The Canary HBAR ETF now holds over 380 million Hedera tokens worth $66 million, signaling growing institutional confidence.

Despite short-term consolidation, analysts expect renewed strength as ETF inflows and enterprise adoption rise. With the asset trading at $0.17 and showing bullish momentum, investors anticipate potential upside amid expanding network activity and market stability.

Canary HBAR ETF Expands Holdings Above 380 Million Tokens

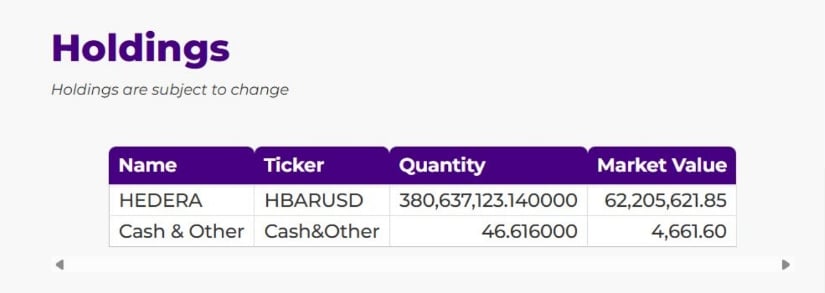

New portfolio data released on November 5, 2025, shows that the Canary ETF (HBR) has increased its exposure to Hedera Hashgraph, now holding over 380 million tokens. According to market data analyzed by ALLINCRYPTO, the fund’s total holdings are currently valued at around $66 million, reflecting the latest market price. This accumulation marks one of the largest institutional positions in Hedera to date, indicating growing investor participation in the token’s ecosystem.

Source: X

The ETF’s latest filing details 380,637,123 tokens under management, complemented by cash reserves worth approximately $4,661. This suggests near-complete allocation toward the asset, indicating a focused investment strategy on assets backed by enterprise adoption and blockchain utility. With this expansion, the fund now represents a key institutional vehicle for gaining exposure to its token economy, which continues to attract attention for its scalability and energy-efficient network design.

Institutional Confidence Builds Around Hedera’s Growth Outlook

The ETF’s accumulation aligns with broader developments across the ecosystem. Over recent months, the token has seen an increase in tokenized asset projects, enterprise partnerships, and decentralized applications. These trends have strengthened institutional engagement, positioning it as a growing component of blockchain-based portfolios.

The move by Canary ETF also reflects interest in assets with practical use cases in real-world applications such as payments, supply chain tracking, and decentralized identity management. Market observers note that funds of this scale often influence liquidity depth and overall market visibility for the underlying asset.

Should the asset maintain its current price momentum or record further growth, the ETF’s valuation could move toward the $70 million mark. The allocation pattern mirrors a gradual institutional shift toward tokens linked to network activity and sustainable infrastructure, areas where the asset has maintained a consistent focus.

Analysts Anticipate Prolonged Consolidation Before Next Phase

Analyst BOLUCEE_BLOCK offered a neutral projection for its price trend, noting that the token may enter a consolidation phase before potential recovery. The forecast suggests that the asset could trade sideways through the remainder of 2025, with possible stabilization extending into early 2026. According to the analysis, this period may reflect cooling momentum following months of accumulation and the absence of new large-scale catalysts.

HBARUSD Chart | Source:x

The analyst’s best-case projection envisions renewed upward movement driven by institutional inflows into the token-based funds and growing network usage. However, in a less favorable scenario, limited enterprise expansion or slower adoption could leave the asset range-bound for an extended duration. Despite these conditions, the presence of institutional holdings may continue to provide underlying market support, offering stability while awaiting future adoption triggers.

The Altcoin Price Strengthens Above Key Support Zone

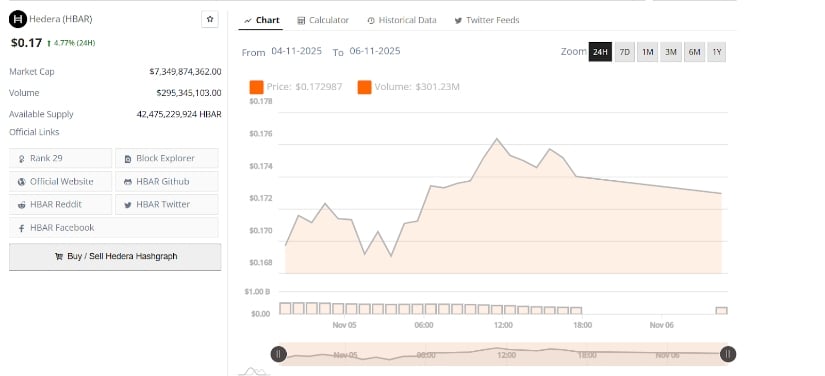

Hedera traded around $0.17 at press time, recording a 4.77% increase in the past 24 hours. The uptick lifted its market capitalization above $7.3 billion, with a trading volume of nearly $295 million, showing renewed participation from buyers. Intraday data reflected a temporary surge to $0.176, followed by minor profit-taking that brought the price back toward $0.172.

HBARUSD 24-Hr Chart | Source: BraveNewCoin

Market charts reveal strong support near $0.168, where buyers have repeatedly absorbed selling pressure. Maintaining levels above this zone could open a path toward $0.18, marking a potential short-term resistance level. The steady rise in trading volume suggests growing interest from traders, coinciding with increased institutional accumulation. As long as the token sustains this demand trend, the market may continue to consolidate gains made during the latest ETF expansion phase.