Hedera is showing renewed strength after forming a triple-bottom inside a major weekly demand zone and breaking upward with a 13% surge.

The price reclaimed key mid-range levels, signaling strong accumulation, rising momentum, and improving market sentiment. With buyers defending structure and volume expanding, Hedera now holds a bullish setup that favors continued upside if support remains intact.

Triple Bottom Structure Forms Within a Weekly Demand Zone

HBAR posted a strong recovery after forming a clear triple-bottom pattern inside a weekly demand zone that has been active for several months. Market data shows three distinct retests of this area, each generating reaction wicks that indicate renewed buying pressure.

The repeated defense of the same region has provided stability during prolonged downside movement, giving the price the platform needed to consolidate before the recent breakout.

HBARUSD Chart | Source:x

The weekly falling channel remains intact, with the latest touch aligning precisely with the channel’s lower boundary. This technical alignment suggests that the broader trend structure remains orderly despite extended retracement phases.

Each move back into the channel support resulted in controlled candles rather than volatile sell-offs, indicating that sellers have been unable to force continued downside momentum. This behavior has set the stage for its recent advance above short-term resistance levels.

Breakout Structure Reflects Momentum Shift on Higher Time Frames

Hedera’s breakout from the lower portion of the falling channel marks the first strong upward shift after weeks of compressed price movement. The breakout came as the price pushed above descending resistance, supported by a series of higher lows that formed during previous retests of the demand zone. This ascent suggests that earlier accumulation phases are beginning to show in price action through directional movement instead of range-bound activity.

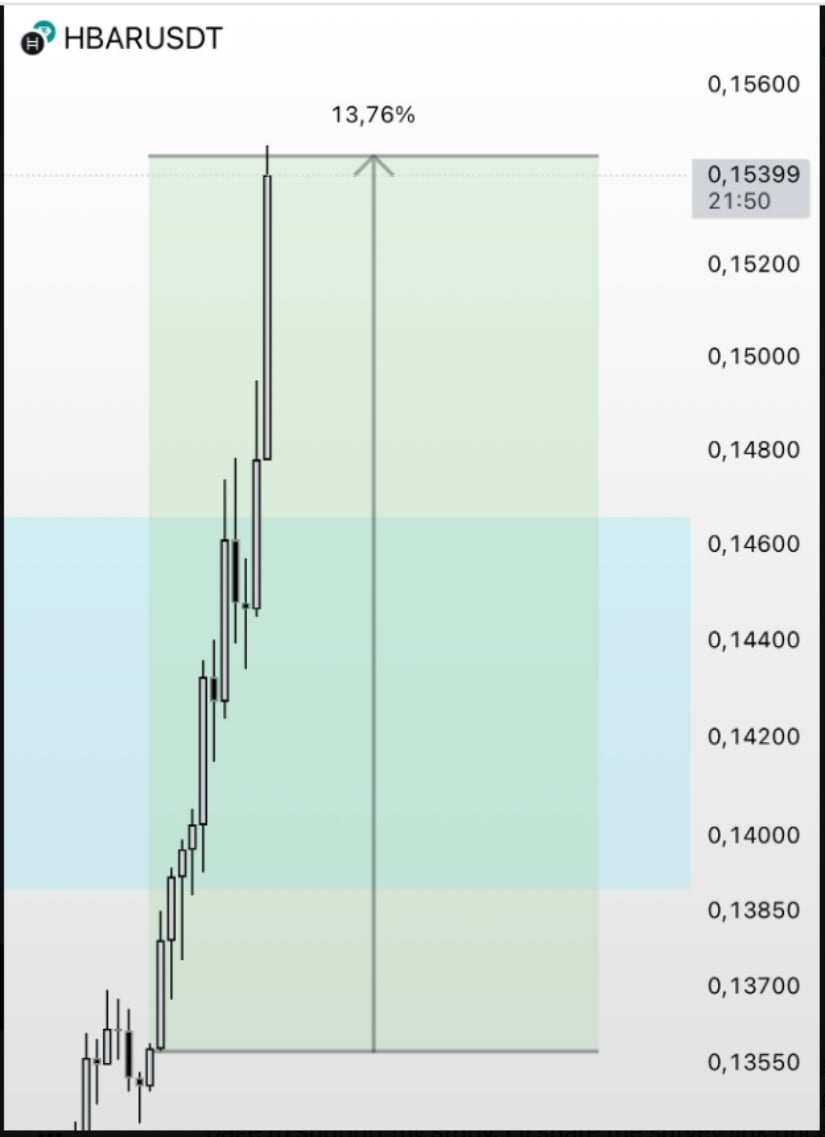

HBARUSDT Chart | Source:x

The mid-channel region has now been reclaimed, serving as a structural pivot area in recent sessions. Once the price closed above this level, the market maintained that position through intraday swings, suggesting that buyers are defending newly reclaimed zones.

The tight structure within the breakout leg shows controlled, steady candles rather than sharp reversals, indicating stability as the move progresses. The current behavior shows the pair moving into territory that lacked sustained trading activity in prior weeks.

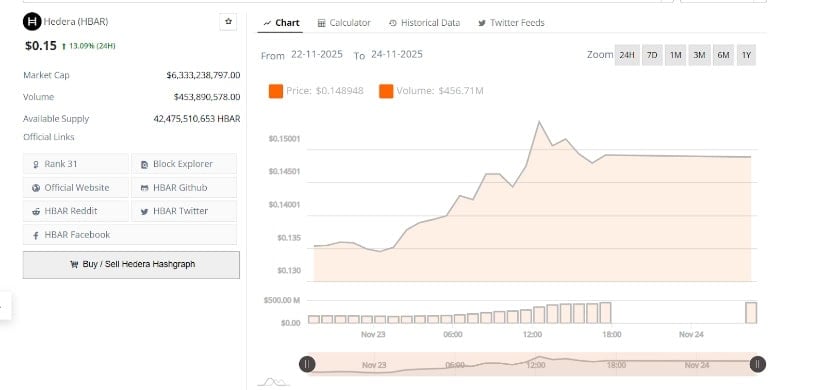

Intraday Chart Shows 13% Gain Driven by Higher Volume

The intraday chart recorded a 13% move from approximately $0.133 to above $0.150 within 24 hours. The advance occurred on expanding volume, suggesting stronger market participation. The rise developed through a sequence of higher lows, confirming a short-term upward structure consistent with ongoing accumulation. The price response after each minor pullback showed that buyers remained active throughout the session.

HBARUSD 24-Hr Chart | Source: BraveNewCoin

During the strongest intraday push, HBAR reached highs around $0.1504 before moderating slightly. Despite the cooling in momentum, the market retained most of the gains, with price stabilizing near $0.149–$0.150 late in the session. Sellers were unable to force the market back into earlier ranges, keeping the token above levels that previously served as intraday resistance.

Market Holds Reclaimed Range as Buyers Maintain Control

Hedera has now established a short-term floor above the mid-$0.14 region, an area that market participants are monitoring closely. Maintaining this zone would allow the pair to retain its upward trajectory. The shallow nature of recent pullbacks indicates that market participants continue to respond to dips with steady demand, helping the structure maintain form.

If the pair holds above the reclaimed range, the broader trend may continue developing toward higher price levels. A move back below the mid-$0.14 area could place the token back into its earlier consolidation band, although current market behavior shows no such shift yet. For now, the recent breakout and strong daily gain provide a clearer technical structure after several weeks of constrained activity.