Kalshi and Polymarket have dominated the prediction market space this year. However, recent developments point to emerging challengers. One of them is Opinion Labs, a prediction platform that is allegedly backed by Yzi Labs, Binance’s investment arm.

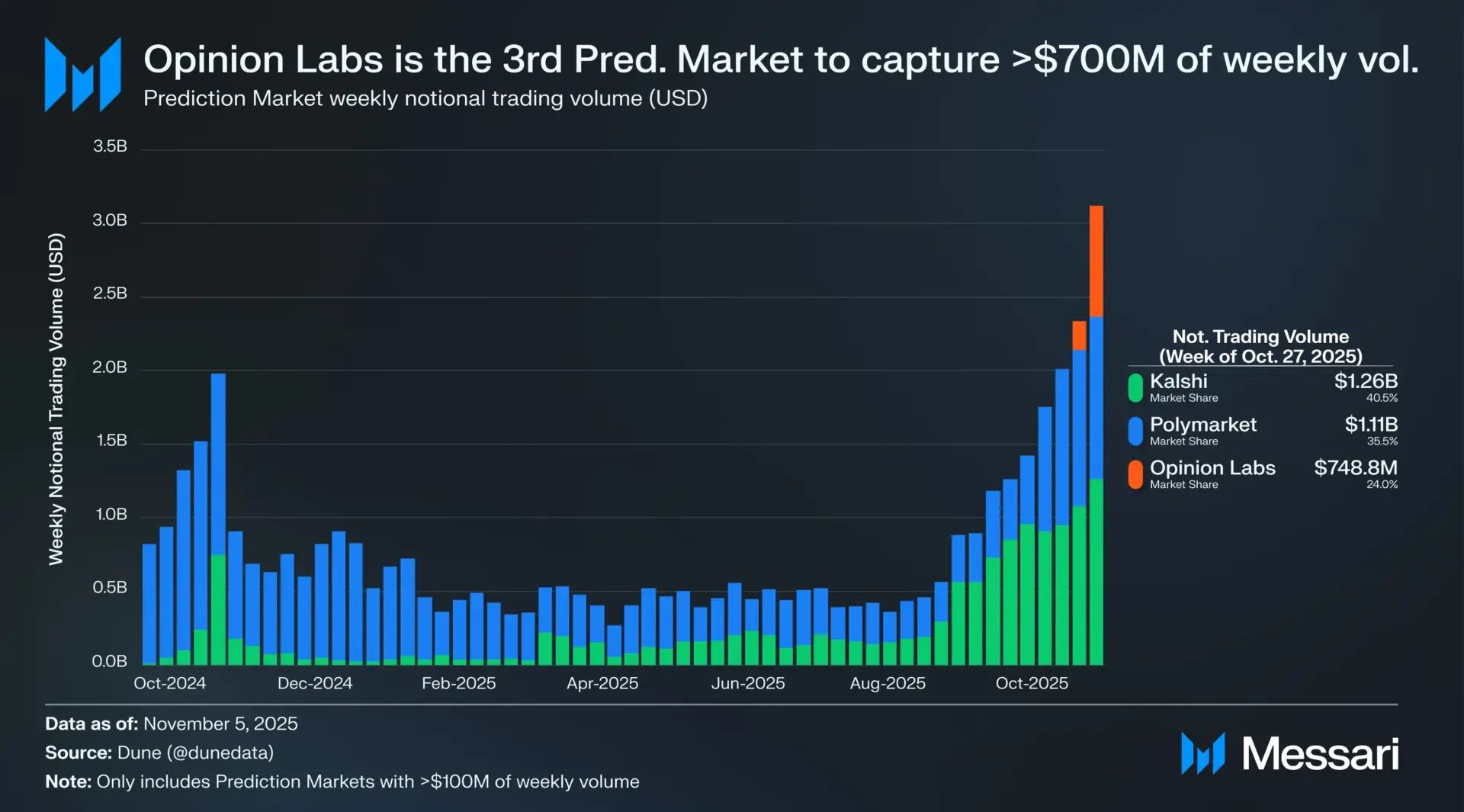

The platform reportedly became the third prediction market to surpass $700 million in trading volume over a week.

Market watchers are now calling an arms race for supremacy, despite the head start that the duo of Kalshi and Polymarket currently enjoy.

Opinion Labs becomes third option behind Kalshi and Polymarket

There is no doubt that Kalshi and Polymarket are the current undisputed leaders in the prediction markets space, but rivals are already emerging to claim shares in a fast-growing market.

Opinion Labs attracted $748.8 million in notional volume for the week of October 27, 2025; Kalshi earned $1.26 billion, and Polymarket attracted $1.11 billion. It is no mean feat, considering that Opinion opened its prediction market to the public on November 4. Before then, users needed an invite code to get in.

Austin Weiler, research analyst for Messari’s protocol services team, noted Opinion’s entry into the prediction markets game expressed excitement to see another “potentially major” player with the volume to back up operations enter the prediction markets space.

Another similar contender is the Limitless platform, which is currently thriving on Base. While the decentralized prediction market has been gaining buzz as a “Polymarket clone” with its smaller but fast-growing footprint, it promotes itself on the promise of lower fees and easier on-ramping for retail users.

October was great for prediction market platforms Kalshi and Polymarket

Prediction markets are here to stay, and Kalshi and Polymarket are the current leaders of the growing brood. According to Austin Weiler, who shared a thread on their performance, last month, Polymarket recorded $1.9 billion in notional volume while Kalshi had $1.8 billion, both paced at over $45 billion annualized as of October 22.

The analyst implied the performance has been the result of a battle for supremacy among prediction platforms, with their attempts to outdo each other driving real product improvements and attracting attention to prediction markets outside of crypto.

Kalshi and Polymarket also lead in terms of funding. Weiler’s thread claims both teams have insane funding, with Kalshi raising $185 million in June and another $300 million in October, while Polymarket closed a $2 billion round from ICE last month.

The NHL also signed licensing deals with both Kalshi and Polymarket, making it the first major U.S. league to endorse prediction markets. With the partnership, Kalshi and Polymarket are now able to run NHL-branded markets & will get visibility during league broadcasts.

This means millions of viewers, a lot of whom have never heard of prediction markets, will now see them on TV, not just CT. All this is expected to translate into increased interest in prediction markets, and when that happens, platforms like Kalshi and Polymarket already have infrastructure in place to serve.

Of course, with the growing sector, they also now have to worry about rivals, some of whom have emerged.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.