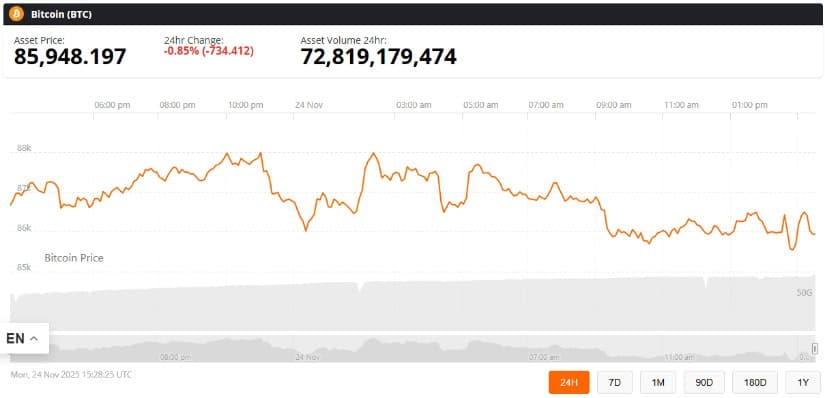

Bitcoin (BTC) rebounded to around $86,000 today after struggling to breach the $88,000–$90,000 resistance zone, signaling consolidation amid mixed market signals.

The digital asset saw a weekend bounce from lows near $84,500 following multiple unsuccessful attempts to break the upper resistance. Traders and analysts note that the $88,000–$90,000 range has historically acted as a critical short-term barrier, with prior rejections often leading to minor retracements toward $82,000–$83,000 support. Market sentiment is currently balanced: some technical participants point to Fibonacci support around $82,900, while others consider recent price swings within normal post-halving volatility patterns.

Bitcoin Stabilizes Near $86K Following Weekend Rebound

Bitcoin is currently holding near $86,000 as of November 24, 2025, based on spot trading data from Brave New Coin. The cryptocurrency faced technical resistance at the $88,000–$90,000 range, reinforcing caution among short-term traders.

Bitcoin price may bounce between $82,200 and $85,800, providing a potential exit and re-entry zone for short-term traders. Source: chart_khan on TradingView

Technical analyst @chart_khan, who frequently publishes short-term structure analyses on TradingView, noted: “The reversal in the $82,200–$85,800 range could provide a consolidation zone before the next move. Traders with short positions may consider exiting and re-entering within this range.”

This aligns with historical patterns where similar resistance rejections have led to brief retracements, followed by range-bound trading as the market reassesses buying and selling pressure.

Market Indicators Suggest Risk-On Sentiment

Market sentiment has played a key role in Bitcoin’s recent price action, with investors closely monitoring both crypto-specific signals and broader financial markets. Understanding how equity trends, volatility indices, and macroeconomic indicators interact with Bitcoin can help traders and investors gauge potential short-term movements.

Bitcoin hovers near $86,000 as VIX declines and Nasdaq and S&P futures show early gains. Source: @TedPillows via X

Key market metrics provide additional context for Bitcoin’s price movements:

VIX Volatility Index: Declined to approximately 21.9–22.1, per CBOE futures data, suggesting lower market fear.

S&P 500 E-mini Futures: Hovered around 6,628–6,653 (+0.5%–1%), according to CME Group reports.

Nasdaq 100 E-mini Futures: Rose to 24,447–24,538 (+0.58%–0.72%), per CME data.

These indicators suggest that macro conditions are moderately supportive of risk assets, including cryptocurrencies. While positive correlations exist, Bitcoin’s reaction may remain muted if institutional sell-offs or high-volatility events occur.

Technical Outlook: Resistance and Support Levels

Bitcoin’s immediate technical structure emphasizes the importance of reclaiming the $88,000–$90,000 resistance. A sustained break above this level could increase the probability of an upward continuation, provided broader risk-on conditions persist. Conversely, failure to breach this zone may trigger a retest of monthly lows near $82,000.

Bitcoin faces rejection at resistance and may drop toward a new monthly low if it fails to reclaim the $88K–$90K zone. Source: @TedPillows via X

From an on-chain perspective, wallet flows and exchange balances indicate moderate selling pressure from retail traders but limited large-scale withdrawals by institutional holders. These patterns suggest that Bitcoin’s short-term consolidation is supported by liquidity within the $84,000–$86,500 range.

Looking Ahead: What This Means for Traders and Investors

Investors monitoring Bitcoin’s price should weigh both short-term and long-term considerations. Short-term traders may watch the $88,000–$90,000 resistance zone for potential breakout opportunities, but should remain cautious of retracements toward Fibonacci support near $82,900. For long-term holders, consolidation around $86,000 does not significantly change Bitcoin’s fundamentals, and typical post-halving volatility could present accumulation opportunities.

Market dynamics, including institutional activity, ETF inflows, funding rates, and liquidity zones, continue to influence price behavior. Sustained interest from major holders of Bitcoin ETFs may support upward momentum, whereas high leverage and sudden liquidations could exert short-term downward pressure, underscoring the need for measured risk management.