The viral claims suggesting that XRP has no connection to payments are quickly falling apart under a basic review of official documentation. As misinformation spreads across social platforms, the publicly available documentation continues to reinforce the asset’s real, payment-centric utility, contradicting the narrative gaining traction online.

How Documentation Debunks The XRP Role Speculation

In an X post, a researcher known as SMQKE has revealed that the narrative claim that XRP is just a cryptocurrency with no connection to traditional finance payments is sharply contradicted by the documentation that defines the asset. A surface-level review has already shown just how inaccurate that statement is.

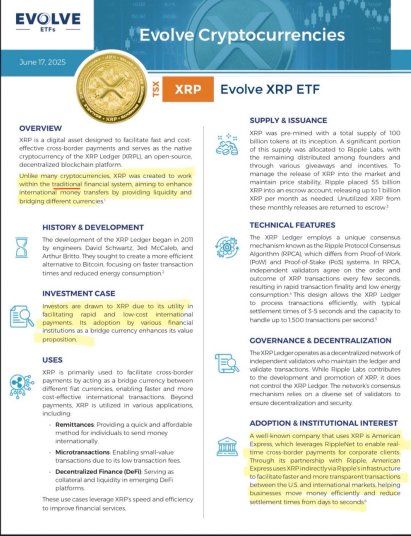

According to SMQKE, unlike many cryptocurrencies built purely for decentralized experimentation, XRP was designed to operate within the existing traditional finance system. The report highlights that XRP was intended to enhance international money transfers by serving as a neutral bridge between currencies and providing liquidity. Furthermore, the documentation also shows that XRP is a digital asset engineered specifically to address long-standing inefficiencies in the traditional payment system.

The conversation around RippleNet isn’t about experiments. Crypto analyst Xfinancebull highlighted that more than 300 banks are not testing RippleNet; they are partnering with it. Brad Garlinghouse isn’t speaking in vague possibilities; instead, he is forecasting where XRP could capture up to 14% of current SWIFT volume by 2030, which is an estimated $21 trillion in annual value moving across the XRP Ledger infrastructure.

His focus is not on the chart price movements. It’s about how global financial plumbing is being re-engineered in real-time. The idea centers on a system where banks could settle cross-border transactions instantly 24/7, with lower operational fees, all powered by XRP.

From this perspective, the transformation is being built. While the retail traders often react to every red candle, the institutions are entering partnerships and signing integrations. “You don’t buy XRP for today. You buy it for the financial world that is coming,” Xfinancebull noted.

Major Capital Shifts From Observing To Building

A recent move from Ripple has shifted conversations entirely. XFBAcademy has pointed out that banks didn’t raise $500 million to reshape the future of money, but Ripple did. Moves like this indicate exactly why the long-term outlook around XRP will continue to build strength. Meanwhile, real utility is finally being funded at the highest institutional levels.

XFBAcademy explains that when names like Fortress, Citadel, Pantera, Brevan Howard, and Galaxy participate simultaneously, it’s not speculation, but a signal where infrastructure is heading. This raise isn’t fueled by speculative propaganda. Instead, it is tied to RLUSD, institutional rails, and the treasuries moving into on-chain.

This kind of capital doesn’t chase existing narratives but actively builds new ones. The expert frames moments like these as the real turning points. These are the junctures when the smartest money transitions from observation to funding the new plumbing of global finance.