The meme coin market remains in a phase of broad consolidation, but the coin continues to attract attention from traders who see signs of potential reversal.

The token has been trading near a key support zone within a descending channel, signaling that the ongoing bearish momentum could be approaching exhaustion.

The Floki Price Prediction narrative now centers on whether the asset can sustain its base near $0.00005904 and establish a breakout that could initiate a bullish phase heading into 2026.

Analyst Shows Descending Channel Setup

A chart shared by technical analysts on X highlights that FLOKI/USD is moving within a descending channel, which typically indicates prolonged corrective movement. However, as the price approaches the lower boundary of this channel, a potential reversal or end to bearish pressure may be forming.

Source: X

The pattern suggests that price compression is nearing its limit, and a breakout above the upper boundary could mark the start of a new upward leg. Traders are closely observing this setup, as historically, similar structures in the coin’s chart have preceded short-term rallies.

Analysts suggest that a break and hold above key resistance levels—particularly near $0.0000690combined with rising trading volume and positive ecosystem news, could confirm the start of a new bullish phase extending into mid-2026. Conversely, a failure to maintain the $0.0000570 support could expose the asset to further downside risk toward $0.0000500.

Market Data Reflects Support Retest Around $0.000059

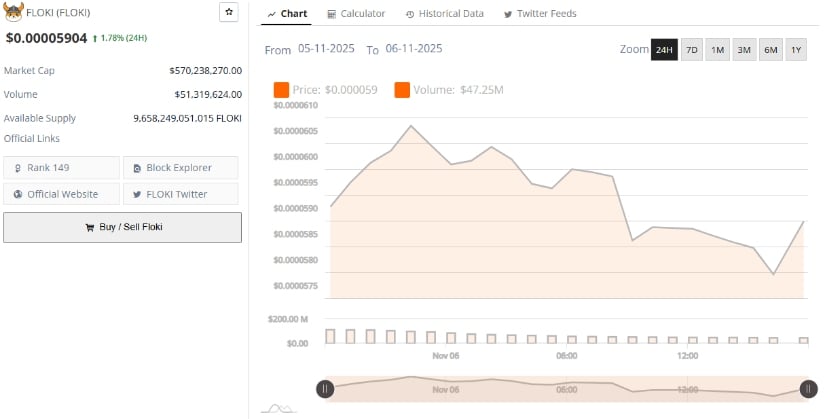

According to BraveNewCoin, the coin is currently priced at $0.00005904, up 1.78% in the past 24 hours, with a market capitalization of $570.23 million and a 24-hour trading volume of $51.31 million. The token holds a circulating supply of 9.65 trillion tokens, ranking #149 by market cap.

Source: BraveNewCoin

The daily chart on TradingView shows the asset testing the lower Bollinger Band at $0.0000570, with the basis (middle band) near $0.0000690, and the upper band at $0.0000811. This configuration indicates sustained selling pressure but also highlights a compression phase that may soon lead to directional volatility.

Market Sentiment and Outlook at a Pivotal Technical Level

The Relative Strength Index (RSI) currently reads 35.52, hovering near the oversold threshold of 30, while the RSI-based moving average stands at 41.86. These readings imply weakening downside momentum, and if RSI rebounds toward 45–50, it could trigger a short-term relief rally.

Both fundamental growth and the current technical chart structure suggest that FLOKI is at a pivotal point on the daily timeframe. The descending channel is narrowing, volatility is contracting, and RSI is flattening signals often preceding decisive breakouts.

Source: TradingView

If bullish momentum returns, potential targets lie at $0.000069 (basis line) and $0.000081 (upper Bollinger Band), while sustained bullish sentiment could drive mid-term moves toward $0.00010.

For now, traders are advised to monitor trading volume spikes, RSI divergence, and price action near the lower channel boundary, as these could indicate whether the asset is preparing for a reversal or facing another leg of consolidation.