A wallet linked to Bitmine kept adding more ETH, even as prices moved to the $2,800 range. Bitmine is among the few DAT companies to continue with sporadic and sizable ETH orders.

Bitmine has not given up on ETH, adding another transaction to a newly created wallet. Another 28,625 flowed into a custom wallet from the FalconX hot wallet, the preferred counterparty for Bitmine. The wallet is also linked to Tom Lee, the founder of Bitmine and a strong ETH proponent.

Bitmine added over $82M worth of ETH just days following another purchase of 21K ETH.

Bitmine also remained one of the last ETH buyers among DAT companies, expanding its treasury by 10% in the last month. During that period, ETH broke down below the $4,000 and later below the $3,000 mark, allowing Bitmine to buy the dip. Even after the latest purchases, however, the average price for Bitmine’s treasury is above $4,000 per ETH, putting pressure on the company with unrealized losses.

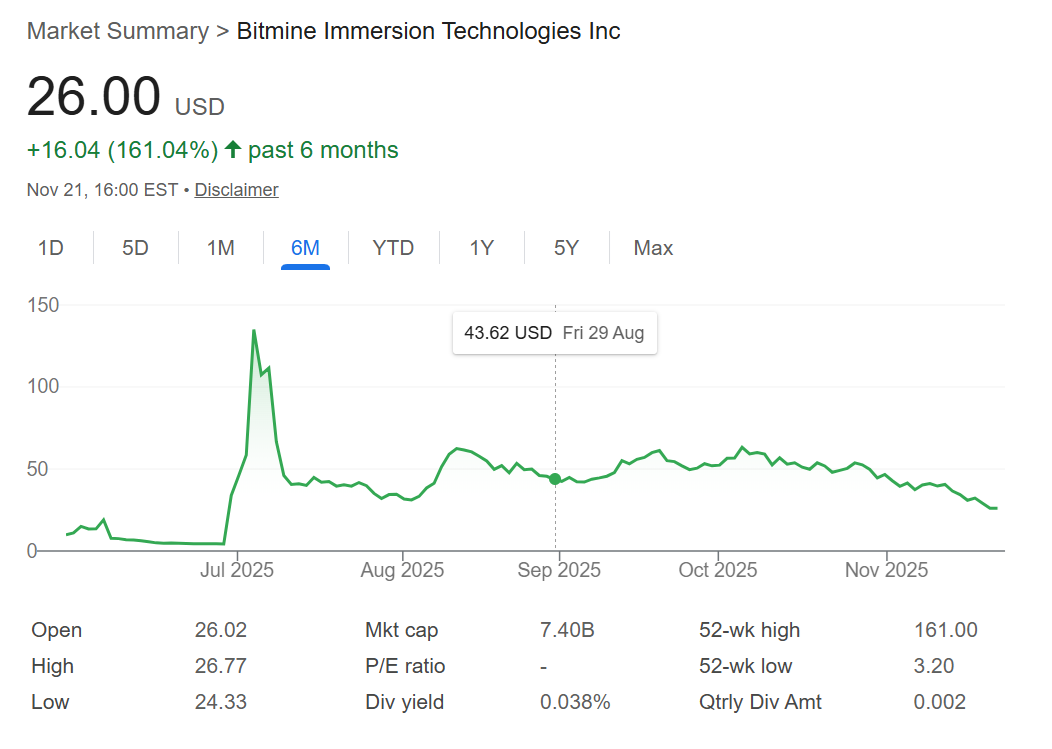

BMNR shares trade near one-month low

BMNR shares dipped to $26, down from a peak above $135 in July. Bitmine’s mNAV value is at 0.72, suggesting the shares do not command a premium to the treasury. A low mNAV does not mean BMNR is a bargain, but signals a loss of confidence in the DAT playbook.

The recent purchases show Bitmine still has resources to buy ETH even in its distressed state. The company already holds 2.94% of the ETH supply, aiming for a total of 5%.

Despite its drop, BMNR has support from over 31% in institutional ownership. A total of 353 holders increased their positions, buying in at the end of September, a period of much higher optimism for ETH. For now, there are no signs of institutional capitulation, as only a handful of smaller backers decreased their holdings. Among the most active sellers was Sassicaia Capital Advisers, which sold 38,000 shares in September, cutting its exposure by 82%.

Bitmine bets on Ethereum staking

While the ETH price slid, Bitmine is making its long-term bet on Ethereum staking. The company’s goal is to stake its treasury, earning long-term passive income.

Bitmine recently announced MAVAN, or Made in America Validator Network. The company aims to position itself as a secure, known validator for institutional clients. While Ethereum staking is permissionless, securing more significant funds with a known validator is more reliable.

The work of a large-scale validator may bring $400 to $500M a year in block rewards and fees. However, realizing those earnings may come at a cost, as the rewards are in the form of ETH tokens.

Bitmine plans to pay out $0.01 dividend per share, based on its revenues for 2025. The company considers its playbook superior to Strategy’s approach, as ETH can be used for staking, along with the issuance of liquid staking tokens.

Sign up to Bybit and start trading with $30,050 in welcome gifts