Google Finance has quietly expanded its market tracking tools to include data from US prediction markets Kalshi and Polymarket.

With interest in crypto-linked prediction platforms rising, the integration highlights how traditional finance is beginning to merge with decentralized market insights.

Prediction Markets Enter the Mainstream

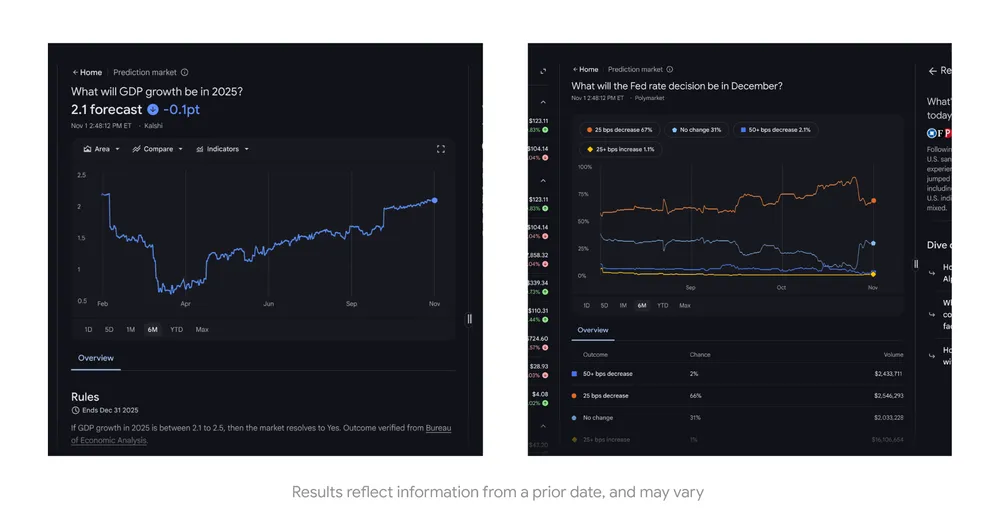

Google Finance recently added prediction market data from Kalshi and Polymarket, marking its first foray into event-based financial tracking. The inclusion allows users to view live odds on major events, such as elections, inflation reports, and crypto regulatory outcomes, alongside traditional assets. The feature underscores the increasing relevance of crowd-based forecasting within the broader financial ecosystem.

Explore prediction markets data: Google Finance

Kalshi operates under US Commodity Futures Trading Commission (CFTC) oversight, while Polymarket runs on blockchain infrastructure outside the regulated derivatives space. Their appearance on Google Finance suggests that institutional investors and data providers are beginning to treat event contracts as valuable sentiment indicators rather than speculative novelties.

Bridging Traditional and Decentralized Finance

The integration blurs the line between traditional financial data and decentralized information flows. For years, prediction markets remained niche platforms within crypto communities. Now, by surfacing this data through Google Finance, prediction-based insights are being normalized alongside stock and commodity information.

Financial analysts say the move could help refine market sentiment analysis. Prediction contracts often react more quickly than equities or bonds to political or macroeconomic signals, offering traders an early glimpse of shifting expectations.

“Google isn’t just displaying Polymarket data — it’s enabling AI-driven financial forecasting that could rival traditional economists.” — Crypto Trader @WinghavenCrypto

As a result, these datasets may soon complement conventional economic indicators, such as CPI forecasts and Treasury yields.

Regulatory and Market Implications

The move comes as US regulators continue debating how to classify event contracts. Kalshi’s regulated model contrasts sharply with Polymarket’s decentralized operations, which previously faced CFTC enforcement action. Yet, both platforms are gaining traction, especially as crypto-native investors explore event trading as a hedge against macro uncertainty.

If mainstream platforms like Google continue integrating prediction market data, it may prompt further policy clarity from regulators.

“That’s massive. Google just legitimized decentralized prediction markets, this is the bridge between TradFi data and on-chain truth.” — @Xfinancebull

It could also accelerate the acceptance of decentralized markets as a legitimate component of the financial information landscape—an evolution that mirrors Bitcoin’s gradual integration into traditional market dashboards over the past decade.