ZkSync (ZK), a Layer-2 altcoin that had fallen more than 90% from its peak, is now showing strong signs of recovery in both price and trading volume. This rebound has led many analysts to predict further upside potential.

What’s fueling ZK’s recent surge, and how far could the rally go? Here’s a closer look at the main drivers behind its 150% rise in November.

The Forces Behind ZK’s 150% Price Rally

ZkSync is a Layer-2 scaling solution for Ethereum that leverages zero-knowledge proofs (ZK proofs) to process transactions faster, cheaper, and more securely — allowing Ethereum to scale without sacrificing decentralization.

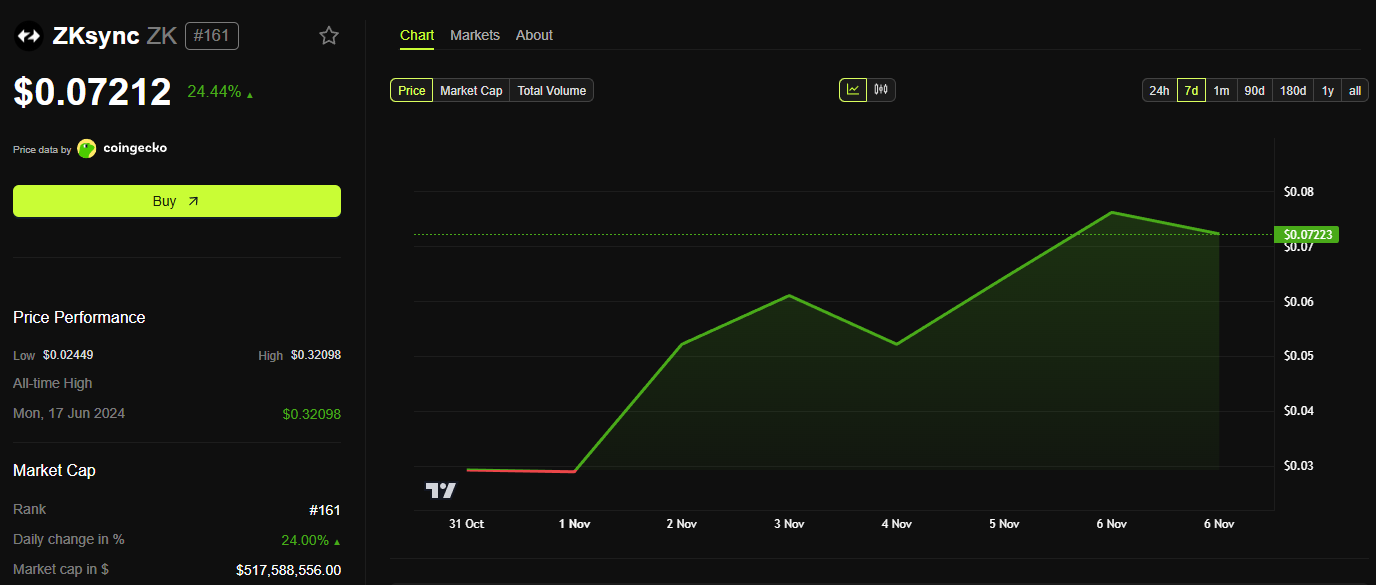

According to BeInCrypto data, ZK’s price jumped from $0.03 to over $0.07 during the first week of November. This rally occurred even as the overall crypto market faced extreme fear and sharp declines in altcoins following Bitcoin’s drop below $100,000.

ZKsync Price Performance. Source: BeInCrypto

CoinGecko data shows that ZK’s 24-hour trading volume surpassed $700 million, a massive leap from the average of less than $20 million per day in the previous month. A 30x increase in spot volume highlights traders’ growing interest in ZK.

Meanwhile, LunarCrush data reveals that social mentions of ZkSync have reached their highest level in a month, reflecting a surge in community attention. What exactly is driving this growing enthusiasm?

Vitalik’s Endorsement Ignites the Rally

The turning point came in early November, when Ethereum co-founder Vitalik Buterin publicly praised ZkSync’s Atlas upgrade. The update significantly improves Ethereum’s transaction speed and cost efficiency, driving network adoption and revenue.

“ZKsync has been doing a lot of underrated and valuable work in the Ethereum ecosystem,” Vitalik Buterin said.

Analysts compared this endorsement to Vitalik’s show of support for the Solana (SOL) developer community in December 2022 — a gesture that preceded SOL’s explosive rise from $8 to $290.

Founder’s Proposal Adds More Fuel

While Vitalik’s praise kick-started the rally, ZkSync’s founder, Alex, soon added momentum with a bold proposal. He called for a complete transformation of the ZK governance token, turning it from a purely governance-based asset into a utility token with real economic value.

The proposal links ZK to network revenue by using both on-chain fees (from cross-chain transactions) and off-chain fees (from enterprise licensing) to buy back and burn tokens, fund protocol development, and support ecosystem incentives.

Investors are betting big on this idea, believing it will make ZK more functional and drive strong, sustainable demand. Instead of being used solely for voting, ZK would now be directly tied to real revenue streams.

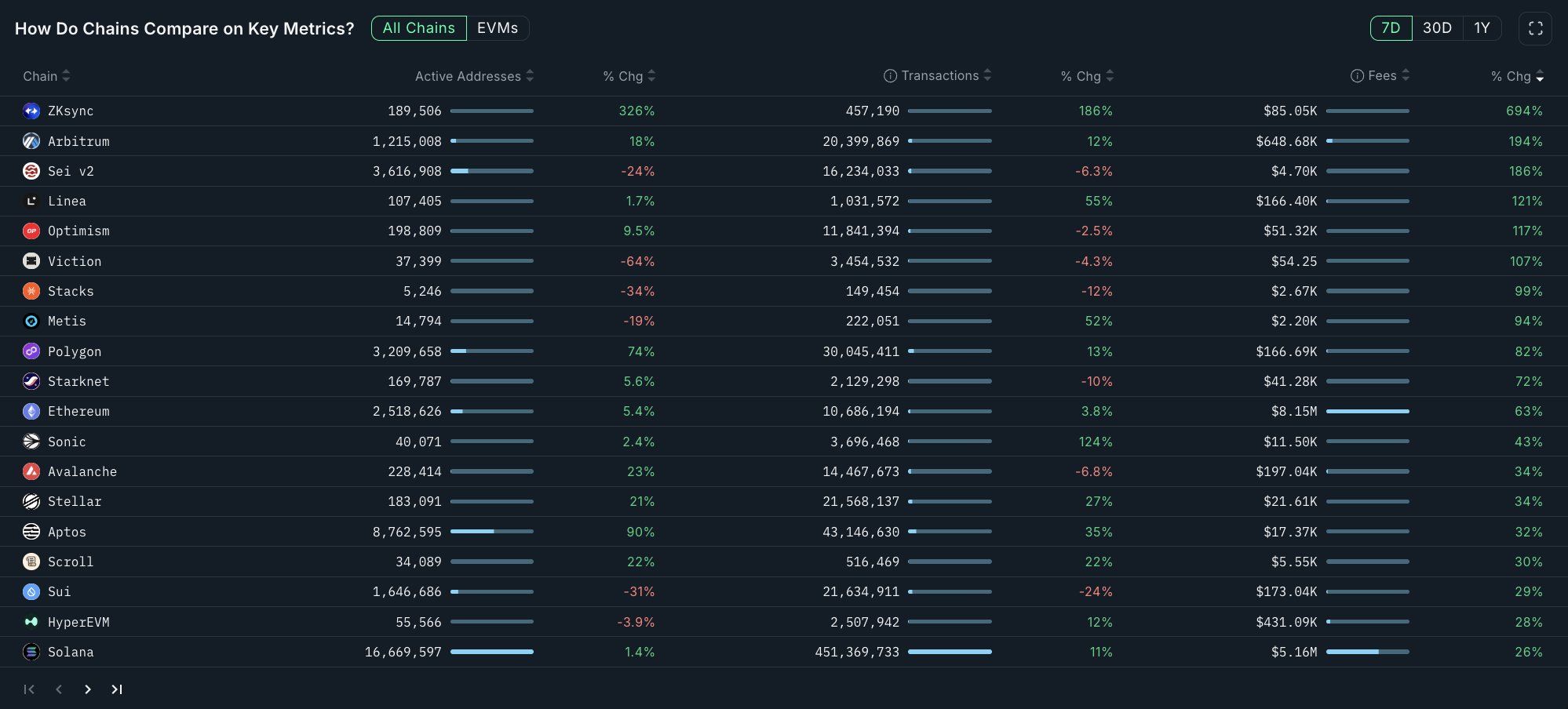

This mechanism could create an “economic flywheel” — where network revenue fuels token buybacks and burns, increasing holder value over time. According to Nansen, ZkSync currently ranks among the top chains with the fastest-growing fee revenue in the past seven days.

Chains with the Biggest Fee Growth in early October. Source: Nansen

Privacy Narrative Adds Another Catalyst

Another factor driving ZK’s rise is the growing market interest in privacy-focused cryptocurrencies. Zcash (ZEC), which pioneered the zk-SNARK cryptography, has sparked renewed attention in the sector.

ZkSync recently unveiled ZkSync Prividium, a privacy-focused solution tailored for enterprises. This has given investors even more reason to remain bullish as privacy narratives gain momentum.

Positive discussions are now fueling further optimism. Some analysts predict that ZK could continue to climb by another 135% to reach $0.15 after a short-term correction.

“After such sharp rallies, I’m expecting a healthy correction toward the $0.065 zone. If that level holds as support, the structure looks set for another strong rally aiming for +135%,” trader LaCryptoLycus said.

However, ZK would still need to climb another 250% to reclaim its all-time high of $0.27. The token’s circulating supply remains only 34% of the total, and around 173 million ZK are unlocked each month.

The challenge now is whether the project can sustain this positive momentum despite broader market fear. Maintaining investor confidence over the coming months will be crucial for sustaining ZK’s rally.