Ethereum (ETH) is showing tentative signs of recovery after a recent pullback, with traders and analysts closely monitoring the $2,800 support area as a potential springboard toward higher resistance levels near $3,550.

The cryptocurrency’s modest gains today come amid mixed market sentiment, as long-term holders strengthen their positions while inflows from new investors remain limited. Analysts are observing Ethereum’s short-term momentum alongside broader technical and on-chain indicators to understand potential near-term trajectories.

Ethereum Price Today Shows Modest Gains

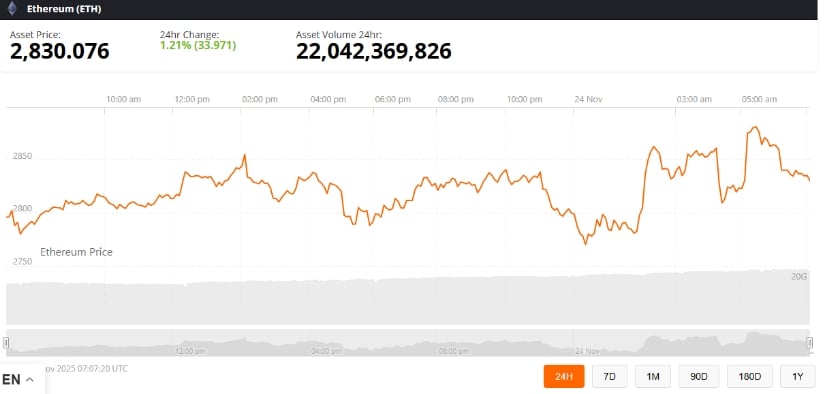

Ethereum, the second-largest cryptocurrency by market capitalization, is trading at roughly $2,837, reflecting a 0.77% increase over the past 24 hours as of November 24, 2025. The asset experienced an intraday low of $2,762 and a high of $2,854, illustrating normal volatility in short-term trading.

Ethereum was trading at around 2830.07, up 1.21% in the last 24 hours at press time. Source: Ethereum price via Brave New Coin

The current ETH price is just below the psychological $3,000 mark, a level traders and investors watch closely as it has historically served as both resistance and a milestone for market sentiment.

Long-Term Holders Strengthen Ethereum’s Support

On-chain data from the HODLer Net Position Change metric, which measures the net movement of ETH within long-term wallets, indicates increased confidence among Ethereum’s established investors. A slowdown in outflows suggests these holders are transitioning from passive storage to incremental accumulation.

ETHUSD continues to trade within an ascending channel, and a retest of the lower support area could support renewed bullish momentum toward the $2,850–$2,870 zone and potentially enable an upside breakout. Source: Chirsmons_Fx_Tr on TradingView

While long-term holders provide foundational support, the broader rally depends on fresh inflows from new market participants. Currently, the number of new Ethereum addresses has stagnated, suggesting limited external demand—a factor that could delay ETH’s advance toward $3,550.

Ethereum’s Elliott Wave Pattern Signals Potential Rebound

Technical analysts using Elliott Wave theory identify Ethereum’s recent dip below $3,000 as Wave 2—a corrective phase typically preceding bullish expansions. According to Merlijn The Trader, a chart analyst known for wave-based interpretations, “Wave 2 corrections have occurred three times before and were followed by notable upward moves in ETH. The $2,800 region aligns with prior retracement zones, although outcomes depend heavily on broader market momentum.”

Ethereum is currently in a Wave 2 corrective phase, with analysts noting that similar setups have historically led to strong Wave 3 expansions and significant price rallies from the discount zone. Source: Merlijn The Trader via X

It is important to note that Elliott Wave analysis is interpretive, and different analysts may count waves differently. This method should not be treated as a precise prediction but as a framework for understanding potential market structure.

The concept of the discount zone refers to areas where historical buying pressure has previously supported price recoveries. In Ethereum’s current cycle, the $2,800 level serves as such a zone, potentially moderating downside risk and supporting short-term rebounds.

Short-Term Ethereum Price Targets

Ethereum is trading within an ascending channel, maintaining several support levels. Analysts suggest that if ETH retests the lower channel support around $2,850–$2,870 and retains momentum, it may move toward $3,450–$3,550, a resistance range defined by:

Descending trendline resistance on the 4-hour chart.

Historical reaction zones where Ethereum previously faced rejection.

Ethereum is forming a short-term bottom near $2,860, with technical analysis pointing toward a potential move into the $3,450–$3,550 trendline resistance zone if momentum continues. Source: Algo Trading Mql5 on TradingView

“Price appears to be forming a short-term bottom,” said Li Wei, a technical analyst focusing on multi-timeframe trend analysis. “A move toward trendline resistance is reasonable if momentum continues, but surpassing this zone requires confirmation from volume and broader market engagement.”

This approach highlights why analysts often combine volume, trend strength, and historical price behavior to contextualize technical targets, rather than relying solely on pattern recognition.

Market Outlook for Ethereum

Ethereum’s support from long-term holders provides a stabilizing factor, yet the absence of substantial new investment may keep ETH sideways below $3,000. A sustained rally will likely require fresh capital and broader participation.

If inflows increase, Ethereum could test the $3,000 threshold and potentially target $3,131 or higher, contingent on market conditions. Such movements would restore bullish sentiment, though analysts caution that price action is always sensitive to macroeconomic factors, liquidity, and trader behavior.

This outlook underscores the importance of monitoring the Ethereum price today, on-chain metrics, and technical confirmations rather than relying solely on price targets.

Final Thoughts

Ethereum’s current pullback near $2,800 appears to be part of a normal market cycle, supported by long-term holders and potentially guided by Elliott Wave structural patterns. Analysts highlight that while technical setups suggest possible rebounds, outcomes remain uncertain and contingent on new capital inflows and market momentum.

Investors and traders are encouraged to combine Ethereum technical analysis, on-chain insights, and prudent risk management while keeping abreast of Ethereum news to make informed decisions.