The meme coin market continues to show mixed signals, with the crypto emerging as one of the few assets maintaining its structure amid broad consolidation.

The token has been trading close to a historically significant support area, prompting increased attention from traders analyzing its long-term price setup.

The Dogwifhat Price Prediction outlook is now centered on whether the token can hold its current base around $0.43 and transition from accumulation to expansion as technical compression nears resolution.

Analyst Reveals Key Triangle Setup

A chart shared by Chartist Extraordinaire on X depicts a three-week timeframe for WIF/USD, showing a large descending triangle pattern that has been developing over several months. The structure highlights two critical areas labeled “Buying Opportunity #1” and “Buying Opportunity #2”, positioned along a long-term ascending trendline support.

According to the analyst, these levels have historically served as accumulation zones during prior consolidation phases. The latest price action around $0.43, which sits just above the trendline, suggests that the token is undergoing its final retests before a potential breakout.

Source: X

The analyst’s chart projects highly optimistic upside targets of approximately $4.85, $42, and $100, which are based on measured-move projections or Fibonacci extensions derived from the triangle’s width. These ambitious price levels imply a multi-month to multi-year bullish outlook.

The remark that there are “no more buying opportunities left” underscores a belief that the accumulation phase is nearly over, and any dips from this point could be brief before the next macro uptrend begins.

Market Data Show Consolidation Near $0.43

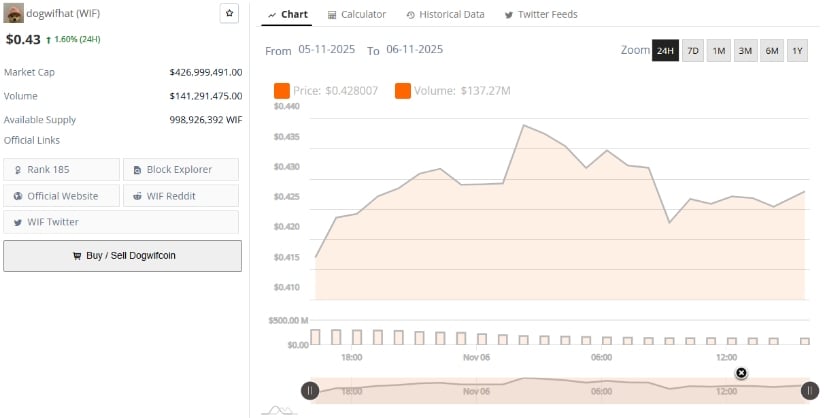

At press time, Dogwifhat is trading at $0.43, up 1.60% in the past 24 hours, with a market capitalization of $427 million and a 24-hour volume of $141 million, according to BraveNewCoin.

The daily chart on TradingView shows the asset sitting just above the lower Bollinger Band at $0.418, with the basis (middle band) at $0.510 and the upper band at $0.602. This positioning reflects that the asset is under short-term selling pressure but remains within a defined range.

Source: BraveNewCoin

The Relative Strength Index (RSI) stands at 35.47, hovering just above the oversold zone, while the RSI-based moving average is at 39.80, confirming weak momentum but hinting at a potential rebound if buying volume increases.

Technical Outlook Awaits Breakout Confirmation

Technically, Dogwifhat remains in a compression phase, characterized by tightening price action and declining volatility. Such setups often precede decisive moves, either a bullish breakout or a bearish continuation.

Source: TradingView

If the token breaks above the descending resistance line with strong volume, it could confirm the start of a new bullish cycle, targeting higher resistance levels around $0.70, $1.00, and beyond. However, if the token fails to hold above the $0.30 threshold, the bullish scenario could be invalidated, opening the door for deeper retracement.

For now, analysts see the $0.40–$0.43 range as the critical zone to watch, as it represents the lower boundary of long-term structural support.

Traders are advised to monitor volume surges, RSI divergence, and breakout confirmation candles before entering positions, as the next move could define the coin’s trajectory for the coming months.