Bitcoin (BTC) is once again in focus as it navigates a key two-week trendline, with technical charts hinting at a potential weekly cup-and-handle formation that could guide the price toward $90,000.

Traders and analysts are carefully monitoring BTC as it approaches critical support and resistance levels. A confirmed breakout above this trendline could signal renewed bullish momentum, while a rejection may result in short-term consolidation or a deeper correction. Historical patterns and technical indicators continue to shape traders’ expectations, emphasizing probability over certainty in market behavior.

BTC Approaches Critical Trendline

Recent chart analysis indicates that Bitcoin is testing a two-week ascending trendline, a level that has historically served as both support and resistance. Technical strategist Ali (@ali_charts) points out that this trendline aligns with three previous higher lows in the last 12 months, which increases its probability of serving as a structural support zone.

If BTC closes above this trendline on sustained volume, analysts suggest it could move toward $88,000–$90,000. Conversely, failure to maintain this level may lead to short-term consolidation or a downward correction. Support zones to watch include $82,000, $78,000, and $75,000, which have historically influenced price behavior during retracements.

BTC is testing a two-week trendline; a breakout could target $88–$90K, while rejection may lead to consolidation or a drop toward $75–$82K. Source: TheAlphaHustle on TradingView

Experience insight: In April 2024, when BTC retested a similar multi-week trendline, the cryptocurrency bounced nearly 12% within one week, demonstrating how these levels can act as pivot points in volatile markets.

Weekly Cup-and-Handle Pattern in Focus

Technical analysts are observing a potential weekly cup-and-handle pattern, a classic bullish setup often signaling a consolidation followed by a breakout. The “cup” reflects a rounded price dip and recovery, while the “handle” represents a smaller retracement before a potential rally.

A weekly BTC/USD chart shows Bitcoin breaking below a $90K trendline, hinting at a cup-and-handle pattern, with further drops to $50–60K becoming plausible amid shifting market sentiment. Source: フ ォ リ ス via X

Historically, BTC cup-and-handle breakouts have produced continuation moves between 20% and 40% when confirmed by volume and trendline support. Bitcoin’s pullback from October highs above $125,000 to sub-$90,000 formed the cup, and traders are watching the handle for a potential breakout signal.

Analyst note: Michael van de Poppe recently highlighted that confirmation of this handle could see BTC testing its previous high while establishing a stronger short-term base.

Historical MACD Signals Suggest Caution

While bullish formations are visible, some indicators advise prudence. The monthly MACD recently crossed bearish, a pattern that historically coincided with notable BTC corrections.

Ali (@ali_charts) notes, “In three prior cycles where the monthly MACD turned bearish, BTC experienced retracements averaging around 60%. While past performance does not guarantee future results, this signal indicates elevated downside risk if macro conditions weaken.”

Historically, each bearish monthly MACD crossover has coincided with an average 60% BTC decline, suggesting a potential drop toward $40,000 if the pattern repeats. Source: Ali Martinez via X

Such historical data emphasizes the probabilistic nature of these signals. Traders should interpret MACD crossovers as warning flags rather than precise predictors, particularly given BTC’s sensitivity to macroeconomic events like Federal Reserve rate changes.

Strategists Await Pullbacks

Professional traders are considering retracement zones as potential entry points. One widely observed “zone of interest” includes multiple technical factors:

50% Fibonacci retracement from recent swings

Sell-side liquidity zones near prior lows

Valid 8-hour fair value gaps (FVG)

Borders of the discount zone

While BTC may not retrace to these levels, such areas historically provide high-probability setups for cautious traders. A crypto strategist noted, “I’ll monitor price action in this zone and consider positions if BTC confirms support.”

This approach reflects a disciplined trading mindset, balancing risk and opportunity rather than relying solely on directional predictions.

CME Gap and Short-Term Forecasts

Crypto analyst Michael van de Poppe highlighted a short-term movement toward the CME gap at $85,200, which could act as a temporary support before a potential rebound. Such gaps historically influence short-term price behavior, making them relevant for traders managing positions around volatile market events.

Bitcoin has bounced nearly 10% from recent lows. A short-term dip toward the CME gap at $85.2K is likely before climbing back to $90–$96K to establish a new base. Source: Michaël van de Poppe via X

The proximity of Federal Reserve policy announcements adds a layer of uncertainty. While BTC shows technical potential for bullish setups, ongoing volatility underscores the importance of risk-aware trading strategies.

Bitcoin Price Outlook

In summary, Bitcoin’s short-term outlook combines bullish and bearish signals:

Break above the two-week trendline toward $90K

Confirmation of the weekly cup-and-handle pattern

Monitoring MACD crossovers alongside historical correction probabilities

Observing retracement zones for potential high-probability entries

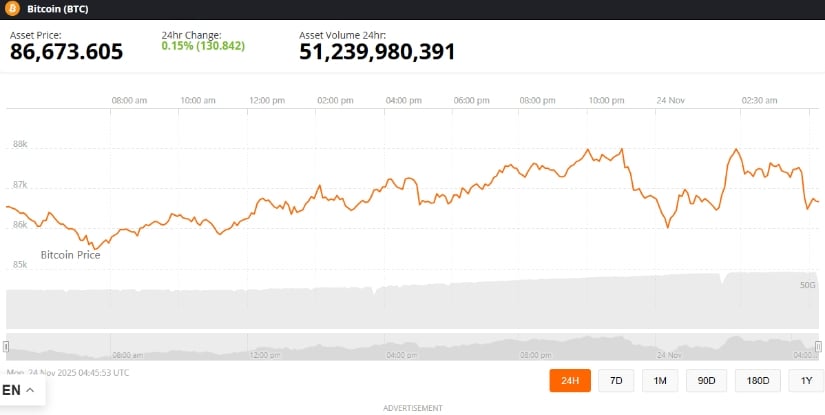

Bitcoin was trading at around 86,673.60, up 0.15% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Traders are advised to treat these signals as probability-based indicators, not guarantees. BTC’s technical potential is evident, but careful observation of support and resistance levels, coupled with disciplined risk management, remains crucial.