Ethereum price prediction discussions are intensifying as the second-largest cryptocurrency continues to flash warning signs on multiple fronts.

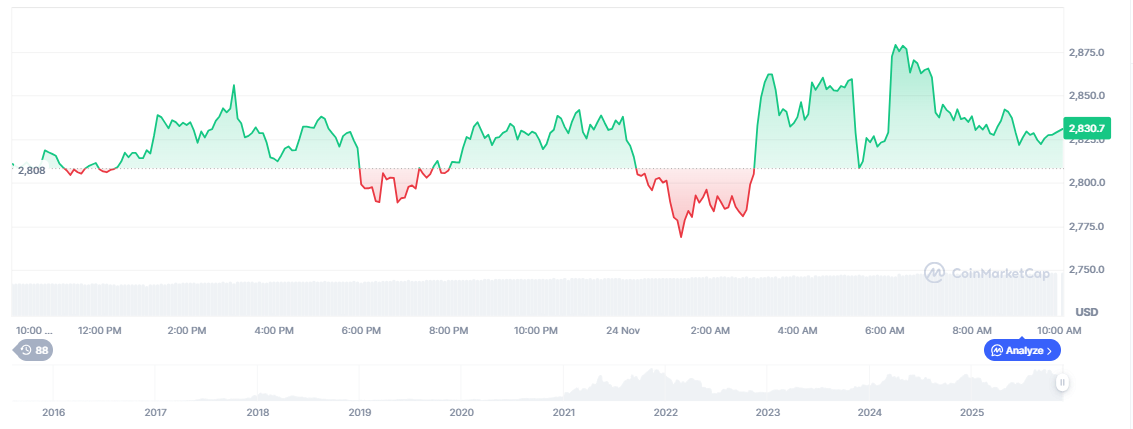

Despite a minor rebound to $2,838 today, a repeating fractal pattern from 2022 is triggering renewed concern among analysts, with downside targets as low as $2,500 now back in play.

Meanwhile, as Ethereum loses short-term steam, early-stage meme tokens like Maxi Doge are beginning to steal attention from retail traders looking for cheaper, momentum-driven bets.

Is Ethereum Repeating Its 2022 Breakdown?

A fractal is a recurring pattern that appears in different timeframes on price charts, often signaling potential reversals. Right now, Ethereum is mirroring the exact setup seen in late 2022 – a prolonged decline followed by short-lived relief rallies that fail to break key resistance.

In that 2022 cycle, ETH dropped from $4,750 to $800, losing over 81.93% of its value. While the current drop isn’t nearly as steep, the structure is strikingly similar.

Ethereum has lost around 28% over the last 30 days, and analysts warn that if the fractal plays out again, ETH could revisit the $2,450–$2,500 zone – a further 10–12% drop from current levels.

That downside scenario aligns with weak macro sentiment and multiple resistance levels forming in the $2,900–$3,000 range. Price has now been rejected from this zone repeatedly, turning it into a ceiling that traders are watching closely.

Ethereum Price Prediction Hinges on Outflows and Derivatives Weakness

A large part of the bearish Ethereum price prediction narrative is tied to sustained capital outflows and weakening derivatives data.

According to spot metrics, ETH saw a $415M net outflow in just 24 hours, suggesting that investors are moving coins off exchanges and reducing exposure.

These outflows are part of a broader pattern that’s held across all timeframes. ETH has seen consistent negative flows over the past quarter – and many institutional desks interpret this as a sign of medium-term caution. Traders aren’t buying the dips. They’re sitting out.

At the same time, open interest (OI) has dropped from $45B to $35.5B over the last month, a clear signal that speculative appetite is waning. Without strong leverage demand or fresh inflows, Ethereum’s ability to push through resistance remains limited.

This doesn’t necessarily imply a crash – but it does suggest that traders may prefer to rotate capital into assets with stronger momentum or better short-term upside.

Ethereum Price Forecast Through 2030: What Models Say

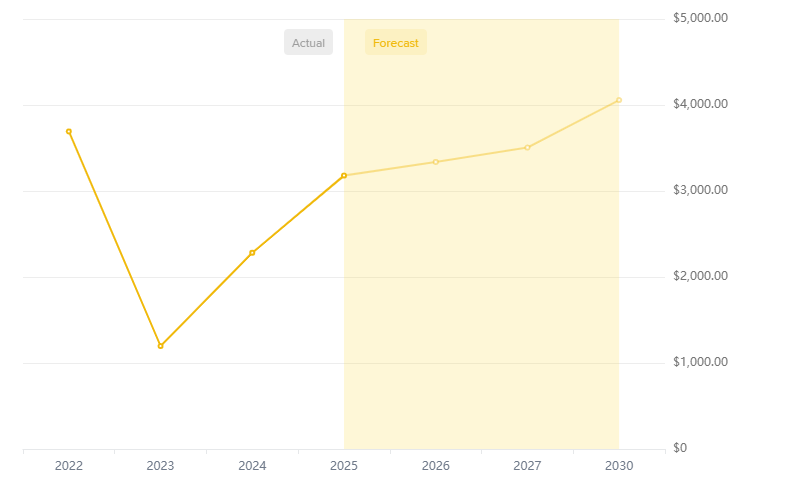

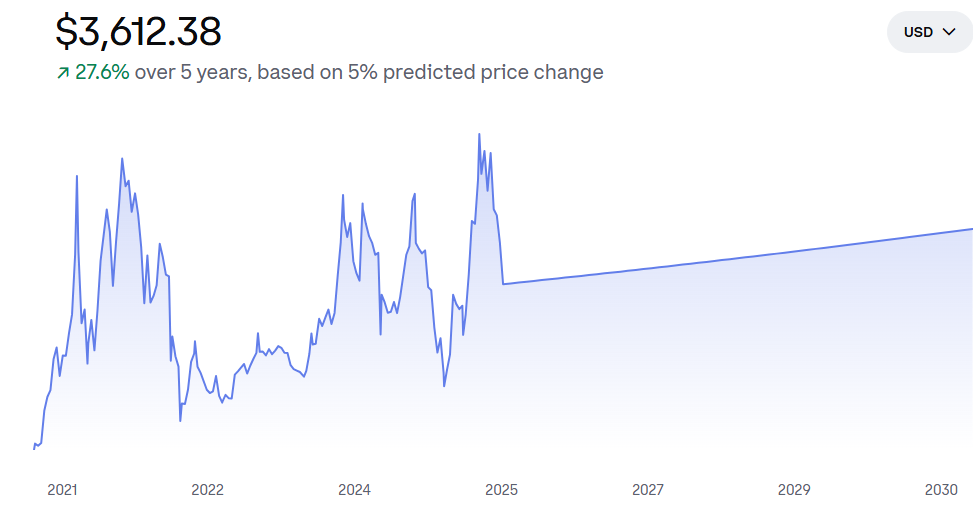

Despite current headwinds, longer-term Ethereum price predictions remain moderately bullish.

Forecast models place ETH at $3,178.95 by 2025, climbing gradually to over $4,000 by 2030. These estimates assume Layer 2 scaling success, growing DeFi usage, and broader crypto adoption trends.

2025: $3,178.95

2026: $3,337.89

2027: $3,504.79

2028: $3,680.03

2030: $4,057.23

While these numbers paint a positive trajectory, the underlying assumption is that Ethereum will maintain dominance – a risky assumption given growing competition and shifting capital dynamics.

Investors need to weigh these projections against near-term realities: falling volume, price rejections, and decreasing liquidity.

Moreover, with staking yields flattening and gas fees declining, some of the economic incentives that once supported ETH price strength have started to erode. That leaves many wondering where the next catalyst will come from – and how long traders are willing to wait.

Technical Indicators Flash Mixed Signals for Ethereum Bulls

Short-term indicators are offering mixed reads. The 50-day and 100-day moving averages have turned sideways, while ETH remains trapped between support near $2,700 and resistance near $3,000.

A confirmed break below $2,700 could open the door to $2,500, especially if broader market sentiment remains weak.

Other tools, like RSI (Relative Strength Index), are hovering in neutral territory, showing neither extreme oversold nor overbought conditions. This lack of conviction mirrors the broader hesitation in the market.

Candlestick analysis also shows rejection wicks forming around $2,850 – suggesting sellers are still in control every time ETH attempts to climb higher. Until a daily close above $3,000 is sustained, bullish momentum is likely to remain capped.

Why Traders Are Rotating Into Maxi Doge Instead

While Ethereum grapples with chart resistance and outflows, Maxi Doge ($MAXI) is drawing fresh attention. With a presale price of just $0.0002695 and over $4.18 million raised, the project is showing signs of viral traction – especially among traders hunting for early entries.

One of the biggest advantages for Maxi Doge right now is timing. The clock is ticking: with less than 18 hours until the next price jump, buyers are rushing to secure allocations before the cost rises again.

This time-based pressure, combined with meme appeal and a low barrier to entry, is fueling serious short-term interest.

In contrast to Ethereum’s sluggish grind, Maxi Doge offers fast-paced price action and a clear upside narrative: a growing presale, strong social sentiment, and limited-time incentives that reward early adoption.

It’s no surprise that some Ethereum holders are starting to rotate smaller positions into projects like $MAXI – especially when ETH’s next move remains uncertain.