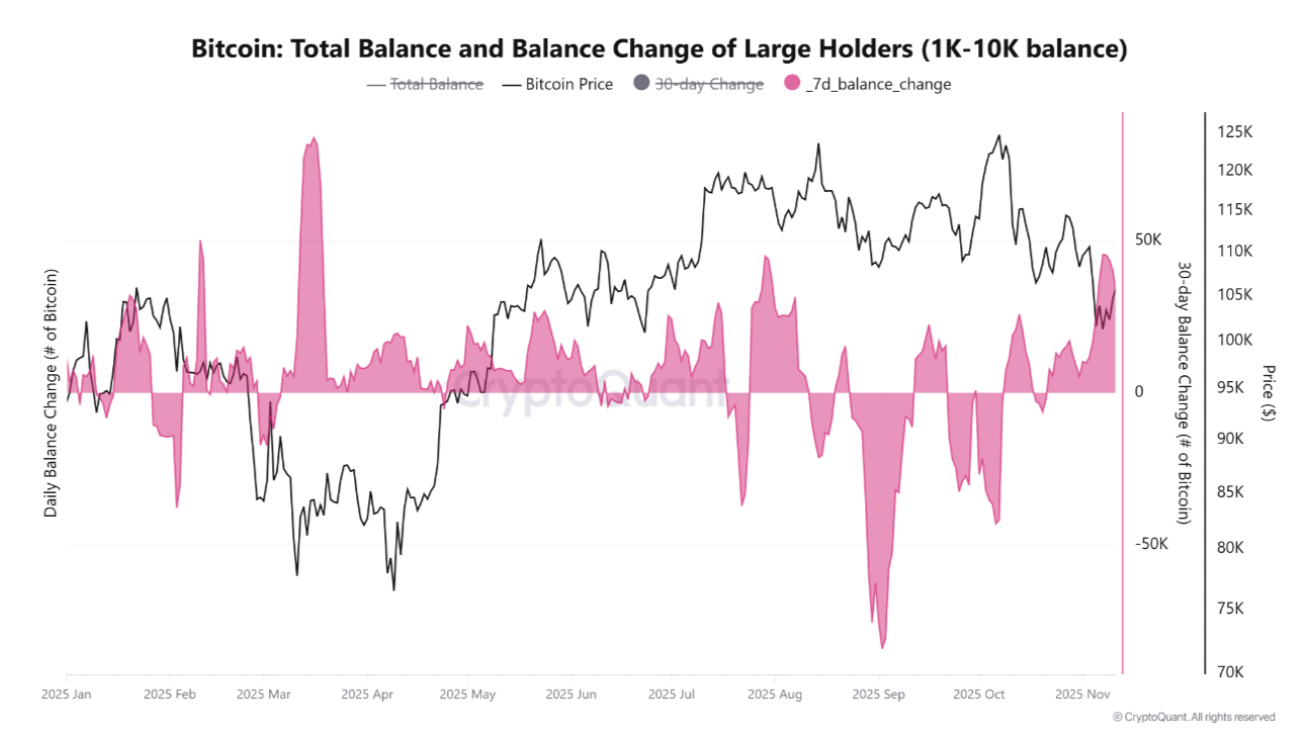

Bulls don’t seem willing to let Bitcoin (BTC) dive below $100,000 again, as on-chain data shows that whales have been frantically buying the token as it nears this key threshold.

Data from CryptoQuant shows that whales have increased their buying activity as the token hit $100,000 multiple times in the past few days.

This is a sign that the market considers this level relevant to keep the bull market going.

Yesterday, the U.S. government finally ended the longest shutdown in its history, and cryptos are reacting positively to the news. Today, Bitcoin’s price has advanced by 0.9% to $102,500.

However, weakness continues as market sentiment remains heavily depressed. This is normal during accumulation phases and tends to be a contrarian signal of an upcoming explosion.

The Fear and Greed Index has dropped to 25, just a couple of months after it hit a local peak of 62. This sentiment shift was triggered primarily by President Donald Trump’s decision to increase tariffs on Chinese imported goods by 100%.

Moreover, the head of the Federal Reserve, Jerome Powell, highlighted that the U.S. central bank may not cut rates in December as the market expected.

The market panicked over these comments, sending BTC below $100,000 for the first time since June. However, now that the shutdown is over, the market could recover its senses.

Bitcoin Price Prediction: Key Levels to Watch as BTC Bounces Off $100K

The daily chart shows that the $100,000 area has been a strong support for the token in the past few days. Every time the price has dipped below this mark, buyers have shown up to scoop up BTC.

This is consistent with on-chain data and emphasizes the technical relevance of this key level. It also increases the odds of a bullish Bitcoin price prediction.

The Relative Strength Index (RSI) has been dormant lately, further confirming that Bitcoin has entered a phase of consolidation. We would need a big move upwards at this point, preferably accompanied by big volumes, to confirm that the market is ready to move higher.

The key resistance to watch moving forward would be the $109,000 area, as this level shows confluence between the 200-day exponential moving average (EMA) and a former support.

If the price rises above this mark, the odds will favor a retest of the token’s all-time high in the next few weeks.

The end of the shutdown could be the catalyst that the market needs to reverse its course. Meanwhile, inflation data tomorrow could seal the deal and push BTC higher if prices advance at a slower pace than the market expected.

As BTC recovers, top crypto presales like Bitcoin Hyper ($HYPER) will benefit. This is a promising project that has raised over $27 million to launch the first real L2 for the Bitcoin blockchain, potentially kicking off a new chapter of growth for its entire ecosystem.

Bitcoin Hyper ($HYPER) Solves Bitcoin’s Scaling Issues Through a Solana-Powered L2

Bitcoin Hyper ($HYPER) will make the top network realize its full potential by supporting faster transaction processing speeds, lower fees, and smart contract support.

As the first real Bitcoin layer-2 network, it will overhaul the mainnet to open the door for decentralized apps and AI-powered tools that are capable of running directly on the Bitcoin ecosystem.

The Hyper Bridge is designed to safely receive BTC tokens from investors, storing them in a canonical address within the OG network. Once in there, users will receive the corresponding amount of assets in the Hyper L2 to access a growing list of dApps.

This is all possible with the help of the faster and cheaper Solana blockchain. With transaction speeds set to rival modern chains, Bitcoin Hyper aims to make the world’s most recognized blockchain a top contender to Ethereum and others.

Developers will finally be able to create DeFi platforms, dApps, and other Web3 tools without worrying about scalability problems.

Once the solution is rolled out, $HYPER will experience significant demand as wallets and exchanges will rush to adopt it.

To buy $HYPER before the next price increase, simply head to the Bitcoin Hyper website and link up your wallet.

You can either swap USDT or ETH for this token or use a bank card to invest.