phases.

SEIUSD Chart | Source:x

Furthermore, the high-timeframe Relative Strength Index (RSI) shows a clear bullish divergence, where the price records lower lows while the RSI moves higher. This divergence often signals weakening downward momentum and the potential start of a reversal. The alignment between RSI behavior and the support retest strengthens the case for a possible shift toward bullish control if the asset maintains stability above this zone.

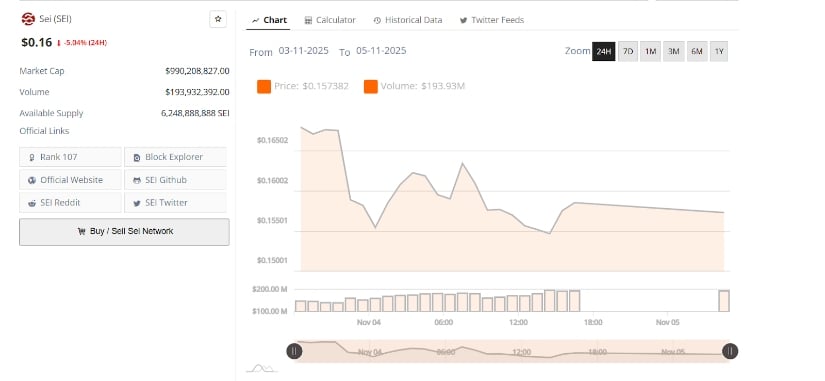

The Altcoin Price Action Reflects Short-Term Pressure

At the time of writing, the altcoin trades near $0.16, down around 5% in the past 24 hours. The daily trading volume stands at approximately $193.9 million. The short-term chart shows continued rejection near the $0.162–$0.165 range, marking it as an active resistance area. Multiple attempts to reclaim this level have failed, keeping sellers in control of near-term price action.

SEIUSD 24-Hr Chart | Source: BraveNewCoin

Below, immediate support is seen around $0.157, which has acted as a temporary stabilizing area. If this support gives way, it could test the next psychological level near $0.150, where previous buying interest emerged. Volume data shows consistent participation without notable spikes in accumulation or liquidation. A sustained move above $0.165, however, could pave the way for short-term recovery toward $0.175, aligning with the early stages of a potential bullish breakout if momentum strengthens.