AVAX crypto is holding steady near key support, with participants eyeing a potential breakout as technical compression and improving on-chain metrics hint at a bullish reversal.

AVAX crypto appears to be nearing a turning point after weeks of heavy selling pressure. Despite muted trading volumes, the Avalanche token has shown signs of stability near the $17 mark, where buyers are beginning to absorb supply.

Momentum Shift Could Be Near for AVAX Crypto

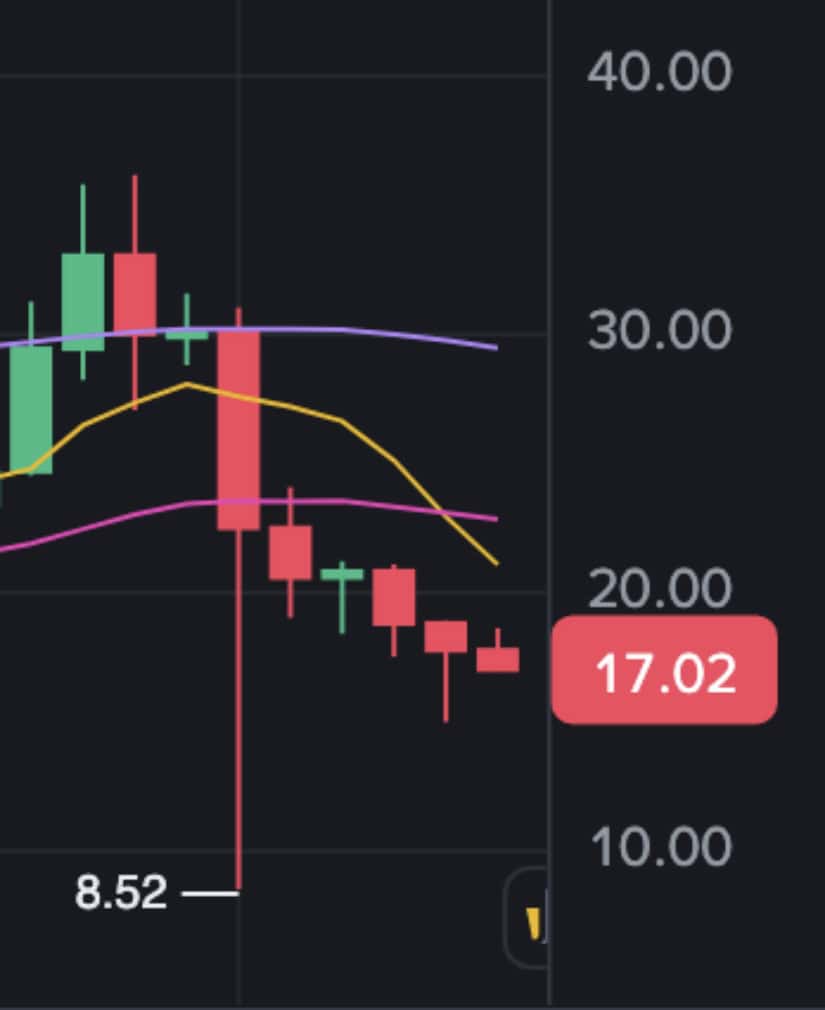

After eight straight weeks of red candles, Avalanche has entered a deep exhaustion phase around $17, where both the 50- and 200-week moving averages have now converged above price. REKTBuildr’s chart shows compression forming under these averages. The presence of long downside wicks hints that sellers are starting to fade while bids re-emerge near the lower bands.

AVAX shows early signs of exhaustion after eight consecutive red weeks, hinting at a potential momentum flip near the $17 zone. Source: REKTBuildr via X

If bulls manage to reclaim the $18 to $19 region, the next challenge sits near the $24 to $27 resistance cluster. A weekly close above these levels could mark the start of a healthy recovery towards the $30 zone, where the broader trendline from August currently rests. The structure suggests the worst part of the drawdown may be over, with price preparing for a potential momentum flip.

Range Structure Defines AVAX’s Short-Term Landscape

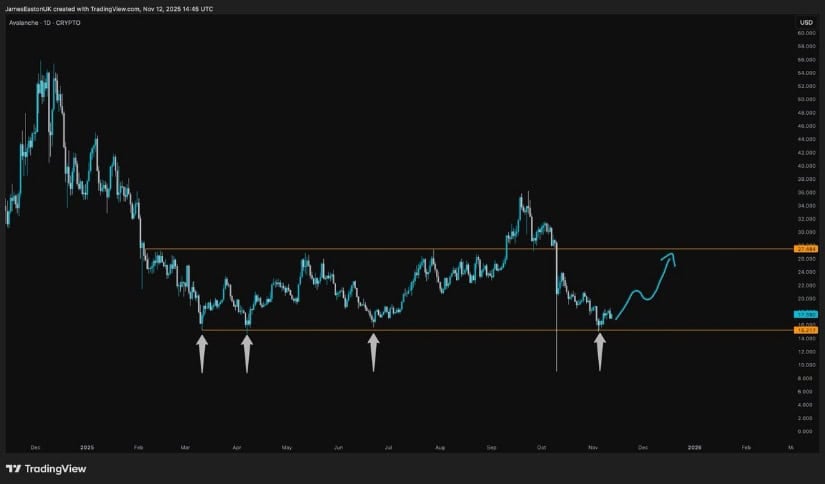

AVAX has carved a well-defined trading range, oscillating between $13.5 support and $22 resistance, as shown on James’s chart. This prolonged sideways phase underscores market balance after a prolonged selloff.

Price action now sits mid-range, hovering near $17 to $18, where equilibrium typically forms before the next directional impulse. A sustained break above $22 could trigger a higher-timeframe shift, while a close below $14 would negate the base structure. Until confirmation arrives, the pair remains in a holding pattern, awaiting volatility expansion.

AVAX continues to trade within a defined $13.5–$22 range, consolidating mid-zone near $17 as participants await the next decisive breakout. Source: James via X

Critical Resistance Levels in Focus

The Sniper Club’s 1-day chart outlines a tactical recovery map, identifying $17 as a high-conviction support zone. From here, the key resistance stack lies at $19 to $22.5 and $27-$31.5. These levels align with previous supply areas that saw heavy distribution earlier in the year.

AVAX is approaching key resistance levels between $19 and $31.5, with a breakout above $22.5 potentially confirming a major trend reversal. Source: The Sniper Club via X

A clean reclaim of $22.5 would not only neutralize the local downtrend but also open the door towards the upper resistance band near $30 to $32. This zone overlaps with both the 0.618 Fibonacci retracement and prior weekly order block, making it a decisive level for validating medium-term trend reversal.

On-Chain Metrics Reinforce AVAX’s Strengthening Case

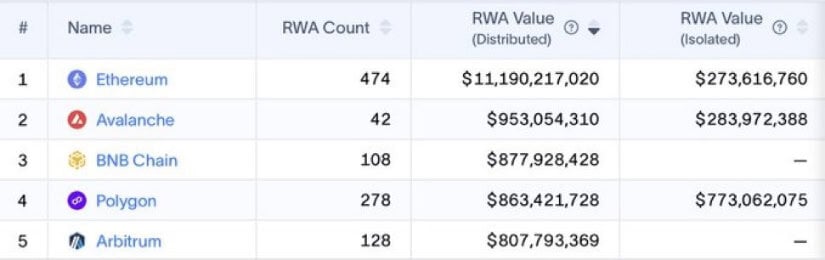

Mash CT highlighted that Avalanche’s RWA sector has crossed $950 million, surpassing BNB and Polygon to become the second-largest RWA ecosystem behind Ethereum. This growth showcases Avalanche’s expanding institutional and on-chain use cases, supported by increasing tokenized asset activity.

Such on-chain expansion usually finds its way into price action over time. As more activity and capital flow into Avalanche, it strengthens demand for AVAX crypto, which often leads to recovery moves. If this trend continues, the growing on-chain base could help the price reflect the network’s improving fundamentals.

Avalanche’s RWA sector has surpassed $950 million, positioning it as the second-largest after Ethereum and signaling growing institutional traction. Source: Mash CT via X

Technical Compression Suggests AVAX Breakout Setup

Kevin’s chart reveals that AVAX is coiling under a descending trendline that stretches back several weeks. Price has made higher lows within this compression, showing that buyers are gradually absorbing supply near $16.2 to $17.3. Short-term EMAs are beginning to realign upward, and momentum indicators are flattening, both signals of a maturing base.

AVAX is showing compression beneath a descending trendline, hinting at a potential breakout as higher lows and rising EMAs signal growing bullish pressure. Source: Kevin via X

If the breakout above the descending resistance confirms, AVAX crypto could retest $21.5 to $23 initially, followed by $26 to $28 in an extended move. However, failure to hold the near-term demand box would likely prolong consolidation within the current range. The setup remains constructive, not speculative, an early sign that accumulation may already be underway.

Final Thoughts

AVAX price has endured an extended correction phase, yet its ecosystem metrics continue to improve beneath the surface. The alignment of on-chain expansion, tightening technical ranges, and consistent buying interest near structural supports paints a cautiously optimistic outlook.

As the market digests months of downside, bulls appear ready to reassert control. Reclaims above $22 could reignite momentum towards $30, validating the improving fundamentals. While patience remains essential, AVAX’s blend of technical stabilization and growing real-world adoption suggests that a healthier recovery phase may be just around the corner.