The cryptocurrency market experienced a sharp decline on Tuesday, following significant outflows from Bitcoin and Ethereum ETFs on Monday. And Synthetix, which has been performing well in recent weeks, was unable to avoid the downturn.

Its price has dropped 17% today to $1.95, facing resistance after an explosive breakout since mid-September. However, it has remained up by a remarkable 171% over the past month after ecosystem developments fueled bullish momentum.

So, the question becomes, is this a good dip-buying opportunity, or is SNX about to give back its gains? Let’s examine what caused the SNX surge, the recent dip, and whether bullish momentum will return.

We’ll also evaluate the risk-adjusted opportunities of a new project generating significant buzz, called Bitcoin Hyper. Currently in presale, HYPER has raised an impressive $23.5 million to develop a Bitcoin Layer 2 blockchain. Its rapid rise suggests it could pose strong competition to current top gainers like SNX.

Synthetix to Launch the First Ethereum-Based Perp DEX, $1M Trading Competition

There appear to be two core drivers that fueled the Synthetix rally: one is the upcoming launch of the first perpetual futures DEX on Ethereum, expected this quarter. With trading volume and mindshare around perp DEXes reaching new heights in recent weeks, this alone would have been a strong catalyst, especially given Ethereum’s deep liquidity.

But then there’s the second catalyst: a well-timed trading competition scheduled for October 20 with $1 million up for grabs for the winner.

However, while these catalysts caused a massive price surge, there’s now heavy push back as the broader market struggles. As the price chart shows, SNX is forming a highly bearish wick on the weekly time frame, indicating strong profit-taking and a lack of sustained enthusiasm surrounding the price catalysts.

SNX Shorts Remain Dominant – Bearish Signal or Hidden Opportunity?

Coinglass data shows that despite SNX’s rising price this month, the longs/shorts ratio remained below a reading of 1, indicating that shorts are outpacing longs and that bears are in control of the market.

Additionally, Coinalyze data reveals that in the last 24 hours, 55% of leveraged positions on SNX favored shorts, further emphasizing the bearish outlook.

There is no denying this is a cause for concern. While bullish catalysts, such as the project’s launch of the first-ever Ethereum perpetual DEX and a $1 million trading competition, exist, bearish factors counterbalance them.

Not only are shorts accumulating, but with SNX up 171% this month, there’s plenty of downside potential if traders continue taking profits and rotating into projects that have yet to pump.

However, it’s also important to consider the potential for a short squeeze. Picture this: bears become complacent, the wider market begins to recover, and the October 20 trading competition sparks a fresh wave of adoption. If that timeline unfolds, a massive short squeeze could occur, liquidating bears and pushing the price higher.

Ultimately, it may come down to a coin flip whether Synthetix will boom or bust in the coming days. But that’s a gamble many traders won’t want to take – especially when there are plenty of undervalued altcoins available to buy right now. One option gaining significant traction is Bitcoin Hyper. Let’s explore what it’s all about and why it might outperform.

Expert Backs New Bitcoin L2 Bitcoin Hyper for 100x Gain

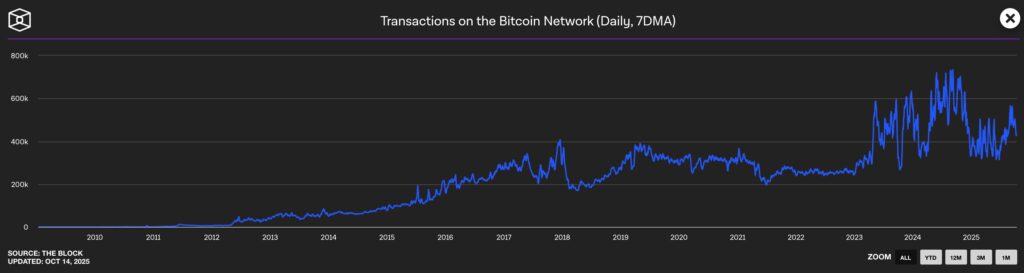

It’s no secret that Bitcoin has a speed problem, but what many people don’t realize is that on-chain activity on the Bitcoin network has declined significantly in 2025. The reason is simple: there are many other chains where you can do much more than just hoard wealth, so why would investors limit themselves to Bitcoin?

Data from The Block shows that on-chain transactions have dropped well below 2024 levels this year, which is why Bitcoin needs Bitcoin Hyper if it wants to keep growing. Bitcoin Hyper is a Bitcoin Layer 2 built using the Solana Virtual Machine, unlocking smart contract functionality, thousands of transactions per second, and interoperability with Solana.

Moreover, it uses ZK-rollups to periodically report its state back to the Bitcoin L1, meaning Hyper transactions benefit from the same immutability, decentralization, and neutrality as if they had been executed on Bitcoin itself.

It’s a setup that unlocks DeFi, payments, meme coins, and much more on Bitcoin – without compromising its most valuable tenets. As a result, investors are buzzing about HYPER, with Umar Khan from 99Bitcoins recently tipping it for 100x gains.

The project is available for purchase in presale, having raised over $23.5 million so far, which marks a significant milestone in investor interest. But with the presale ongoing, investors still have the opportunity to get involved early.

This is in stark contrast to Synthetix, which has already surged nearly 200% this month and has a valuation of $690 million, suggesting that the potential for stronger risk-adjusted returns lies with HYPER.