What is Celo?

Celo describes itself as a mobile-first, carbon-neutral blockchain that makes DeFi accessible to anyone with a mobile phone. Celo has a mission of building a financial system that creates conditions of prosperity for everyone.

It is the Ethereum Virtual Machine (EVM) compatible platform where sending and receiving stablecoins can be completed just with mobile devices. Celo is also designed to map phone numbers to wallet addresses, making the process more effective and removing the need for long seed phrases. The stablecoins on the platform is also produced by Celo, the first of which being the Celo dollar, CUSD. These stablecoins can assist its users in paying instantly, sharing directly and borrowing funds easily. Furthermore, the blockchain also allows for applications to be built on it.

How Does Celo Work?

The foundation

Celo uses the proof of stake consensus to verify transactions instead of the popular proof of work model, which requires miners. Through this method, holders of Celo tokens can stake their tokens to verify transactions on the blockchain and receive rewards. Additionally, Celo token holders may also lock up their tokens, vote for such validators, and get rewarded for their contribution in the selection.

Ultra-light Client

Since users from multiple geographic locations around the world lack the necessary connectivity to interact with blockchain, Celo developed techniques to enable anyone to connect to the Celo network even with low connectivity through an ultralight client. This ultra-light client allows devices to connect to full nodes and allows users of Celo to require 17,000 times less data.

Celo Stablecoin

Celo uses a reserve backing method to assist in its quest for a stablecoin free from volatility and fluctuations. It uses the simple double token seigniorage model seen in many other projects to stabilise the price associated with the currency.

Get Cipher’s stories in your inbox

Join Medium for free to get updates from this writer.

For example, when the price of CUSD increases above the $1 peg due to increased demand, users can sell $1 of Celo to the reserve to receive newly minted CUSD. When the price of CUSD decreases below the $1 peg due to decreased demand, users can sell Celo from the reserve to receive CUSD. This mechanism provides an arbitrage opportunity for the holders and participants of the Celo Ecosystem.

Growth So Far

Press enter or click to view image in full size

This year, Celo has achieved record growth in total value locked in the blockchain. TVL reached $1.16 Billion in late October and is currently at $713 million. Celo hosts a wide range of Celo native applications, the biggest of which is Mento, an AMM used for stablecoin arbitrage mentioned above.

Tokenomics

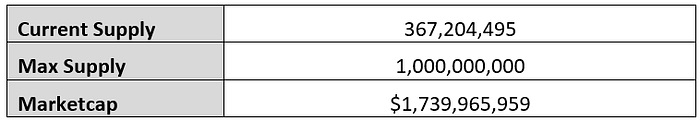

Press enter or click to view image in full size

Celo, the native token of the Celo blockchain, has the following use case and utilities:

Transaction Fees on the blockchain

Used for the seigniorage and maintaining peg of stablecoin

Staking and securing the network

Governance

Future Outlook

Celo has been rapidly increasing its total value locked as we had seen in the previous section. The goal of Celo is to bring blockchain connectivity to users that have smartphones — which is around 6 billion people. Celo was the fastest growing blockchain in 2021 and has achieved multiple milestones such as hosting Kickstarter, the popular crowdfunding platform. Positioning itself as the mobile-first platform, it is poised to grow future in the future as blockchain technology becomes more dominant.

Press enter or click to view image in full size

Celo, the native token is up 206% over the past year and ranks 84th among all cryptocurrencies.